Is this guide for you?

This guide will help you complete the Consulting Services Price Report.

The various sections of the survey questionnaire are printed in this guide for your reference, along with definitions of the corresponding terms and concepts. In each section, an encircled number indicates that the associated term or concept is explained in more detail. Simply look-up the appropriate number in the list of terms provided below the caption.

An example of how terms and concepts are referenced is as follows:

1 - Business Activity

This is the business activity for which you are to select a consulting contract to report. Statistics Canada has identified this business activity based on information your company has provided to either Statistics Canada and/or the Canada Revenue Agency (CRA) in the past.

Lost the return envelope or need help?

Call us at 1-888-951-4550, email us at sppi.consulting@statcan.gc.ca, or fax to 1-613-951-3117.

La version française de cette publication est intitulée Guide de déclaration : Rapport sur les prix des services de conseils.

Survey Purpose

The data collected in this survey will be used to produce price indexes that measure changes in the prices of the various services offered by the industry and will improve statistical estimates of the consulting services industry with respect to volume of activity and productivity. Businesses can use these indexes to benchmark their performance with similar companies and to analyze their costs (in aggregate form only). Your information may also be used by Statistics Canada for other statistical research purposes.

Industry Overview

The consulting services industry in Canada is a vital part of the Canadian economy. According to Statistics Canada's Annual Survey of Services Industries, operating revenue increased by 1.6% in 2010 to $12.8 billion, up from $12.6 billion in 2009. The management consulting services industry accounted for 68.1% of the consulting services industry revenue in 2010, where environmental and other scientific and technical consulting services made up the remaining 31.9%.

General Information

Before You Start

Do you have to complete this report?

The completion of this report is a legal requirement under the Statistics Act, Revised Statutes of Canada, 1985, Chapter S-19.

What is the return date for this report?

Generally, this report must be completed and returned to Statistics Canada within 15 days of its receipt. Please return the completed questionnaire using the postage-paid return envelope. You may also fax the completed questionnaire to Statistics Canada at 1-613-951-3117 or e-mail it to sppi.consulting@statcan.gc.ca.

How were firms selected to participate in this survey?

Firms were selected randomly into the survey sample from a list of all Canadian businesses that offer consulting services. Statistics Canada also considered the geographical make-up of the businesses in the selection of the survey sample.

Can I complete and submit this report on-line?

This report will be available to complete on-line in the near future. Until then, you can return the completed questionnaire using the postage-paid return envelope, fax the completed questionnaire to Statistics Canada at 1-613-951-3117 or e-mail it to sppi.consulting@statcan.gc.ca.

Getting Started

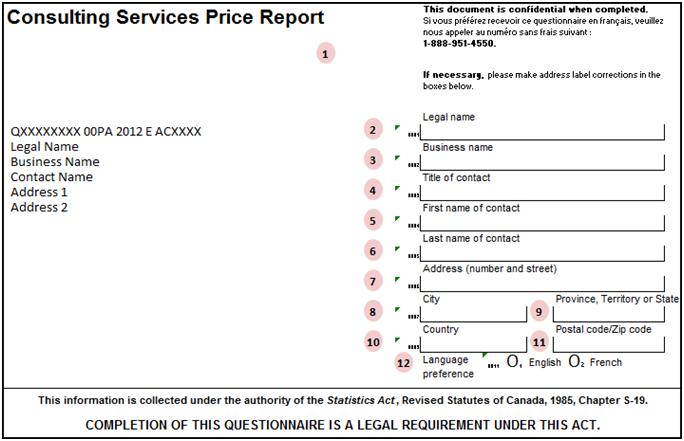

Please review the contact information printed on the questionnaire label. If you need to make changes to this information, please use the form located in the upper right-hand corner of the questionnaire's front page.

Before mailing the survey questionnaire for the first time, Statistics Canada will conduct a short telephone interview with the respondent in order to confirm the mailing address and contact information of the respondent. Statistics Canada will also confirm during this interview that the selected business provides consulting services, and it will allow the respondent to ask any questions he/she may have concerning the survey.

The first time you complete this report, you will select a consulting contract that your company has completed in the recent past (i.e. within the past twelve months). You will provide some basic details about this contract, as well as its price information, using the enclosed survey questionnaire.

How will my information be used?

Statistics Canada will use your information to compile and publish price indexes for the consulting services industry. The purpose of these indexes is to measure the long-term price movements of consulting services.

Ordinarily, price indexes are compiled by following the prices of a fixed basket of goods/services over time (i.e. following price movements by holding the quality of the underlying goods and/or services constant over time). Of course, due to the highly specialized and customized nature of consulting work, firms within this industry rarely offer the same services repeatedly over time. In order to address this problem, businesses reporting for this survey will select a consulting contract or project that they have completed in the recent past and that is representative or typical of the work they do. On a quarterly basis, firms in the survey sample will report the price that would be estimated, or quoted, if they were to provide a price quote for the selected contract in the current quarter.

What type of contract should I select to represent my firm's activities?

It is important that you select a contract that is representative of typical contracts offered by your firm. By selecting a contract that is representative, the price movements that you will report over time for the selected contract will be an accurate and comprehensive measure of the overall price movements and pricing dynamics of your business. If you need help to select an appropriate contract, please call 1-888-951-4550 or e-mail sppi.consulting@statcan.gc.ca.

It is also important to select a contract that you will be able to re-price over time. Choose a contract for which you will be able to easily provide a price estimate, or price quote, in future quarters.

According to the 2011 Canadian Management Consulting Industry: Trends and Outlook study, 80% of consulting firms use fixed fee and/or hourly/daily rate pricing sometimes/most of the time. Please select a contract that was priced using either fixed fee or hourly/daily rate pricing. Through the focus-group testing that was performed for this survey questionnaire, Statistics Canada found that contracts utilizing this fee model are the simplest to re-price over time.

According to the same industry publication, 29% of large firms (100+ full-time consultants) use outcome-based fees at least sometimes, up from just 10% two years ago.

Despite the increased use of this fee model, we ask that you do not choose a contract that was priced using outcome-based fees or contingency fees. Because such a contract would need to be carried out each quarter in order for a price to be reported, we ask that you do not select a contract that was priced using outcome-based or contingency fees.

What about Information Technology (IT) Consulting Services?

Price indexes produced by Statistics Canada follow the North American Industry Classification System (NAICS), which does not include IT/Computer consulting services in its definition of the management, scientific and technical consulting services industry. In other words, Statistics Canada does not consider IT/Computer consulting to be covered by this survey. Of course, due to the fact that management and IT consulting services are inextricably linked in practice, it is likely that the contract you choose to represent your company's activities has an IT component. Such contracts are permissible, as long as the contract is not predominately IT-based.

What if the selected contract becomes unrepresentative over time?

Due to the dynamic and changing nature of consulting services, consulting contracts may lose their relevance over time. If this happens, the resulting price index will lose its relevance over time. If you feel that the selected contract no longer accurately represents your company's business, you can replace it with a new contract. Please call 1-888-951-4550 if you would like to substitute your current contract for a newer, more relevant contract.

What size of contract should I select?

The important thing is that you choose a contract that is representative of your company's business activity. That being said, larger, more complex, contacts will be more difficult to re-price over time. Try to choose a contract that is simple enough that it can be re-priced over time without imposing undue burden on the respondent.

Glossary of Terms and Definitions

Front Page

1 - Reference Period

This is the time period for which you will report prices.

2 - Legal Name

Please make corrections here if the legal name of the company to which the questionnaire was addressed is printed incorrectly on the label.

3 - Business Name

Please make corrections here if the business name of the company to which the questionnaire was addressed is printed incorrectly on the label.

4 - Title of Contact

Please make corrections here if the title of the contact that is to receive this questionnaire is printed incorrectly on the label.

5 - First Name of Contact

Please make corrections here if the first name of the person who is to receive this questionnaire is printed incorrectly on the adjacent label.

6 - Last Name of Contact

Please make corrections here if the last name of the person who is to receive this questionnaire is printed incorrectly on the label.

7 - Address (number and street)

Please make corrections here if the address of the person who is to receive this questionnaire is printed incorrectly on the label.

8 - City

Please make corrections here if the city of the person who is to receive this questionnaire is printed incorrectly on the label

9 - Province or Territory

Please make corrections here if the province or territory of the entity to which the questionnaire was addressed is printed incorrectly on the label.

10 - Country

Please make corrections here if the country of the entity to which the questionnaire was addressed is printed incorrectly on the adjacent label.

11 - Postal Code/Zip Code

Please make corrections here if the postal code/zip code of the entity to which the questionnaire is addressed is printed incorrectly on the label.

12 - Language Preference

Please check the appropriate box if you would like to change the language in which you receive the questionnaire and other correspondence from Statistics Canada ■

Page 2 of 5

1 - Business Activity

This is the business activity for which you are to select a consulting contract to report. Statistics Canada has identified this business activity based on information your company has provided to either Statistics Canada and/or the Canada Revenue Agency (CRA) in the past. Detailed definitions of the business activities can be found on page 14 of this guide.

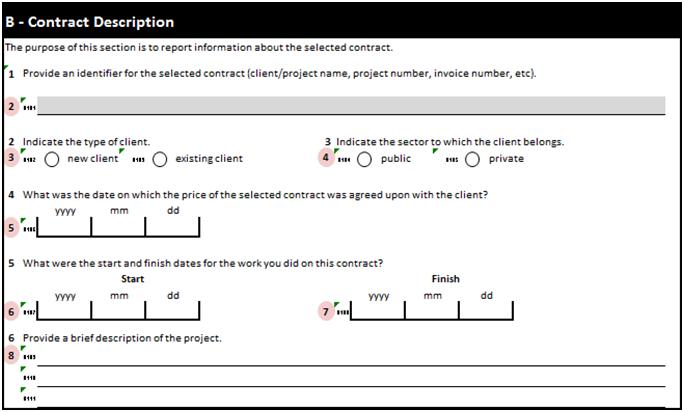

2 - Contract Identifier

This is the identifier that your business uses to identify the selected contract. You may use as an identifier any name and/or number that uniquely identifies the selected contract. It is important that you provide an identifier in case you need to review the details of the selected contract at a later date.

3 - Type of Client

Select new client if your company had not done business with the client prior to having worked on the selected contract. Select repeat client if your company has done business with the client prior to having worked on the selected contract.

4 - Client Sector

Does the client belong to the public or the private sector?

Examples of public sector clients include: federal government, provincial and territorial governments (including health care), municipal governments, various non-governmental organizations (NGOs), crown corporations, post-secondary institutions, etc.

Private sector clients include businesses in the following industries: financial services, energy (resources), utilities, technology, telecoms and media, consumer products, retail distribution, and manufacturing and other.

5 - Contract Agreement Date

This is the date on which the terms and prices of the selected contract were agreed upon with the client.

6 - Project Duration – Start

This cell refers to the date on which your business started work on the selected contract.

7 - Project Duration – Finish

This cell refers to the date on which your business finished work on the selected contract.

It is important that you select a contract that has been completed in the recent past (i.e. within one year). This will ensure that the selected contract is representative of your company's current business activity.

Although it is preferable to select a contract that has been completed for the client, please leave this cell blank if the work associated with the selected contract is not yet complete.

8 - Project Description

Provide a brief description of the selected contract. This section is for your reference only. Statistics Canada will send this questionnaire back to you in future quarters with this information pre-filled ■

Page 3 of 5

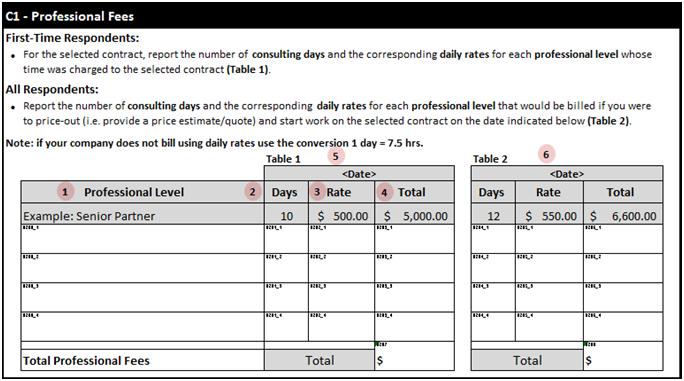

1 - Professional Level

Some businesses include in their invoicing the full range of professional levels whose time was charged to the project, as well as the associated professional fees. If the contract that you select was invoiced in this manner, please report the professional levels that were charged to the client according to the project invoice. Some of the professional levels indicated in the 2011 Canadian Management Consulting Industry: Trends and Outlook study include: principals, senior partners, c-suite executives, newer partners, VPs, experienced professionals, professionals with several years of experience, and entry-level new associates.

In some instances, a company might negotiate the price with the client based on an internal estimate of the number of days that will be spent working on the project as well as the daily rates that the consultant has established for him/herself. If the contract that you select was invoiced in this manner, please report the professional level(s) that were used in this internal calculation. For smaller firms that do not have the full range of professional levels, you could list the names or position of the consultants whose time was charged to the selected contract.

2 - Days

If you are reporting for the selected contract, report the number of days that were charged for each level of professional whose time was charged to the selected contract.

If you are reporting for the current period, report the number of days that would be billed if you were to provide a (price) estimate to the same client for the selected contract in the current quarter (i.e. what would you charge if you were to negotiate the price of the selected contract with the same client now).

If hours were used in the invoicing of the selected contract, please convert to days using the following conversion: 1day = 7.5hours.

3 – Rate

If you are reporting for the selected contract, report the daily rates that were charged for each level of professional whose time was charged to the selected contract.

If you are reporting for the current period, report the daily rates that would be billed if you were to provide a (price) estimate to the same client for the selected contract in the current quarter (i.e. what would you charge if you were to negotiate the price of the selected contract with the same client now).

If hours were used in the invoicing of the selected contract, please convert the hourly rates to daily rates using the following conversion: 1day = 7.5hours.

4 - Total

The total is equal to the number of days multiplied by the daily rate:

Total = Days x Rate

5 – Table 1

When you complete this report for the first time, Table 5 will be labelled Selected Contract. In this case, report the consulting days, the associated daily/per-diem rates, and the total professional fees that were charged to the selected contract. The selected contract covers a consulting project that was provided to an actual client, preferably within the last year. In most cases, you will need to refer back to the contract that was signed with the client in order to report this information.

In future quarters, Table 5 will be used by Statistics Canada to print the data that you reported for the previous quarter. We provide the respondent with the previous quarters' data so that it is easier for you to report data for the current quarter.

6 – Table 2

Use Table 2 to provide the number of consulting days and the associated daily rates that would apply if you were to provide an estimate or quote for the selected contract on the date indicated. In Table 2 you are reporting data for the current quarter. In other words, the days and daily/per-diem rates that would apply if you were to provide a price quote for the selected contact in the current quarter. The reference date is typically chosen to be the middle Wednesday of the reference quarter. The reason why Statistics Canada uses a reference date is so that all businesses in the survey sample report prices applicable to the same period.

When completing Table 2, you are welcome to cross out professional levels that you have reported in the past but that no longer apply. Similarly, you can add professional levels if your firm has made changes/additions to its roster of professional levels. Changes and/or additions of professional levels could occur, for example, if over time your firm adopts a new workforce pyramid, staff profile, or reorganizes its personnel such that certain specializations or positions are no longer applicable ■

Page 4 of 5

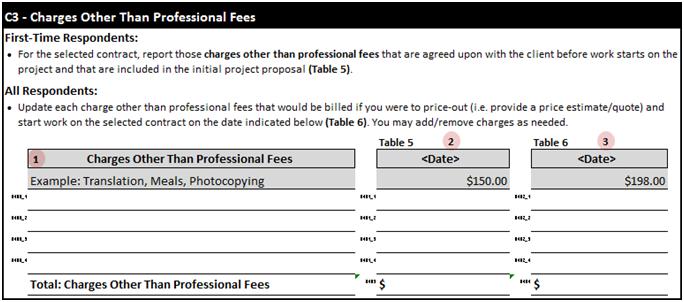

1 - Charges Other Than Professional Fees

Expenses other than professional fees may be either included in the fee as overhead expenses or charged directly to the client.

Typical billable or reimbursable expenses are travel, board and lodging expenses (e.g. testing, computing, printing, purchase of special equipment), long-distance communication and document delivery.

In this section you will report those charges that are billed to the client over and above the professional fees that you reported on the previous page.

Report: those charges that are applied or estimated 'up-front', or when the initial agreement with the client is established. For example, some firms include a surcharge (i.e. as a percentage of the professional fees) in the overall price of the contract in order to account for expected incidentals or overhead expenses.

Do not report: those charges that are recorded while the business carries out the project and that are reimbursed by the client at a later date.

2 – Table 5

When you complete this report for the first time, Table 5 will be labelled Selected Contract. In this case, report the value of those charges that are applied or estimated 'up-front' for the selected contract. The selected contract covers a consulting project that was provided to an actual client, preferably within the last year. In most cases, you will need to refer back to the contract that was signed with the client in order to report this information.

In future quarters, Table 5 will be used by Statistics Canada to print the data that you report for the previous quarter. We provide the respondent with the previous quarters' data so that it is easier for you to report data for the current quarter.

3 – Table 6

Use Table 6 to report the value of those charges that are applied or estimated 'up-front' that would apply if you were to provide an estimate or quote for the selected contract on the date indicated. In Table 6 you are reporting data for the current quarter.

In other words, the charges (other than professional fees) that would apply if you were to provide a price quote for the selected contract in the current quarter. The reference date is typically chosen to be the middle Wednesday of the reference quarter. The reason why Statistics Canada uses a reference date is so that all businesses in the survey sample report prices applicable to the same period ■

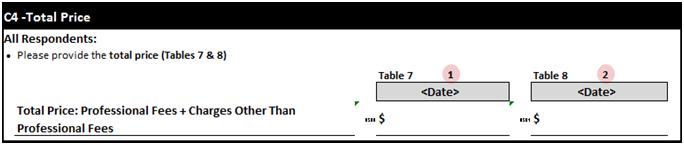

1 – Table 7

When you complete this report for the first time, Table 7 will be labelled Selected Contract. In this case, report the total price of the selected contract. This amount should be equal to the sum of the total of sections C1 through C3. Exclude any sales tax or any other tax that is collected for remittance to a government agency.

In future quarters, Table 7 will be used by Statistics Canada to print the data that you reported for the previous quarter. We provide the respondent with the previous quarters' data so that it is easier for you to report data for the current quarter.

2 – Table 8

Use Table 8 to report the total price that would be charged if you were to provide an estimate or quote for the selected contract on the date indicated. This amount should be equal to the sum of the totals of sections C1 through C3. Please exclude any sales tax or any other tax that is collected for remittance to a government agency ■

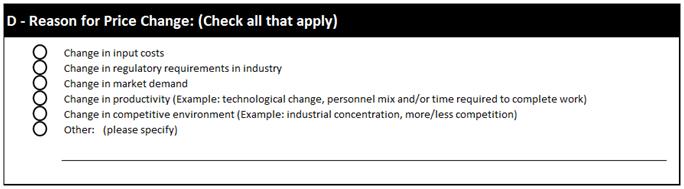

If the price that you reported for the current quarter is different than what was reported for the previous quarter, please indicate the reasons for this change in price ■

Business Activities

Statistics Canada has selected your company to report for a particular business activity. This business activity is printed in Section B of the survey questionnaire. The business activity that Statistics Canada has selected for your company is based either on survey information you have previously reported to Statistics Canada or on business profile information your company has reported to the Canada Revenue Agency (CRA). This section of the Guide gives more detailed definitions of the different business activities covered by this survey, including example activities.

Administrative and General Management Consulting Services

This Canadian industry comprises establishments primarily engaged in providing advice and assistance to other organizations on administrative management issues, such as financial planning and budgeting; equity and asset management; records management; office planning; strategic and organizational planning; site selection; new business start-up; and business process improvement. This Canadian industry also includes general management consultants that provide a full range of administrative; human resource; marketing; process, physical distribution and logistics; or other management consulting services to clients.

Example Activities:

- Administrative management consultants

- Business start-up consulting services

- Financial management consulting services (except investment advice)

- General management consulting services

- Records management consulting services

- Reorganization consulting service

- Site selection consulting services

- Strategic planning consulting services

- Customer service management consulting services

- Customs consulting services

- Efficiency experts

- Freight rate consulting services

- Inventory planning and control management consulting services

- Logistics management consulting services

- Manufacturing operations improvement consulting services

- Materials management consulting services

- New product development consulting services

- Operations research consulting services

- Physical distribution consulting services

- Production planning and control consulting services

- Productivity improvement consulting services

- Sales management consulting services

- Tariff management consulting services

- Telecommunications management consulting services

Exclusion(s): Firms primarily engaged in:

- providing office or general administrative services on a day-to-day basis.

Human Resources Consulting Services

This Canadian industry comprises establishments primarily engaged in providing advice and assistance to other organizations on human resource management issues, such as human resource and personnel policies, practices and procedures; employee benefits planning, communication, and administration; compensation systems planning; wage and salary administration; and executive search and recruitment.

Example Activities:

- Actuarial consulting services

- Benefit consulting services

- Compensation services, labour relations

- Consulting services, personnel management

- Employee assessment consulting services

- Employee compensation consulting services

- Human resource consulting services

- Labour relations consulting services

- Organization development consulting services

- Personnel management consulting services

Exclusion(s): Firms primarily engaged in:

- Executive search consultants

- Providing professional and management development training

Environmental Consulting Services

This Canadian industry comprises establishments primarily engaged in providing advice and assistance to other organizations on environmental issues, such as the control of environmental contamination from pollutants, toxic substances and hazardous materials. These establishments identify problems, measure and evaluate risks, and recommend solutions. They employ a multi-disciplined staff of scientists, engineers and other technicians, with expertise in areas such as air and water quality, asbestos contamination, remediation and environmental law. xamples of establishments in this industry are environmental consultants, sanitation consultants and site remediation consultants.

Example Activities:

- Environmental consulting services

- Sanitation consulting services

- Site remediation consulting services

Scientific and Technical Consulting Services

This Canadian industry comprises establishments, not classified to any other industry, primarily engaged in providing advice and assistance to other organizations on scientific and technical issues.

Example Activities:

- Agricultural consulting (technical) services

- Agrology consulting services

- Agronomy consulting services

- Economic consulting services

- Energy consulting services

- Hydrology consulting services

- Livestock breeding consulting services

- Motion picture consulting services

- Nuclear energy consulting services

- Occupational health and safety consulting services

- Physics consulting services

- Safety consulting services ■