- 1. Survey objective

- 2. Survey frame

- 3. Sampling and stratification

- 4. Edit and imputation

- 5. Outliers

- 6. Weighting

- 7. Response rate

- 8. Estimation and confidentiality

1. Survey objective

This new survey is intended as a quick study of sales below $4 in the restaurant and prepared food and beverages industry in Ontario. It is in the form of a very short questionnaire (two questions) and allows for evaluating the proportions of sales that are currently non taxable. This is being done in order to eventually coordinate the sharing of a harmonized sales tax in that province. The survey could become an annual survey and should offer a greater level of detail than the current Restaurants Survey by the Service Industries Division.

2. Survey frame

The Business Register (BR) is used to create the survey frame. The statistical unit is the establishment.

To be included in the population, establishments must operate in Ontario (OPAddressProvince = ON), be active on the Business Register (BusinessStatusCode = 1) and be part of an industry sector (NAICS) that is listed in Table 1. In order to reflect the Unified Enterprise Survey (UES) as much as possible, units tagged InScopeForSurveyFlag = 0 were excluded.

In total, the survey frame is composed of 76,633 establishments.

3. Sampling and stratification

To select the sample, the following parameters were considered:

- Target size of 1,500 units

- Desired response rate of 60%

- Coefficient of variations (CVs) targeted by domain

- 10% for industry groups 6, 11 and 12

- 5.8% for the other industry groups

| Domains: Industry Group | NAICS included |

|---|---|

Notes

|

|

| 1- Bakeries | NAICS 311811 and 445291 |

| 2- Cafeterias; coffee shops; lunch counters and snack bars; doughnut and muffin shops; limited-service restaurants | NAICS 722210 |

| 3- Chip wagons; hot dog stands; coffee stands; mobile food services | NAICS 722330 |

| 4- Cocktail lounges, taverns and bars | NAICS 722410 |

| 5- Convenience stores | NAICS 445120 and 447110 |

| 6- Convention centres | NAICS 531120 |

| 7- Food service contractors | NAICS 722310 |

| 8- Full-service restaurants | NAICS 722110 |

| 9- Grocery stores | NAICS 445110 |

| 10- Hotels and motels | NAICS 7211 |

| 11- Lodging houses | NAICS 7213 |

| 12- Private or social clubs or legion halls | NAICS 813410 |

| 13- Snack bars | NAICS 512130, 7111, 7112, 71131, 712, 7131, 713210, 713299, 7139 |

| 14- Vending machinesFootnote 1 | NAICS 454210 |

Each domain was stratified by size based on revenues to obtain one take-none stratum, two take-some strata and one take-all stratum. In order to be as close as possible to the UES, the Royce-Maranda (RM) thresholds of the UES were used to define the take-none stratum for each North American Industry Classification System (NAICS) code. However, as this is the first time for this survey and the relationship between sales of prepared food and beverages under $4 and total sales of prepared food and beverages is unknown, one sample was selected from among the take-none strata. To optimally determine the other thresholds for each of the domains, the StatMx generalized system was used. It should be mentioned that each NAICS code has a different RM threshold, while all NAICS codes within a single domain have the same thresholds defining the take-some and take-all strata. The generalized sampling system was subsequently used to allocate according to the total cost minimization and sample selection method.

Program used by the Business Survey Methods Division (BSMD):

Sampling_Feb24_2010.sas

Name of file containing the survey frame and sample:

final_framesample_26fev10.sas7bdat

Some important variables:

| Name of variable | Definition |

|---|---|

| GroupInt | Industry groups used for stratification (domains) |

| ini_weight | Initial weight |

| Must_take | Indicates whether the establishment is on the must-take list or not (0 = no, 1 = yes) |

| _sample_ | Indicates whether the establishment is in the sample or not (0 = no, 1 = yes) |

| sizeclasslh | Size (0 = Take-none, 1 = Small take-some, 2 = Medium take-some, 3 = Take-all) |

| stratum2 | Used for stratification (GroupInt X sizeclasslh) |

| GroupeInt | NAICS(NAICS) | Sizeclasslh | Total | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 2 | 3 | ||||||||

| Take-None | Small Take-Some | Medium Take-Some | Take-All | ||||||||

| N | n | N | n | N | n | N | n | N | n | ||

Footnotes

|

|||||||||||

| 311811 | 437 | 39 | 2 | 0 | 52 | 10 | 11 | 11 | 502 | 60 | |

| 445291 | 285 | 19 | 151 | 12 | 45 | 10 | 10 | 10 | 491 | 51 | |

| 1 | Total | 722 | 58 | 153 | 12 | 97 | 20 | 21 | 21 | 993 | 111 |

| 2 | 722210 | 5,840 | 30 | 5,767 | 58 | 1,099 | 52 | 18 | 18 | 12,724 | 158 |

| 3 | 722330 | 283 | 13 | 98 | 8 | 23 | 7 | 7 | 7 | 411 | 35 |

| 4 | 722410 | 540 | 12 | 441 | 20 | 178 | 22 | 18 | 18 | 1,177 | 72 |

| 445120 | 1,741 | 19 | 3,265 | 32 | 145 | 5 | 4 | 4 | 5,155 | 60 | |

| 447110 | 912 | 8 | 49 | 1 | 481 | 8 | 19 | 19 | 1,461 | 36 | |

| 5 | Total | 2,653 | 27 | 3,314 | 33 | 626 | 13 | 23 | 23 | 6,616 | 96 |

| 6 | 531120 | 17,223 | 87 | 5,048 | 52 | 488 | 50 | 47 | 47 | 22,806 | 236 |

| 7 | 722310 | 667 | 8 | 0 | 0 | 238 | 8 | 13 | 13 | 918 | 29 |

| 8 | 722110 | 5,615 | 28 | 5,097 | 52 | 1,453 | 52 | 10 | 10 | 12,175 | 142 |

| 9 | 445110 | 2,297 | 23 | 713 | 33 | 271 | 35 | 6 | 6 | 3,287 | 97 |

| 721111 | 537 | 7 | 3 | 0 | 201 | 7 | 48 | 48 | 789 | 62 | |

| 721112 | 69 | 1 | 94 | 0 | 18 | 0 | 0 | 0 | 181 | 1 | |

| 721113 | 160 | 2 | 73 | 2 | 32 | 1 | 7 | 7 | 272 | 12 | |

| 721114 | 339 | 2 | 544 | 7 | 8 | 0 | 0 | 0 | 891 | 9 | |

| 721191 | 432 | 5 | 27 | 0 | 0 | 0 | 0 | 0 | 459 | 5 | |

| 721192 | 410 | 5 | 83 | 1 | 2 | 0 | 0 | 0 | 495 | 6 | |

| 721198 | 111 | 0 | 26 | 0 | 7 | 0 | 0 | 0 | 144 | 0 | |

| 10 | Total | 2,058 | 22 | 850 | 10 | 268 | 8 | 55 | 55 | 3,231 | 95 |

| 11 | 721310 | 37 | 7 | 51 | 7 | 21 | 7 | 9 | 9 | 118 | 30 |

| 12 | 813410 | 770 | 8 | 1,532 | 25 | 316 | 33 | 55 | 55 | 2,673 | 121 |

| 512130 | 122 | 1 | 0 | 0 | 108 | 7 | 0 | 0 | 230 | 8 | |

| 711111 | 194 | 4 | 210 | 2 | 8 | 0 | 2 | 2 | 414 | 8 | |

| 711112 | 56 | 2 | 9 | 0 | 8 | 0 | 2 | 2 | 75 | 4 | |

| 711120 | 31 | 0 | 37 | 0 | 1 | 0 | 0 | 0 | 69 | 0 | |

| 711130 | 484 | 5 | 604 | 6 | 17 | 3 | 0 | 0 | 1,105 | 14 | |

| 711190 | 17 | 1 | 27 | 1 | 0 | 0 | 0 | 0 | 44 | 2 | |

| 711211 | 182 | 2 | 5 | 0 | 19 | 1 | 3 | 3 | 209 | 6 | |

| 711213 | 668 | 4 | 303 | 3 | 29 | 0 | 7 | 7 | 1,007 | 14 | |

| 711218 | 215 | 0 | 13 | 1 | 3 | 0 | 0 | 0 | 231 | 1 | |

| 711311 | 106 | 0 | 23 | 1 | 7 | 0 | 2 | 2 | 138 | 3 | |

| 711319 | 79 | 0 | 24 | 0 | 9 | 0 | 1 | 1 | 113 | 1 | |

| 712111 | 36 | 1 | 30 | 1 | 3 | 0 | 1 | 1 | 70 | 3 | |

| 712115 | 3 | 0 | 8 | 0 | 3 | 0 | 2 | 2 | 16 | 2 | |

| 712119 | 21 | 1 | 32 | 0 | 8 | 0 | 1 | 1 | 62 | 2 | |

| 712120 | 6 | 0 | 13 | 0 | 1 | 0 | 0 | 0 | 20 | 0 | |

| 712130 | 24 | 1 | 7 | 0 | 2 | 0 | 2 | 2 | 35 | 3 | |

| 712190 | 22 | 0 | 18 | 0 | 5 | 1 | 1 | 1 | 46 | 2 | |

| 713110 | 51 | 1 | 6 | 0 | 7 | 1 | 5 | 5 | 69 | 7 | |

| 713120 | 114 | 0 | 11 | 0 | 6 | 1 | 0 | 0 | 131 | 1 | |

| 713210 | 2 | 0 | 2 | 0 | 2 | 0 | 4 | 4 | 10 | 4 | |

| 713299 | 72 | 1 | 27 | 0 | 31 | 2 | 2 | 2 | 132 | 5 | |

| 713910 | 349 | 7 | 255 | 4 | 217 | 21 | 4 | 4 | 825 | 36 | |

| 713920 | 35 | 0 | 5 | 0 | 17 | 1 | 0 | 0 | 57 | 1 | |

| 713930 | 136 | 0 | 229 | 5 | 29 | 1 | 0 | 0 | 394 | 6 | |

| 713940 | 917 | 11 | 599 | 9 | 113 | 11 | 4 | 4 | 1,633 | 35 | |

| 713950 | 66 | 0 | 137 | 3 | 10 | 1 | 0 | 0 | 213 | 4 | |

| 713990 | 820 | 6 | 754 | 11 | 51 | 6 | 2 | 2 | 1,627 | 25 | |

| 13 | Total | 4,828 | 48 | 3,388 | 47 | 714 | 57 | 45 | 45 | 8,975 | 197 |

| 14Table 3 Note 1 | 454210 | 386 | 7 | 18 | 18 | 97 | 14 | 28 | 28 | 529 | 67 |

| Total | 43,919 | 378 | 26,470 | 375 | 5,889 | 378 | 355 | 355 | 76,633 | 1,486 | |

4. Edit and imputation

This part contains the specifications for the edit and imputation. Actions (edits and imputation) are listed in the order which they should be carried out. Further directions are given with respect to the creation of a series of derived variables. These derived variables form a key part of the imputation strategy and therefore their creation is the first step in the process.

Edit rules are used to identify and correct records with inconsistent, incomplete or invalid responses. Where no direct correction is possible, the unacceptable values will be replaced by imputed values. All edits are indicated with a circular bullet.

Imputation indicates the manner in which the record that was not corrected through edits will be corrected. As a general rule, it has been determined that we will not engage in imputation methods which might introduce bias. This means that donor imputation will be used applying the general selection criteria below, either alone or in the context of a specified value or nearest neighbour search using some other variable. All cases of imputation are indicated with an arrow bullet.

Edit and imputation will be carried out on completed questionnaires only.

4.1 Definition of completed questionnaire

A questionnaire is considered to be complete if one of these questions has been filled out.

4.2 Convention for indicating responses

The questionnaire contains two questions eliciting an accepted range of responses. The following provide an explanation of how they appear in this text:

C0300 ) Please report your total sales of food and non-alcoholic beverages in 2009 in dollars $: We expect a number ranging from 0 $ to 999 999 999 997 $.

For the second question the respondent has the option answering either at question 1a or 1b.

C0401) Of that total, please report the amount of sales that were Provincial Sales Tax (PST)-exempt in 2009 in percentage %: We expect a percentage ranging from 0 % to 100 %.

C0400) Of that total, please report the amount of sales that were PST-exempt in 2009 in dollars: We expect a number ranging from 0 $ to 999 999 999 997 $.

4.3 General selection criteria for donors

Throughout this document there is reference to 'general selection criteria'. This refers to the general method to be applied for donor selection during imputation. Donors are to be selected using ranked criteria, where rank 1 is considered the optimal donor, followed by rank 2, etc. Each rank has two possible levels of matching based on the industry detail.

4.4 General selection criteria for donors to be used in imputation

A. Industry group x Strata

B. Industry group

4.5 Derived variables

A series of derived variables are to be created for the purpose of implementing the imputation strategy, for the creation of statistical tables and for use by researchers and analysts, including researchers under the Facilitated Access program.

4.5.1 Strata

This revenue size variable is based on REV variable derived from BR auxiliary information. A strata use for sampling was developed using this information. Based on the UES, a take-all, 2 take-some and a take-none were separated into four different groups. The boundaries are variable for each different industry group.

| Strata | Criteria |

|---|---|

| Take-All | The take-all stratum which would consist of the largest enterprises. |

| Take-Some – Large | The take-some large stratum is composed of medium-size enterprises put into a substratum with a higher sampling fraction than the one containing the smallest take-some enterprises. |

| Take-Some – Small | The take-some small stratum is composed of medium-size enterprises put into a substratum with a smaller sampling fraction than the one containing the larger take-some enterprises. |

| Take-none | The take-none stratum is composed of smallest enterprises and has a smallest sampling fraction. |

4.5.2 Region

| Region | Criteria |

|---|---|

| Onta | Ontario |

4.5.3 Industry group

| Industry Group | Criteria |

|---|---|

| Bakeries | NAICS 311811 and 445291 |

| Cafeterias; coffee shops; lunch counters and snack bars; doughnut and muffin shops; limited-service restaurants | NAICS 722210 |

| Chip wagons; hot dog stands; coffee stands; mobile food services | NAICS 722330 |

| Cocktail lounges, taverns and bars | NAICS 722410 |

| Convenience stores | NAICS 445120 and 447110 |

| Convention centers | NAICS 531120 |

| Food service contractors | NAICS 722310 |

| Full-service restaurants | NAICS 722110 |

| Grocery stores | NAICS 445110 |

| Hotels and motels | NAICS 7211 |

| Lodging houses | NAICS 7213 |

| Private or social clubs or legion halls | NAICS 813410 |

| Snack bars | NAICS 512130, 7111, 7112, 71131, 712, 7131, 713210, 713299, 7139 |

| Vending machines1 | NAICS 454210 |

1. There are 31 must-take establishments among the NAICS 454210. They are the following:

North American Industry Classification System 454210Must-take establishments

North American Industry Classification System 454210Must-take establishments continued

North American Industry Classification System 454210Must-take establishments continued

2. This establishment replaces S28318697, which was on the original list, because S28318697 is an enterprise rather than an establishment. |

|

Question C0300:

Question C0300 is mandatory. But we will still write specifications for this question if they would come to be necessary.

- If C0300 > 999 999 999 997 then C0300 = 'blank'

- If C0300 < 0 then C0300= 'blank'

- If C0300 < C0400 then C0300 = C0400

- If C0300/REVBR > 2 then C0300 = REVBR and if C0401 = . then C0401 = (REVBR /C0300)*C0401 (outlier detection)

- If C0300 = 'blank' then impute using ratio of BR information from derived variable REV.

Question C0401:

- If C0401 > 100 then C0401 = 'blank'

- If C0401 < 0 then C0401= 'blank'

- If C0401 = 'blank' and C0400 ne 'blank' then

- C0401 = C0400/C0300 (If C0300 ne 0)

C0401 = 0 (If C0300 = 0 and C0400 = 0)

- C0401 = C0400/C0300 (If C0300 ne 0)

- If C0401 = 'blank' and C0400 = 'blank' then impute C0401 using using general selection criteria. After imputation do this edit C0400 = C0401 * C0300.

Question C0400:

- If C0400 > 999 999 999 997 then C0400 = 'blank'

- If C0400 < 0 then C0400= 'blank'

- If C0300 < C0400 then C0300 = C0400

- If C0400 = 'blank' and C0401 ne 'blank' then

- C0400 = C0401 * C0300.

- No imputation needed, the imputation of C0401 and the last edit (C0400 = C0401 * C0300) implicitly imputes C0400 from C0401.

4.7 Imputation rates

| NAICS Groups | Weighted | |||

|---|---|---|---|---|

| C0300 | C0401 | C0400 | ||

| Total - Ontario | 9.1% | 9.8% | 9.8% | |

| 1 | Bakeries | 5.8% | 5.6% | 5.6% |

| 2 | Cafeterias; coffee shops; lunch counters and snack bars; doughnut and muffin shops; limited-service restaurants | 14.3% | 19.4% | 19.4% |

| 3 | Chip wagons; hot dog stands; coffee stands; mobile food services | 0.0% | 0.0% | 0.0% |

| 4 | Cocktail lounges, taverns and bars | 0.0% | 13.8% | 13.8% |

| 5 | Convenience stores | 22.2% | 27.4% | 27.4% |

| 6 | Convention centres | 1.9% | 0.0% | 0.0% |

| 7 | Food service contractors | 0.3% | 0.6% | 0.6% |

| 8 | Full-service restaurants | 6.7% | 6.4% | 6.4% |

| 9 | Grocery stores | 40.5% | 16.0% | 16.0% |

| 10 | Hotels and motels | 0.0% | 6.0% | 6.0% |

| 11 | Lodging houses | 1.6% | 0.0% | 0.0% |

| 12 | Private or social clubs or legion halls | 4.0% | 5.3% | 5.3% |

| 13 | Snack bars | 6.1% | 8.1% | 8.1% |

| 14 | Vending machines | 0.0% | 1.2% | 1.2% |

| NAICS Groups | Unweighted | |||

|---|---|---|---|---|

| C0300 | C0401 | C0400 | ||

| Total - Ontario | 6.2% | 11.4% | 11.4% | |

| 1 | Bakeries | 7.0% | 5.3% | 5.3% |

| 2 | Cafeterias; coffee shops; lunch counters and snack bars; doughnut and muffin shops; limited-service restaurants | 14.6% | 16.7% | 16.7% |

| 3 | Chip wagons; hot dog stands; coffee stands; mobile food services | 0.0% | 0.0% | 0.0% |

| 4 | Cocktail lounges, taverns and bars | 0.0% | 20.0% | 20.0% |

| 5 | Convenience stores | 17.3% | 30.8% | 30.8% |

| 6 | Convention centres | 0.8% | 0.8% | 0.8% |

| 7 | Food service contractors | 8.3% | 16.7% | 16.7% |

| 8 | Full-service restaurants | 5.3% | 9.3% | 9.3% |

| 9 | Grocery stores | 28.2% | 30.8% | 30.8% |

| 10 | Hotels and motels | 0.0% | 16.7% | 16.7% |

| 11 | Lodging houses | 5.9% | 0.0% | 0.0% |

| 12 | Private or social clubs or legion halls | 1.2% | 6.0% | 6.0% |

| 13 | Snack bars | 5.2% | 10.4% | 10.4% |

| 14 | Vending machines | 0.0% | 6.8% | 6.8% |

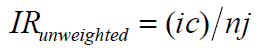

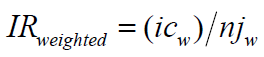

The rates were obtained using the following formulas:

where ic:= imputed cells (if the cell is imputed, ic = 1, if not ic = 0) for respondent i to question j, nj:= number of cells responded for question j

where ic:= imputed cells (if the cell is imputed, ic = initial weight, if not ic = 0) for respondent i to question j, njw:= sum of initial weights for cells responded for question j

5. Outliers

After performing the estimation process, the subject matter noticed certain discrepancies between the estimates produced for the survey on the sale of prepared food and beverages and the restaurants survey produced by the UES. Following this observation, the BSMD investigated and found that groups 5, 9 and 13 possessed heterogeneous respondent groups. These groups were vulnerable to outliers or response errors because total revenue and revenue from sales of prepared food and beverages were significantly different. Using the ratio of the value responded by the establishment compared with that in the Business Register, the BSMD developed cut-off thresholds for acceptable values. Quids with values above the cut-off threshold will be imputed using the following formula:

| NAICS group | Threshold of the C0300/REVRE ratio | QUID above the threshold | |

|---|---|---|---|

| 5 | Convenience stores | 28.56% | 'Q30394117','Q30393108','Q30392970', 'Q30392985','Q30394340','Q30394113','Q30393360' |

| 9 | Grocery stores | 28.16% | 'Q30393720','Q30393804','Q30393546', 'Q30393155','Q30393893','Q30393070', 'Q30393766', 'Q30393279', 'Q30394300', 'Q30394323', 'Q30393583' |

| 13 | Snack bars | 34.88% | 'Q30394105','Q30394177', 'Q30393344','Q30393049', 'Q30392878', 'Q30393515' |

6. Weighting

We used re-weighting to compensate for total non-response.

Correction for non-response

The units selected during sampling were grouped into four categories as follows:

| Grouped status code | Response code | Frequency |

|---|---|---|

| NR: non-response | '40','51','53','72' | 465 |

| OOS: out of scope | '70','71' | 68 |

| OOB: out of business | '30','60','61','62','63' | 120 |

| REP (INSCOPE): respondent in the scope of the survey | '10', '20' | 833 |

The weight of non-respondents is redistributed among respondents who are in-scope and the OOS and the OOB, using the strata from the sampling plan as a reweighting class. Normally, when there are not enough respondents in a given stratum, a regrouping of strata is necessary. In this survey, only two strata had only one respondent; one of these strata had no non-respondents and the other had a reasonable total of sales of prepared food and beverages. For these reasons, no strata were regrouped.

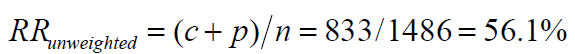

7. Response rate

To calculate the response rate, we calculated the unweighted and weighted response rates. The unweighted response rate calculated at the estimate is 56%, while the weighted response rate is 60%. The unweighted response rate gives an idea of the response rate at the sample level, and is often used during collection, while the weighted rate provides an overall idea, i.e., at the population level.

The rates were obtained using the following formulas:

a)

Where c:= completed questionnaires, p:= partially completed questionnaires, n:= sample size

b) weighted:

where cw:= weighted completed questionnaires, pw:= weighted partially completed questionnaires, nw:= size of weighted sample, oosw:= weighted-out-of-scope, oobw := weighted out-of-business, dupw:= weighted duplicates.

| NAICS Groups | pop | sample | RES | resrate_unweighted | ||

|---|---|---|---|---|---|---|

| Total – Ontario | 76,633 | 1,486 | 833 | 56.1% | ||

| 1 | Bakeries | 311811 and 445291 | 993 | 111 | 57 | 51.4% |

| 2 | Cafeterias; coffee shops; lunch counters and snack bars; doughnut and muffin shops; limited-service restaurants | 722210 | 12,724 | 158 | 96 | 60.8% |

| 3 | Chip wagons; hot dog stands; coffee stands; mobile food services | 722330 | 411 | 35 | 15 | 42.9% |

| 4 | Cocktail lounges, taverns and bars | 722410 | 1,177 | 72 | 35 | 48.6% |

| 5 | Convenience stores | 445120 and 447110 | 6,616 | 96 | 52 | 54.2% |

| 6 | Convention centres | 531120 | 22,806 | 236 | 126 | 53.4% |

| 7 | Food service contractors | 722310 | 918 | 29 | 12 | 41.4% |

| 8 | Full-service restaurants | 722110 | 12,175 | 142 | 75 | 52.8% |

| 9 | Grocery stores | 445110 | 3,287 | 97 | 39 | 40.2% |

| 10 | Hotels and motels | 721111, 721112, 721113, 721191, 721191, 721192 and 721198 | 3,231 | 95 | 66 | 69.5% |

| 11 | Lodging houses | 721310 | 118 | 30 | 17 | 56.7% |

| 12 | Private or social clubs or legion halls | 813410 | 2,673 | 121 | 84 | 69.4% |

| 13 | Snack bars | 512130, 7111, 7112, 71131, 712, 7131, 713210, 713299 and 7139 | 8,975 | 197 | 115 | 58.4% |

| 14 | Vending machines | 454210 | 529 | 67 | 44 | 65.7% |

8. Estimation and confidentiality

The BSMD prepared the weighting files and used the Generalized Estimation System (GES) and CONFID2 generalized systems and SAS macros to produce the estimate table in Excel. The initial weights readjusted in the reweighting were used in GES to produce the estimates. The table contains a measurement of estimate quality (CV or error type depending on the case). In accordance with Statistics Canada guidelines, these tables suppress certain estimates as per confidentiality procedures (rule C2). CONFID2 was used to apply rule C2.

| NAICS Groups | Total sales of food and non-alcoholic beverages | Q | Total sales that were PST-exempt | Q | Total sales that were PST-exempt | Q | ||

|---|---|---|---|---|---|---|---|---|

| (CV) | in $ | (CV) | in % | (SE) | ||||

| Total – Ontario | 14,687,356,672 | 5.9% | 3,008,022,865 | 11.3% | 20.5% | 1.8% | ||

| 1 | Bakeries | 311811 and 445291 | 284,789,609 | 10.8% | 148,419,583 | 17.0% | 52.1% | 5.6% |

| 2 | Cafeterias; coffee shops; lunch counters and snack bars; doughnut and muffin shops; limited-service restaurants | 722210 | 5,759,751,048 | 10.3% | 1,484,385,507 | 16.5% | 25.8% | 2.9% |

| 3 | Chip wagons; hot dog stands; coffee stands; mobile food services | 722330 | 42,358,115 | 14.7% | 20,793,180 | 28.0% | 49.1% | 8.2% |

| 4 | Cocktail lounges, taverns and bars | 722410 | 139,769,178 | 24.8% | 28,835,006 | 50.1% | 20.6% | 10.5% |

| 5 | Convenience stores | 445120 and 447110 | 456,741,793 | 19.9% | 194,987,725 | 34.0% | 42.7% | 8.9% |

| 6 | Convention centres | 531120 | x | x | x | x | x | x |

| 7 | Food service contractors | 722310 | 605,102,678 | 34.9% | 382,711,064 | 36.1% | 63.2% | 8.2% |

| 8 | Full-service restaurants | 722110 | 5,255,279,496 | 9.7% | 348,194,154 | 41.3% | 6.6% | 2.6% |

| 9 | Grocery stores | 445110 | 539,831,793 | 17.7% | 172,358,015 | 26.8% | 31.9% | 5.8% |

| 10 | Hotels and motels | 721111, 721112, 721113, 721191, 721191, 721192 and 721198 | 784,837,047 | 22.7% | 9,381,109 | 23.3% | 1.2% | 0.3% |

| 11 | Lodging houses | 721310 | x | x | x | x | x | x |

| 12 | Private or social clubs or legion halls | 813410 | x | x | x | x | x | x |

| 13 | Snack bars | 512130, 7111, 7112, 71131, 712, 7131, 713210, 713299 and 7139 | 341,489,175 | 16.3% | 44,966,196 | 33.4% | 13.2% | 3.7% |

| 14 | Vending machines | 454210 | 62,371,259 | 16.8% | 21,738,670 | 15.2% | 34.9% | 5.2% |

|

x suppressed to meet the confidentiality requirements of the Statistics Act |

||||||||