July 2010

Introduction

The Business Register Division plays a vital role in Statistics Canada’s economic statistics program. The purpose of this paper is to give the reader a high-level understanding of how the division fulfils this role. It will outline the division’s products and services and describe the Business Register System (BRS) with its underlying concepts. Finally, it will summarize how the data content is maintained on the BR and the role played by quality throughout the process.

Role and Coverage of the Business Register

The Business Register (BR) is a frame that essentially includes all businesses operating within Canada as well as foreign businesses that have links with Canadian companies. It provides statisticians, engaged in the production and analysis of economic statistics, with the highest quality frame in terms of coverage and data elements.

The BR encompasses some of the fundamental concepts of the System of National Accounts and provides facilities to store, browse, maintain and retrieve frame information. It provides information regarding the composition of the population of businesses in Canada in terms of organisational structure, industrial activity, size and geography. The Register, upon request, generates survey questionnaire identifiers which is required for the survey data collection process. It monitors the level of response burden imposed upon individual Canadian businesses by Statistics Canada and provides relevant information to effectively manage response issues.

The BR also responds to the requirements of users other than the survey divisions. It provides the data and the expertise for understanding the industrial composition of various business communities. Data is disseminated in the form of standard products (Canadian Business Patterns CD-ROM) and custom requests to provincial and territorial statistical bodies, some federal departments, businesses and the general public.

As of July 1, 2010, the Business Register contained approximately 2.2 million active businesses of which 99% was composed of simple single unit businesses (see table 1). The remaining 1% of complex businesses (more than one operating entity) accounted for 52% of the Canadian economy.

| # of Businesses (Enterprises) | % of BR Population | # of Operating Entities | % Total Revenue | |

|---|---|---|---|---|

| Simple (one operating entity) | 2,192,872 | 99% | 2,192,872 | 48% |

| Complex (multiple operating entities) | 20,457 | 1% | 169,988 | 52% |

More than one hundred business surveys use the Register to support their activities which include establishing a survey frame, sampling, collecting and processing data, and producing estimates. More than 1,500 employees throughout the Department use the Register to carry out their day-to-day activities.

Concepts

The BR plays a key role in ensuring coherence between Statistics Canada's survey programs by providing a harmonized central frame and reinforcing the fundamental principles of the System of National Accounts (SNA). This includes such notions as enterprise/ establishment, SNA sectoring, and support of major Statistics Canada standards related to economic surveys such as the North American Industrial Classification System (NAICS) and the Standard Geographical Classification (SGC). BRD is also responsible for finding ways to implement these concepts within an operational mode such as through the efficient use of tax information. By mapping Generally Accepted Accounting Principles (GAAP) which are used in the business world, to SNA concepts, the Register represents the business world realities in a format that meets our statistical needs.

Although impossible to duplicate the real business world in its entirety, the Register tries to ensure that coverage is as complete as possible. The starting point is the list of legal entities produced by the Canada Revenue Agency (CRA). As part of the registration process, CRA collects information such as the legal name, business address and the major activity of the business. Once the legal entity is identified and added to the Register, ownership relationships and additional operating entities are derived, where appropriate, to obtain an integrated structure that corresponds to how the business is organized to conduct its business. The legal entity is the basis used by enterprises to establish their operations and carry on business within Canada and therefore is the central unit of the BR.

In order to be considered for an economic survey, a business must have been assigned a NAICS code and meet at least one of the following criteria:

- be an employer (i.e., have employees),

- be a corporate tax filer (T2),

- be a GST registrant with sales greater than $0,

- file an individual tax return (T1) showing business revenue greater than $0 and for which we can match the Business Number (BN) to the Social Insurance Number (SIN) and/or

- show evidence (obtained via profiling activities) of size.

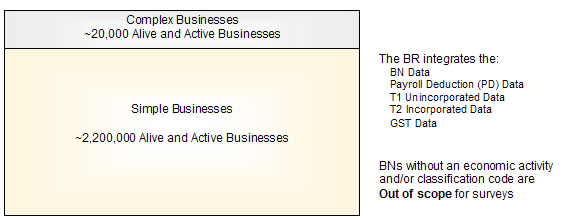

Description of Figure 1

The BPR integrates the:

- BN Data

- Payroll Deduction (PD) Data

- T1 Unincorporated Data

- T2 Incorporated Data

- GST Data

BNs without an economic activity and/or classification code are Out of scope for surveys

Complex Businesses: approximately 20,000 Alive and Active Businesses

Simple Businesses: approximately 2,200,000 Alive and Active Businesses

Different types of organizations are defined as a business such as: a corporation, a self-employed individual, a government entity, a non-profit organization, a partnership, or a financial fund. Understanding the survey population will have an impact on the survey design and improve its effectiveness.

A business is viewed as an integrated structure composed of legal and non-legal operating units. It is the operating units of the integrated structure that are used for sampling purposes. A set of flags has been derived in order to define each unit’s statistical on the Register so as to determine which units should be in scope for a given survey. There are four statistical attributes that are derived for each business:

The statistical Enterprise corresponds to the legal unit in most cases. However, for families of legals that are consolidated, the rule is to select the highest Canadian parent in a hierarchy of legal entities linked by Common Ownership (only majority links considered). For pragmatic reasons a Consolidation may be broken into several Enterprises upon agreement between BRD and the stakeholder survey programs.

The statistical Company is the lowest level of investment centres. This refers to the lowest level where operating profit can be calculated, and that has assets and liability elements to measure capital employed.

The statistical Establishment is, in most cases, equivalent to a profit centre and provides data on the value of output, the cost of inputs and labour. This supplies sufficient data to calculate value added (profit and salary & wages).

The statistical Location is equivalent to the lowest entities within the integrated structure and provides employment and/or revenue data.

The BR is also responsible for maintaining the ownership relationships between legal entities and to record foreign ownership and foreign holdings of Canadian Businesses. This work is performed in close collaboration with other divisions within Statistics Canada.

Business Register System (BRS)

The Business Register System (BRS) is a Microsoft Windows application installed on a client PC. There are five major components comprising the BRS which was developed using a Service Oriented Architecture (SOA). The first component, VB.Net, is the programming language for the Windows Forms User Interface, the business layer and the data layer. The SQL Server 2005 is the underlying database that both stores and manipulates the data. SAS is used to crunch and manipulate input data from external sources. The BRS is a message based system which uses BIZTALK for routing the messages. Finally, Web Services are used to manage both security and access to the data.

All users access the Register by means of the same common interface with a privilege administration tool as the control mechanism to manage this access. The Register includes information on legal and operating entities and their structural relationships. It maintains a journal/log of all updates applied to these entities as well as to stratification variables and information on collection entities. Various modules within the Register manage different aspects of this information.

Browser Module

The Browser Module allows the user to browse and search for information on a given enterprise. It displays information such as the business structure, collection entities, the response burden, and the history of updates contained in the Register (Journal and Log).

The Log contains all of the updates performed on a given variable. The Journal records significant events (e.g., amalgamation, dissolution) concerning a given business.

Update Module

This component serves to control and manage all updates, both manual and batch, that need to be applied to the database. The BR receives requests or signals for updates from various sources such as subject matter, collection and external administrative sources (e.g., CRA). Although each follows a slightly different process, in general the request is vetted to determine if human intervention is required (the Interceptor and/or Workload) and if accepted, it is applied to the database. Whether a request is rejected or accepted, the systems will send out notification to ensure that the affected parties are aware of the status of the request. The diagram below illustrates the flow of an update request.

Description of Figure 2

The figure details the workflow of an update request.

Structure Manager Module

The Structure Manager Module is used to show complex structures on the Browser. It manages these enterprise structures and the links that exist between production entities. It manages and controls the parent-child links, propagates attributes within the structure and checks the coherence of the structure once changes have been made.

Collection Entity Module

This module is responsible for generating and updating collection entities based on the information contained in a survey control file received from the survey’s sampling process. It also manages the manual customization of collection entities that is performed by survey managers based on pre-established business rules.

When an edit or change signal arrives at the BR and requires manual processing, the Update Module will generate a signal to the Workload area for purposes of review by an analyst/profiler. The Workload manages, prioritizes and assigns the signals to the analyst/profiler. After a manual review of the signal, the analyst/profiler either implements or cancels the change request.

Survey Interface Module

The function of this module is to produce two key Register products that are necessary to our partners in conducting their surveys: the Generic Survey Universe File (G-SUF) and the Generic Survey Interface File (G-SIF). The monthly standardized G-SUF is the result of extracting all units that comprise the total business population. It contains a list of all units of production with their tombstone information, the industrial classification, the detail geographical code, the size variables (such as revenue and employees), and other information to satisfy sampling procedures. Survey methodologists use this file primarily for the generation of survey samples. It is also used by subject matter divisions as an input to their edit, imputation and estimation system. From the units selected for a given survey by survey methodologists, the BR provides the G-SIF to collection staff. This file contains the information required in order to carry out data collection, such as the contact name, address and telephone number.

Response Burden Module

This module presents all information relating to respondent burden for economic surveys conducted at Statistics Canada. It displays information on all contact that Statistics Canada has had with a given enterprise. The response burden tool displays this information by survey, enterprise, contact name and questionnaire. Finally, it provides extractions concerning exclusion orders and cases that require specialized treatment. A central frame used by the entire economic survey program means a truly comprehensive view of response burden and thus facilitates its management.

Reports and Analysis Tools

These tools produce the reports needed to manage survey operations and analyse sub-populations. The Survey Frame Assessment (SFA) tool extracts and presents changes that have occurred in a survey’s population between two reference points. It includes changes to NAICS code, births, deaths and size indicators such as revenue. The SFA tool can dynamically display all changes that occurred as of the previous day for selected characteristics by operating entity. This is of particular importance as changes can be reviewed immediately prior to the production of the monthly G-SUF. Other tools include the analysis of updates on the Register and demographic analysis of the business population.

Maintaining the Content of the BR

The Register must be updated on an ongoing basis to ensure the continued quality and appropriateness of its information which is essential for designing and implementing effective surveys. Updates to the data content of the BR are based upon several sources of information but primarily upon administrative data from the Canada Revenue Agency (CRA), feedback from client surveys and information collected during the profiling of businesses. The largest complex enterprises are administered under the Enterprise Portfolio Manager (EPM) program, with BRD being responsible for everything else.

Administrative Data

Canada’s statistical system is heavily dependent upon administrative data for the regular production of statistics. The computerization of administrative programs in the 1960s and 1970s made it possible to increase usage of the resulting data files for statistical purposes. In recent years, further technological advances have facilitated and reduced the cost of manipulating large administrative files and have encouraged the increased use of administrative data.

The Register uses the Business number (BN) as the basis by which to identify businesses on the frame. The other administrative sources such as the individual tax return (T1), the corporate tax return (T2), the good and services tax (GST) and the payroll deduction account (PD) are used to complement the BN data with size variables. We use the BN master file from CRA to create and update tombstone data and to identify potential new businesses. CRA also produces a monthly file on amalgamated BNs with the successor BN. This process is fully automated and it permits us to inactivate amalgamated BNs.

The BR is responsible for assigning a code based upon the North American Industrial Classification System (NAICS) to each business. This work is performed by processing the description of the activity gathered by Canadian Revenue Agency (CRA). Fifty percent of these descriptions are classified automatically by the system once a month and the other fifty percent are classified by Statistics Canada employees. Once these businesses are added to the frame, the BR relies upon CRA data and survey feedback to update the information.

Survey Feedback

Surveys are required to provide feedback to BRD on any frame changes to the business and contact information that comes to light while collecting survey data. Changes are transmitted to BRD via an electronic form which in turn runs as a batch job in the survey feedback processing system. These changes then progress through the update cycle as described earlier.

Profiling

Complex businesses (i.e., businesses that have more than one operating entity) represent less than 1% of the total businesses but contribute to more than 50% of the total revenue in Canada. Although the Business Register uses data from CRA to identify the top legal entity, it is primarily the profiling activities and survey feedback that maintain this population. Data from financial statements and information about the business from their web site are valuable sources of information to delineate the operating entities that form an enterprise. In many cases, contact with the business is required in order to collect more detailed information such as the industrial activity of each operating entity and their accounting practices.

Enterprise Portfolio Management (EPM)

The Enterprise Portfolio Management (EPM) program is under the responsibility of the Enterprise Statistics Division. This team has been assigned roughly 350 of the largest enterprises on the Register. They are responsible for developing and maintaining productive relationships between Statistics Canada and each of the contacts within their portfolios. In essence, the EPMs perform three key functions. They act as focal points for businesses to assist the respondent with the many data demands placed upon them. They also profile business structures in order to gain a clear understanding of how a company’s business and accounting structures relate to their reporting capabilities and to ensure that the Register accurately represents their corporate structures. Finally, the EPMs are responsible for the response management of these large enterprises by coordinating and assisting the collection process for the survey programs.

Quality

The survey frame is at the foundation of every survey program. The quality of the frame is therefore crucial to ensure the production of high quality estimates from each survey. There are millions of changes applied to businesses on the Business Register every year. The majority of these changes are made automatically through the use of administrative data and survey feedback. These are routine updates such as updating the revenue values from the latest income tax return or a change of address for the contact person of a given survey. The remaining updates require review by persons with specialised knowledge (in the Workload module of the BRS). These could include changes in a NAICS code, changes to the status of a business (deathing, birthing) or perhaps an amalgamation. Because these changes could have a significant impact upon our economic survey program, the BR monitors this group closely so users can be informed of any significant change in a timely fashion.

The Quality Assurance Survey (QAS) is a monthly telephone survey of approximately 600 establishments carried out by BRD. Its purpose is to measure the quality of NAICS coding for all establishments on the Register, while at the same time determining the proportion of dead units. Taking this approach provides on-going quality indicators and regular feedback on the impact of changes made to improve these indicators. The QAS results are used to identify problem areas in NAICS coding so that training can be improved. The results will also be used by methodology and subject matter divisions to identify weak areas in the industrial classification process and make any adjustments required to their sampling strategies to compensate for these errors.

Numerous changes occur on the survey frame from one month to the next. Subject matter divisions are interested in understanding both the importance and source of these changes. A large increase or decrease in the number of establishments and any large change in the total revenue requires Methodology and Subject matter specialists to review the change and determine how it should be incorporated within their specific survey program.

To this end, we have developed two features to help provide this information. Firstly, we provide the effective date of the change which records the date of the event. For example, if the business closed an operation, we have the ability to store the effective date of this event as well as the date when the change was applied to the frame. Secondly, we have developed an analytical tool that displays all changes to the survey frame including the source and the nature of the update. This tool accesses the list of all micro records that brought about these changes. The analysis is performed just before the release of the monthly G-SUF by BRD staff. This is to ensure that the largest contributors to the change from one month to the next are either identified as legitimate change or action is taken to remedy the problem. This analysis also provides us with some indication of the quality of work being performed by the people making updates to the frame. In the cases where errors are found, this analysis allows us to provide constructive feedback to the appropriate individuals. It also gives a good indication of any additional training that may be required.

Conclusion

The BR is a central frame database that supports the sampling and collection process for the economic survey programs. It provides a user friendly environment through which Statistics Canada employees may easily browse and update business structures on a real time basis. Built to accommodate the many varying requirements of different survey programs, the BR gives a comprehensive and accurate picture of businesses in Canada.