The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures.

The following supplementary information tables are available on Statistics Canada's website:

- Reporting on Green Procurement

- Gender-based analysis plus

- Response to Parliamentary Committees

- United Nations 2030 Agenda and the Sustainable Development Goals

Reporting on green procurement

This supplementary information table supports reporting on green procurement activities in accordance with the Policy on Green Procurement.

Context

Although Statistics Canada was not bound by the Federal Sustainable Development Act in 2022–23 and is not required to develop a full 2020-23 Departmental Sustainable Development Strategy (DSDS), Statistics Canada adheres to the principles of the Federal Sustainable Development Strategy (FSDS) by complying with the Policy on Green Procurement.

The Policy on Green Procurement supports the Government of Canada's effort to promote environmental stewardship. In keeping with the objectives of the policy, Statistics Canada supports sustainable development by integrating environmental performance considerations into the procurement decision-making process through the actions described in the 2019 to 2022 FSDS "Greening Government" goal.

Commitments

Greening government: The Government of Canada will transition to low‑carbon, climate-resilient and green operations

| FSDS target | FSDS contributing action(s) | Corresponding departmental action(s) | Starting point(s), performance indicator(s), target(s) | Results achieved | Contribution by each departmental result to the FSDS goal and target |

|---|---|---|---|---|---|

|

Actions supporting the Greening Government goal and the Policy on Green Procurement |

Strengthen green procurement criteria. |

Program: Procurement |

Starting point:

Target:

|

|

Incorporating environmental considerations into purchasing decisions through green procurement is expected to motivate suppliers to reduce the environmental impact of the goods and services they deliver and their supply chains. Relevant targets or ambitions:

|

Report on integrating sustainable development

During the 2022–23 reporting cycle, Statistics Canada had no proposals that required a strategic environmental assessment, and no public statements were produced.

Gender-based analysis plus

Section 1: institutional GBA Plus governance and capacity

Governance

The demand for disaggregated data and analyses that include a Gender-based Analysis Plus (GBA Plus) lens continues to increase. To best meet the increased demand for disaggregated data and better support its data users, Statistics Canada continued to increase its GBA Plus capacity and to implement its Disaggregated Data Action Plan (DDAP). The DDAP prioritizes the collection of diversity data (e.g., data that may be broken down by sex or gender, as well as data about Indigenous peoples, racialized groups and people with disabilities) across Statistics Canada's programs. The DDAP also emphasizes Statistics Canada's responsibility for continually identifying and addressing data and knowledge gaps and supporting representative data collection across the country, across age groups and at various levels of geography. In these ways, the DDAP is a key enabler for GBA Plus and intersectional analysis. Such analyses provide much-needed information on the experiences and outcomes of Canadians. In turn, this information allows for more informed decision making, more equitable delivery of programs and services, and the tracking of progress toward a fairer and more inclusive society.

Capacity

Statistics Canada's Centre for Gender, Diversity and Inclusion Statistics (CGDIS) is responsible for reporting to Canadians, generating new information, and building GBA Plus knowledge and capacity. In 2022–23, the scope of the CGDIS increased to support the DDAP, including reviewing, developing and promoting diversity-related statistical standards; to support several Government of Canada initiatives (e.g., Canada's Anti-Racism Strategy and the Federal 2SLGBTQI+ Action Plan); and to produce a great number of statistical products and insights. Previously, the CGDIS released an updated Gender, Diversity and Inclusion Statistics Hub and last year released a sex, gender and sexual orientation customized taxonomy to organize relevant content in an easily accessible way. The hub allows users to access Statistics Canada data relevant to GBA Plus. The CGDIS supported and engaged with an array of stakeholders to better understand their perspectives and data needs; provide methodological advice and analytic expertise on areas related to gender, diversity and inclusion in Canada; and increase GBA Plus knowledge and capacity, both internally and externally. Additionally, the CGDIS continued to lead the agency-wide GBA Plus Responsibility Network to keep developing effective programs and initiatives, an important step toward increased capacity and further GBA Plus implementation throughout the agency. These will benefit the agency's data, people and internal processes, as well as those who rely on the agency's trusted data, analytical products and insights. The CGDIS also implemented a community of practice to provide a communication channel to share best practices and case studies on how to implement GBA Plus in any strategy or initiative.

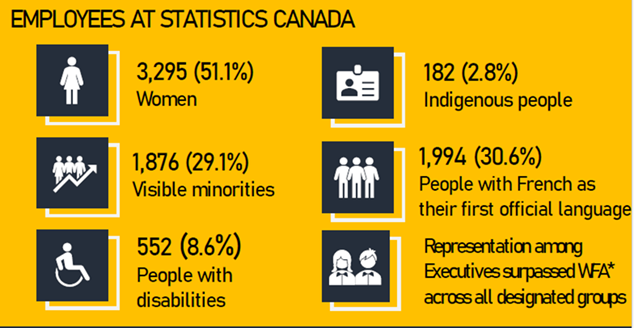

Statistics Canada owes its success to its talented, diverse and inclusive workforce. To best support its workforce, the agency continued to follow its Equity, Diversity and Inclusion Leadership Accountability Framework. This framework increases the agency's accountability to employment equity committees and enables it to better serve its employees through clearly identified roles and responsibilities.

Finally, the agency continued to implement the 2021-to-2025 Equity, Diversity and Inclusion Action Plan: Moving Forward Together, as well as the Integrity and Respect Action Plan. Both action plans aim to improve and promote diversity and inclusion within the workplace, eliminate systemic barriers in appointment processes, and increase representation at all levels across the agency.

Section 2: gender and diversity impacts, by program

Core responsibility: Statistical Information

Program name: Economic and Environmental Statistics

Program goals: The Economic and Environmental Statistics program produces a wide range of economic and environmental statistics, on topics such as national and international accounts, manufacturing, wholesale trade, retail trade, research and development, price indexes, finance, tourism, transportation, agriculture, and the environment.

Target population: All Canadians

Distribution of benefits

| Distribution | Group |

|---|---|

| By gender | The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

| By income level | The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

| By age group | The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

Key program impacts on gender and diversity

| Statistic | Observed results | Data source | Comment |

|---|---|---|---|

| Number of GBA Plus-related statistical products (e.g., catalogued products, such as data tables, research articles, studies, fact sheets, infographics, interactive dashboards, reference products, and minor and major releases disseminated through The Daily) made available on Statistics Canada's website | 627 | Administrative data file that tracks GBA Plus outreach within the Economic and Environmental Statistics program | GBA Plus factors considered in the calculation of this performance indicator include one or more of the following intersectional identity characteristics: sex or gender, age, geography, language, income, Indigenous identity, 2SLGBTQ+ identity, education, race, ethnicity, religion, and disability status. |

| Number of GBA Plus outreach activities (e.g., consultations and presentations) for external stakeholders (e.g., other government departments, academia and non-governmental organizations) | 65 | Administrative data file that tracks GBA Plus outreach within the Economic and Environmental Statistics program | |

| Number of training and awareness initiatives related to GBA Plus | 0 | Administrative data file that tracks GBA Plus outreach within the Economic and Environmental Statistics program | |

| Number of surveys or other tools collecting data on the following GBA Plus identity factors: gender and sexual orientationEconomic and Environmental Statistics - Table note 1 | 8 | Administrative data file that tracks GBA Plus outreach within the Economic and Environmental Statistics program | GBA Plus factors considered in the calculation of this performance indicator include one or more of the following intersectional identity characteristics: sex or gender, age, geography, language, income, Indigenous identity, 2SLGBTQ+ identity, education, race, ethnicity, religion and disability status. |

|

|||

GBA Plus data collection plan

In 2022–23, data requirements to measure impacts were completed. Statistics Canada continues to actively review and analyze the set of measures to identify gaps and improvements where possible.

Program name: Socio-economic Statistics

Program goals: The Socio-economic Statistics program provides integrated information and relevant analysis on the demographic and socio-economic characteristics of individuals, families and households, as well as on the major factors that affect their well-being. Many of the statistical products produced allow for GBA Plus analyses for key population groups.

Target population: All Canadians

Distribution of benefits

| Distribution | Group |

|---|---|

| By gender | The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

| By income level | The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

| By age group | The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

Key program impacts on gender and diversity

| Statistic | Observed results | Data source | Comment |

|---|---|---|---|

| Number of GBA Plus-related statistical products (e.g., catalogued products, such as data tables, research articles, studies, fact sheets, infographics, interactive dashboards, reference products, and minor and major releases disseminated through The Daily) made available on Statistics Canada's website | 218 | Administrative data file that tracks GBA Plus products within the Socio-economic Statistics program | GBA Plus factors considered in the calculation of this performance indicator include one or more of the following intersectional identity characteristics: sex or gender, age, geography, language, income, Indigenous identity, 2SLGBTQ+ identity, education, race, ethnicity, religion, and disability status. |

| Number of GBA Plus outreach activities (e.g., consultations and presentations) for external stakeholders (e.g., other government departments, academia and non-governmental organizations) | 10 | Administrative data file that tracks number of GBA Plus outreach within the Socio-economic Statistics program | |

| Number of training and awareness initiatives related to GBA Plus | 6 | Administrative data file that tracks number of GBA Plus training within the Socio-economic Statistics program | |

| Number of visits to the Gender, Diversity and Inclusion Statistics Hub in 2022–23Socio-economic Statistics - Table note 2 | 39,836 | Administrative data file that tracks number of Gender, Diversity and Inclusion Statistics Hub visits | |

| Number of Gender Results Framework indicators released by sex or gender in 2022–23Socio-economic Statistics - Table note 2 | 3 | Administrative data file that tracks the Gender Results Framework | |

| Number of Gender Results Framework indicators released by sex or gender and other identity factors in 2022–23Socio-economic Statistics - Table note 2 | 3 | Administrative data file that tracks the Gender Results Framework | |

| Percentage of programs from the program inventory, excluding internal services, that have data collection plans for reporting on impacts on gender and diversitySocio-economic Statistics - Table note 2 | 100% | Statistics Canada's website | |

| Number of surveys or other tools collecting data on the following GBA Plus identity factors: gender and sexual orientationSocio-economic Statistics - Table note 1 | 71 | Administrative data file that tracks the number of tools collecting GBA Plus identity factors within the Socio-economic Statistics program | GBA Plus factors considered in the calculation of this performance indicator include one or more of the following intersectional identity characteristics: sex or gender, age, geography, language, income, Indigenous identity, 2SLGBTQ+ identity, education, race, ethnicity, religion, and disability status. |

|

|||

GBA Plus data collection plan

In 2022–23, data requirements to measure impacts were completed. Statistics Canada continues to actively review and analyze the set of measures to identify gaps and improvements where possible.

Program name: Censuses

Program goals: The Censuses program provides statistical information and analyses that measure changes in the Canadian population and its demographic characteristics, and in the agricultural sector. The program includes the Census of Population and the Census of Agriculture.

Target population: All Canadians

Distribution of benefits

| Distribution | Group |

|---|---|

|

By gender |

The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

|

By income level |

The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

|

By age group |

The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

Key program impacts on gender and diversity

The Censuses program is cyclical and includes an array of activities (e.g., consultation and engagement, questionnaire development, data collection, data processing, and dissemination) that must be completed to ensure its success. From start to finish, each census cycle spans approximately seven years, with cycles overlapping (i.e., when one cycle is nearing completion, the next cycle begins). For example, the 2021 Census of Population Program will conclude in 2024–25 with an evaluation of the dissemination results, while the 2026 Census of Population Program will begin in 2023–24.

| Statistic | Observed results | Data source | Comment |

|---|---|---|---|

| Number of GBA Plus-related statistical products (e.g., catalogued products, such as data tables, research articles, studies, fact sheets, infographics, interactive dashboards, reference products, and minor and major releases disseminated through The Daily) made available on Statistics Canada's website | 413 | Statistics Canada's website |

This GBA Plus Supplementary Information Table for fiscal year 2022–23 reflects where a census is within the census cycle. Note that census releases tend to be disseminated throughout, and within, one to two fiscal years, meaning that zero observed results will be reported for years that did not include one or more census releases. GBA Plus factors considered in the calculation of this performance indicator include one or more of the following intersectional identity characteristics: sex or gender, age, geography, language, income, Indigenous identity, 2SLGBTQ+ identity, education, race, ethnicity, religion, and disability status. |

| Number of GBA Plus outreach activities (e.g., consultations and presentations) for external stakeholders (e.g., other government departments, academia and non-governmental organizations) | 0 | Statistics Canada's website | |

| Number of training and awareness initiatives related to GBA Plus | 0 | Statistics Canada's website | |

| Number of surveys or other tools collecting data on the following GBA Plus identity factors: gender and sexual orientationCensuses - Table note 1 | 0 | Statistics Canada's website | GBA Plus factors considered in the calculation of this performance indicator include one or more of the following intersectional identity characteristics: sex or gender, age, geography, language, income, Indigenous identity, 2SLGBTQ+ identity, education, race, ethnicity, religion, and disability status. |

|

|||

GBA Plus data collection plan

In 2022–23, data requirements to measure impacts were completed. Statistics Canada continues to actively review and analyze the set of measures to identify gaps and improvements where possible.

Program name: Cost-Recovered Statistical Services

Program goals: Through the Cost-recovered Statistical Services program, Statistics Canada conducts special surveys to gather new data; produces high-quality statistics that are currently not part of the agency's data holdings; and conducts on-demand special analytical projects to meet specific needs of federal, provincial and territorial institutions and other clients.

Target population: All Canadians

Distribution of benefits

| Distribution | Group |

|---|---|

|

By gender |

The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

|

By income level |

The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

|

By age group |

The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

Key program impacts on gender and diversity

Indicators for cost-recovered products are included in their respective program area (i.e., Economic and Environmental Statistics, Socio-economic Statistics, and Centres of Expertise) and not identified separately.

| Statistic | Observed results | Data source | Comment |

|---|---|---|---|

| Number of GBA Plus-related statistical products (e.g., catalogued products, such as data tables, research articles, studies, fact sheets, infographics, interactive dashboards, reference products, and minor and major releases disseminated through The Daily) made available on Statistics Canada's website | 39 | Excel file that tracks the number of GBA-Plus related products available on Statistic's Canada website with the Cost-Recovered Statistical Services | GBA Plus factors considered in the calculation of this performance indicator include one or more of the following intersectional identity characteristics: sex or gender, age, geography, language, income, Indigenous identity, 2SLGBTQ+ identity, education, race, ethnicity, religion, and disability status. |

| Number of GBA Plus outreach activities (e.g., consultations and presentations) for external stakeholders (e.g., other government departments, academia and non-governmental organizations) | 0 | Statistics Canada's website | |

| Number of training and awareness initiatives related to GBA Plus | 0 | Statistics Canada's website | |

| Number of surveys or other tools collecting data on the following GBA Plus identity factors: gender and sexual orientationCost-Recovered Statistical Services - Table note 1 | 0 | Statistics Canada's website | GBA Plus factors considered in the calculation of this performance indicator include one or more of the following intersectional identity characteristics: sex or gender, age, geography, language, income, Indigenous identity, 2SLGBTQ+ identity, education, race, ethnicity, religion, and disability status. |

|

|||

GBA Plus data collection plan

In 2022–23, data requirements to measure impacts were completed. Statistics Canada continues to actively review and analyze the set of measures to identify gaps and improvements where possible.

Program name: Centres of Expertise

Program goals: The Centres of Expertise support all Statistics Canada programs to ensure that Canadian citizens, businesses, governments, universities and other institutions have access to the most detailed, timely and accurate information at the lowest cost possible—both in terms of dollars and response burden—while protecting the privacy of their information. The Centres of Expertise undertake innovative research, analysis and data development activities and continually seek new data sources, leading-edge methods and systems, cost-effective operations, and new statistical products to address the current and future information needs of Canadians.

Target population: All Canadians

Distribution of benefits

| Distribution | Group |

|---|---|

|

By gender |

The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

|

By income level |

The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

|

By age group |

The program's target population is all Canadians, and the distribution of benefits is equal by gender, income level and age. |

Key program impacts on gender and diversity

| Statistic | Observed results | Data source | Comment |

|---|---|---|---|

| Number of GBA Plus-related statistical products (e.g., catalogued products, such as data tables, research articles, studies, fact sheets, infographics, interactive dashboards, reference products, and minor and major releases disseminated through The Daily) made available on Statistics Canada's website | 48 | Administrative data file that tracks the number of GBA Plus-related products within the Centres of Expertise program. | GBA Plus factors considered in the calculation of this performance indicator include one or more of the following intersectional identity characteristics: sex or gender, age, geography, language, income, Indigenous identity, 2SLGBTQ+ identity, education, race, ethnicity, religion, and disability status. |

| Number of GBA Plus outreach activities (e.g., consultations and presentations) for external stakeholders (e.g., other government departments, academia and non-governmental organizations) | 0 | Statistics Canada's website | |

| Number of training and awareness initiatives related to GBA Plus | 2 | Statistics Canada's website | |

| Number of surveys or other tools collecting data on the following GBA Plus identity factors: gender and sexual orientationCentres of Expertise - Table note 1 | 0 | Statistics Canada's website | GBA Plus factors considered in the calculation of this performance indicator include one or more of the following intersectional identity characteristics: sex or gender, age, geography, language, income, Indigenous identity, 2SLGBTQ+ identity, education, race, ethnicity, religion, and disability status. |

|

|||

GBA Plus data collection plan

In 2022–23, data requirements to measure impacts were completed. Statistics Canada continues to actively review and analyze the set of measures to identify gaps and improvements where possible.

Scales

Gender scale

- First group: predominantly men (80% or more men)

- Second group: 60% to 79% men

- Third group: broadly gender-balanced

- Fourth group: 60% to 79% women

- Fifth group: predominantly women (80% or more women)

Income‑level scale

- First group: strongly benefits low‑income individuals (strongly progressive)

- Second group: somewhat benefits low‑income individuals (somewhat progressive)

- Third group: no significant distributional impacts

- Fourth group: somewhat benefits high‑income individuals (somewhat regressive)

- Fifth group: strongly benefits high‑income individuals (strongly regressive)

Age‑group scale

- First group: primarily benefits youth, children or future generations

- Second group: no significant intergenerational impacts or impacts on generations between youths and seniors

- Third group: primarily benefits seniors or the baby boom generation

Response to parliamentary committees and external audits

Response to parliamentary committees

There were no parliamentary committee reports in 2022–23 requiring a response.

Response to audits conducted by the Office of the Auditor General of Canada (including audits conducted by the Commissioner of the Environment and Sustainable Development)

2022 Report 1 of the Auditor General of Canada

Summary of the chapter with hyperlink from the chapter's title to the department's response: This audit focused on whether the Canada Revenue Agency (CRA) and Employment and Social Development Canada (ESDC) directly, or through leveraging other federal departments and other non‑federal government entities, ensured that hard‑to‑reach populations were made aware of, and could access, the Canada Child Benefit, the Canada Workers Benefit, the Guaranteed Income Supplement and the Canada Learning Bond.

Recommendation 1.31: The CRA, ESDC and Statistics Canada should establish a joint prioritization, planning, monitoring and reporting process to improve how they measure the take-up of benefits. This should include

- assessing available and specific data holdings on hard-to-reach populations

- defining and implementing actions to collect additional data on specific hard-to-reach populations

- improving the use of data in measuring benefit take-up and the sources of gaps in benefit take-up.

Departmental response: Agreed. Statistics Canada emphasizes that there are substantial statistical difficulties with computing take‑up rates as described in some places in this report. The challenges result from problems including missing (or non‑existent) data, imperfect record linkages, and coverage issues (such as surveys that do not collect data on‑reserve or in institutions), which lead to difficulties accurately modelling the size of the population eligible for a benefit. As a result, the use of take‑up rates for monitoring and reporting progress is limited, and other solutions must also be used for monitoring and reporting progress on take‑up. Despite this, estimated take‑up rates can and have been used successfully to help describe differences in take‑up between groups and to help identify population groups to target for interventions.

The recommendation includes assessing available specific data holdings on hard‑to‑reach populations, defining and implementing actions to collect additional data on hard‑to‑reach populations, and improving the use of data in measuring benefit take‑up and the sources of gaps in benefit take‑up. Once a plan has been agreed upon with the CRA and ESDC, Statistics Canada will present funding requirements to federal partners to allow for the work to proceed. Statistics Canada emphasizes that its actions cannot include sharing of confidential microdata with the department or agency. It should be noted that funding has not been identified for these activities, and the majority of Statistics Canada's social statistics programs are cost recovery and funded by federal departments.

Corrective action taken to address the recommendations: Measures put in place by Statistics Canada with its partners, the CRA and ESDC, to address Recommendation 1.31 include the following:

- Improving governance: To ensure that the CRA, ESDC and Statistics Canada work effectively and efficiently together to ensure ongoing prioritization, development and reporting on the take-up of benefits for hard-to-reach populations, the three organizations have formalized governance, leveraging existing working groups and implementing new working groups, committees and senior decision-making tables.

- Improving the use of available data: The CRA and Statistics Canada are completing a second iteration of a study that links T1 tax data for the 2020 tax year to 2021 Census data to better understand participation in the tax and benefits system for different segments of the population.

- Conducting new research: Statistics Canada is examining the tax filing behaviour of recent immigrants (e.g., families with children younger than 18) to determine whether they accessed the benefits for which they were eligible. Statistics Canada also undertook a study that focused on Canadian tax filers deemed eligible for child tax benefits who were observed not receiving them.

- Improving methodologies: Statistics Canada provided population projections to allow ESDC to estimate the eligible base for the Canada Child Benefit to improve calculation of the take-up rate. Statistics Canada also worked with its partners to ensure that consistent definitions of concepts and at-risk groups are used.

- Developing a critical path: Statistics Canada created a critical path for activities through March 2024.

Response to audits conducted by the Public Service Commission of Canada or the Office of the Commissioner of Official Languages

There were no audits in 2022–23 requiring a response.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

| UN Sustainable Development Goals (SDGs) | 2022‒23 planned initiatives | Associated domestic targets or "ambitions" and/or global targets | 2022‒23 results |

|---|---|---|---|

|

SDGs 1 to 17 |

In 2022-23, Statistics Canada will update the Global Indicator Framework and Canadian Indicator Framework data hubs to increase data disaggregation and to update data for indicators where new data are available. Over the second half of 2022–23 and into 2023–24, Statistics Canada will develop infographics for the 17 SDGs and undertake a staggered release strategy to disseminate them. Statistics Canada will develop an SDG measure of progress to provide a robust and simple method to communicate progress on the SDG indicators.

|

All goals and targets in both the Canadian Indicator Framework and Global Indicator Framework |

In 2022–23, Statistics Canada continued to report on both the Global Indicator Framework and the Canadian Indicator Framework for SDGs in the SDG portals. In addition, over the course of the 2022–23 fiscal year, Statistics Canada released infographics on SDGs 1 to 11. Those for the last six goals will be released during the 2023–24 fiscal year. Statistics Canada also developed an easy-to-understand statistical measure of progress for SDG indicators that can be used to communicate areas where progress is being made or where there has been little progress. Statistics Canada drafted the statistical annex for the 2023 Voluntary National Review and also validated data in the main report. |

Financial, human resources and performance information for Statistics Canada's program inventory is available in GC InfoBase.

Organizational profile

Appropriate minister: The Honourable François-Philippe Champagne, P.C., M.P.

Institutional head: Anil Arora

Ministerial portfolio: Innovation, Science and Economic Development

Enabling instrument[s]:

Year of incorporation / commencement: The Dominion Bureau of Statistics was established in 1918. In 1971, with the revision of the Statistics Act, the agency became Statistics Canada.

Other: Under the Statistics Act, Statistics Canada is required to collect, compile, analyze, abstract and publish statistical information relating to the commercial, industrial, financial, social, economic and general activities and condition of the people of Canada.

Statistics Canada has two primary objectives:

- to provide statistical information and analysis on the economic and social structure and functioning of Canadian society, as a basis for developing, operating and evaluating public policies and programs; for public and private decision making; and for the general benefit of all Canadians

- to promote the quality, coherence and international comparability of Canada's statistics through collaboration with other federal departments and agencies, with the provinces and territories, and in accordance with sound scientific standards and practices.

Statistics Canada's head office is located in Ottawa. There are regional offices across the country in Halifax, Sherbrooke, Montréal, Toronto, Sturgeon Falls, Winnipeg, Edmonton and Vancouver. There are also 35 research data centres located throughout the country in academic institutions. In addition, there are five secure rooms available for access by employees of federal departments and selected provincial ministries. These centres provide researchers with access to microdata from population and household survey programs in a secure setting. Canadians can follow the agency on X (formerly Twitter), Facebook, Instagram, Reddit, feeds and YouTube.

Raison d'être, mandate and role: who we are and what we do

"Raison d’être, mandate and role: who we are and what we do" is available on Statistics Canada's website.

For more information on the department’s organizational mandate letter commitments, see the Minister Mandate letter.

Operating context

Information on the operating context is available on Statistics Canada's website.

Reporting framework

Statistics Canada's departmental results framework and program inventory of record for 2022–23 are shown below.

Departmental Results Framework

Core Responsibility: Statistical Information

Statistics Canada produces objective high-quality statistical information for the whole of Canada. The statistical information produced relates to the commercial, industrial, financial, social, economic, environmental and general activities and conditions of the people of Canada.

Result 1

High-quality statistical information is available to Canadians.

- Indicator 1: Number of post-release corrections due to accuracy.

- Indicator 2: Percentage of international standards with which Statistics Canada conforms.

- Indicator 3: Number of statistical products available on the website.

- Indicator 4: Number of Statistics Canada data tables available on the Open Data Portal.

Result 2

High-quality statistical information is accessed by Canadians.

- Indicator 1: Number of visits to Statistics Canada website.

- Indicator 2: Number of hits on Statistics Canada's Application Programming Interface (API).

- Indicator 3: Percentage of website visitors that found what they were looking for.

- Indicator 4: Number of interactions on social media.

Result 3

High quality statistical information is relevant to Canadians.

- Indicator 1: Number of media citations on Statistics Canada data.

- Indicator 2: Number of journal citations.

- Indicator 3: Percentage of users satisfied with statistical information.

Internal Services

Program Inventory

- Economic and Environmental Statistics

- Socio-economic Statistics

- Censuses

- Cost-Recovered Statistical Services

- Centres of Expertise

Spending

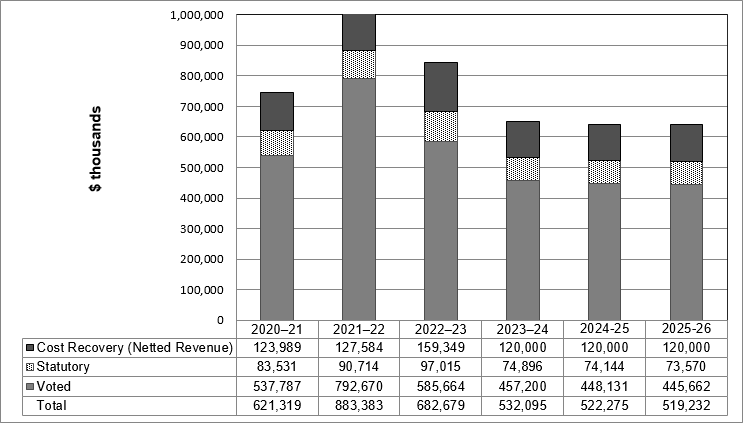

Spending 2020–21 to 2025–26

The following graph presents planned (voted and statutory spending) over time.

Description - Purpose-based engagement

| 2020–21 | 2021–22 | 2022–23 | 2023–24 | 2024-25 | 2025-26 | |

|---|---|---|---|---|---|---|

| Cost Recovery (Netted Revenue) | 123,989 | 127,584 | 159,349 | 120,000 | 120,000 | 120,000 |

| Statutory | 83,531 | 90,714 | 97,015 | 74,896 | 74,144 | 73,570 |

| Voted | 537,787 | 792,670 | 585,664 | 457,200 | 448,131 | 445,662 |

| Total | 621,319 | 883,383 | 682,679 | 532,095 | 522,275 | 519,232 |

Budgetary performance summary for core responsibilities and internal services (dollars)

The "Budgetary performance summary for core responsibilities and internal services" table presents the budgetary financial resources allocated for Statistics Canada's core responsibilities and for internal services.

| Core responsibilities and internal services | 2022–23 Main Estimates | 2022–23 planned spending | 2023–24 planned spending | 2024–25 planned spending | 2022–23 total authorities available for use | 2020–21 actual spending (authorities used) | 2021–22 actual spending (authorities used) | 2022–23 actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Statistical information | 616,663,357 | 616,663,357 | 579,311,471 | 571,978,435 | 754,356,616 | 666,463,788 | 920,977,524 | 731,447,169 |

| Internal services | 80,030,892 | 80,030,892 | 72,783,788 | 70,296,376 | 111,048,632 | 78,844,148 | 89,989,424 | 110,581,024 |

| Total gross expenditures | 696,694,249 | 696,694,249 | 652,095,259 | 642,274,811 | 865,405,248 | 745,307,936 | 1,010,966,948 | 842,028,193 |

| Respendable revenue | -120,000,000 | -120,000,000 | -120,000,000 | -120,000,000 | -159,349,013 | -123,989,068 | -127,583,773 | -159,349,013 |

| Total net expenditures | 576,694,249 | 576,694,249 | 532,095,259 | 522,274,811 | 706,056,235 | 621,318,868 | 883,383,175 | 682,679,180 |

Statistics Canada is funded by two sources: direct parliamentary appropriations and cost-recovery activities. It has the authority to generate $120 million annually in respendable revenue related to two streams: statistical surveys and related services, and custom requests and workshops. If exceeded, a request can be made to increase the authority, as was the case in the last few years.

In recent years, respendable cost-recovery revenue has contributed $120 million to $159 million annually to the agency's total resources. A large portion of this respendable revenue comes from federal departments to fund specific statistical projects. Respendable revenue increased in 2022–23 because of additional work associated with extra demands following the slowdown during the pandemic and the 2021 Census.

Spending fluctuations between the years shown in the graph and table above were mainly caused by the Census Program. Activity for this program peaked in 2021–22 when the 2021 Census of Population and the 2021 Census of Agriculture were conducted and drops in 2022–23 and 2023–24 as these activities wind down. This pattern is typical for the agency because of the cyclical nature of the Census Program. Funding for the 2026 Census of Population and the 2026 Census of Agriculture is not reflected, amplifying the decrease in the overall statistical information funding.

In addition, funding received for new initiatives from Budget 2021 is decreasing from 2022–23 to 2023–24 and will remain relatively the same in 2024–25.

The difference between 2022–23 actual spending and 2022–23 total authorities available for use is largely attributable to how the agency strategically manages its investments. The agency leverages the operating budget carry-forward mechanism to manage the cyclical nature of program operations and investments in the agency's strategic priorities.

Internal services spending from 2020–21 to 2022–23 includes resources from temporary funding related to an initiative approved in 2018–19 to migrate the agency's infrastructure to the cloud. The decrease in funding for outer years is largely attributable to ongoing funding related to cloud expenditures not yet secured and the agency's investment planning cycle. Investment funding from past years will come to an end in future years, while new investment decisions will be finalized only later in the year.

2022–23 Budgetary actual gross spending summary (dollars)

The following table reconciles gross planned spending with net spending for 2022–23.

| Core responsibilities and internal services | 2022–23 actual gross spending | 2022–23 actual revenues netted against expenditures | 2022–23 actual net spending (authorities used) |

|---|---|---|---|

| Statistical information | 731,447,169 | -159,349,013 | 572,098,156 |

| Internal services | 110,581,024 | 0 | 110,581,024 |

| Total gross expenditures | 842,028,193 | -159,349,013 | 682,679,180 |

Statistics Canada generated $159 million in respendable revenue from the sale of statistical products and services.

Human resources

The "Human resources summary for core responsibilities and internal services" table presents the full-time equivalents (FTEs) allocated to each of Statistics Canada's core responsibilities and to internal services.

Human resources summary for core responsibilities and internal services

| Core responsibilities and internal services | 2020–21 actual full-time equivalents | 2021–22 actual full-time equivalents | 2022–23 planned full-time equivalents | 2022–23 actual full-time equivalents | 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents |

|---|---|---|---|---|---|---|

| Statistical information | 6,099 | 7,186 | 5,889 | 7,005 | 5,415 | 5,389 |

| Internal services | 684 | 713 | 659 | 833 | 610 | 584 |

| Total gross expenditures | 6,783 | 7,899 | 6,548 | 7,838 | 6,025 | 5,973 |

| Respendable revenue | -1,340 | -1,542 | -1,181 | -1,795 | -1,189 | -1,189 |

| Total net expenditures | 5,443 | 6,357 | 5,367 | 6,043 | 4,836 | 4,784 |

Similar to trends seen in planned spending, changes in full-time equivalents from year to year are largely explained by the cyclical nature of the Census Program. Activity peaked in 2021–22, when the 2021 Census of Population and 2021 Census of Agriculture were conducted, and decreases thereafter as these activities wind down. Funding for the 2026 Census of Population, the 2026 Census of Agriculture and the cloud is not reflected, amplifying the decrease in overall full-time equivalents in future years.

Expenditures by vote

For information on Statistics Canada's organizational voted and statutory expenditures, consult the Public Accounts of Canada.

Government of Canada spending and activities

Information on the alignment of Statistics Canada's spending with Government of Canada's spending and activities is available in GC InfoBase.

Financial statements and financial statements highlights

Financial statements

Statistics Canada's financial statements (unaudited) for the year ended March 31, 2023, are available on the department's website.

The agency uses the full accrual accounting method to prepare and present its annual financial statements, which are part of the departmental result reporting process. However, spending authorities presented in the previous sections of this report remain on an expenditure basis. A reconciliation between the bases of reporting is available in Note 3 of the financial statements.

Financial statement highlights

| Financial information | 2022–23 planned results | 2022–23 actual results | 2021–22 actual results | Difference (2022–23 actual results minus 2022–23 planned results) | Difference (2022– 23 actual results minus 2021–22 actual results) |

|---|---|---|---|---|---|

| Total expenses | 830,619,454 | 950,829,557 | 1,098,855,896 | 120,210,103 | -148,026,339 |

| Total revenues | 120,000,000 | 159,106,926 | 127,990,099 | 39,106,926 | 31,116,827 |

| Net cost of operations before government funding and transfers | 710,619,454 | 791,722,631 | 970,865,797 | 81,103,177 | -179,143,166 |

The 2022–23 planned results information is provided in Statistics Canada's Future-Oriented Statement of Operations and notes for 2022–23. The assumptions underlying the forecasts were made before the completion of the 2021–22 fiscal year.

The net cost of operations before government funding and transfers was $791.7 million, a decrease of $179.1 million (22.6%) from $970.9 million in 2021–22, mainly because of the decrease in expenses related to the cyclical nature of the 2021 Census Program, for which activities peaked in 2021–22.

Actual versus planned

The difference between actual and planned net costs for 2022–23 is $81.1 million (11.4%). Expenses were $120 million higher than anticipated. A large portion of the increase is attributable to additional cost-recovery work associated with extra demands following the slowdown during the pandemic and the 2021 Census. It is also attributable to funding that was carried forward or reprofiled from 2021–22, allowing the agency to meet the needs of its cyclical programs and to invest in its integrated strategic plans, technology, new data sources, cutting-edge statistical methods and frameworks. In addition, funding received from the fiscal framework for the ratification of certain collective agreements contributed. These elements contributed to additional employee benefit plan spending. The increases were partially offset by budget carried forward to 2023–24.

Revenues were $31.1 million higher than anticipated, mainly because of an increase in additional cost-recovery work associated with extra demands following the slowdown during the pandemic and the 2021 Census.

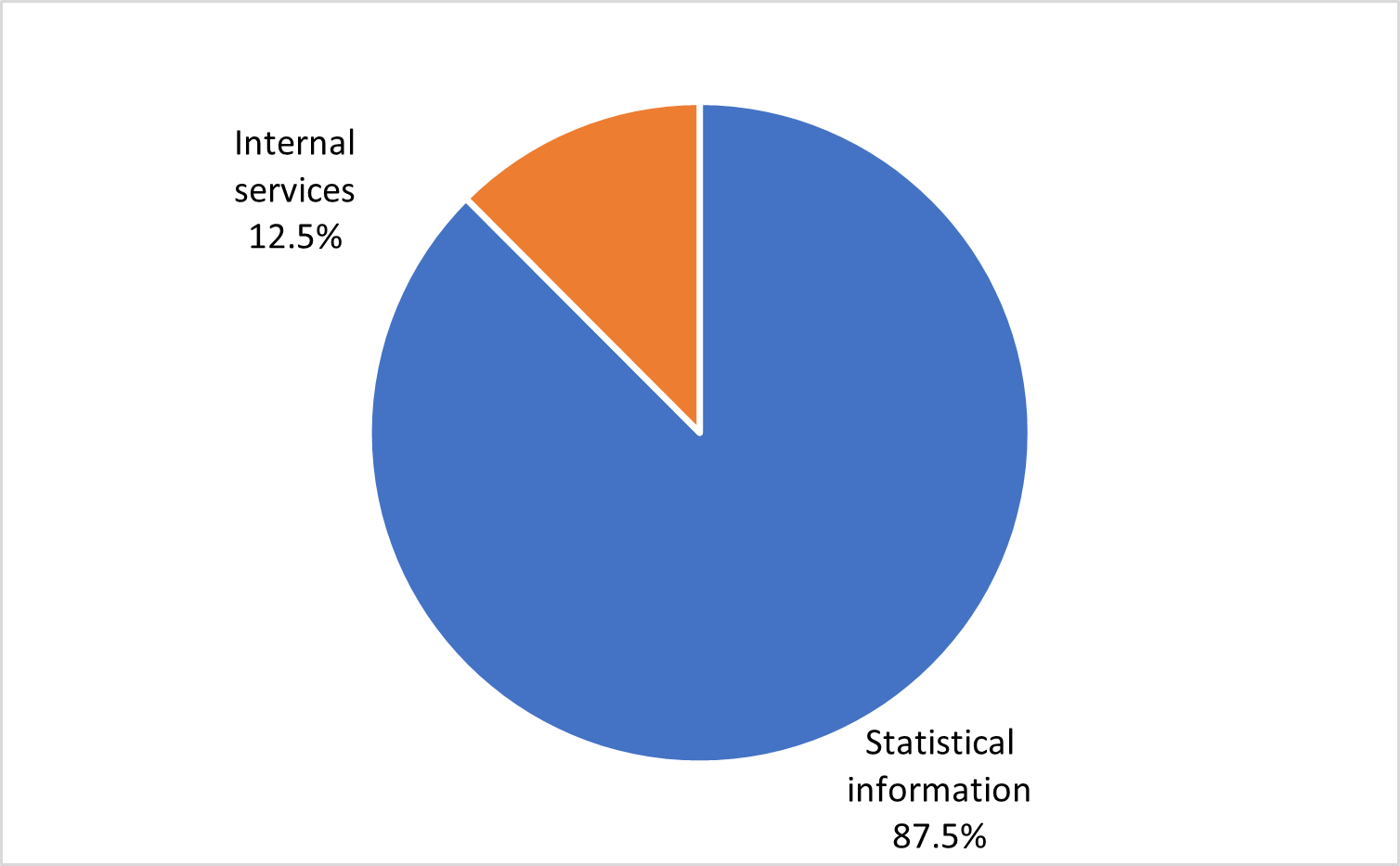

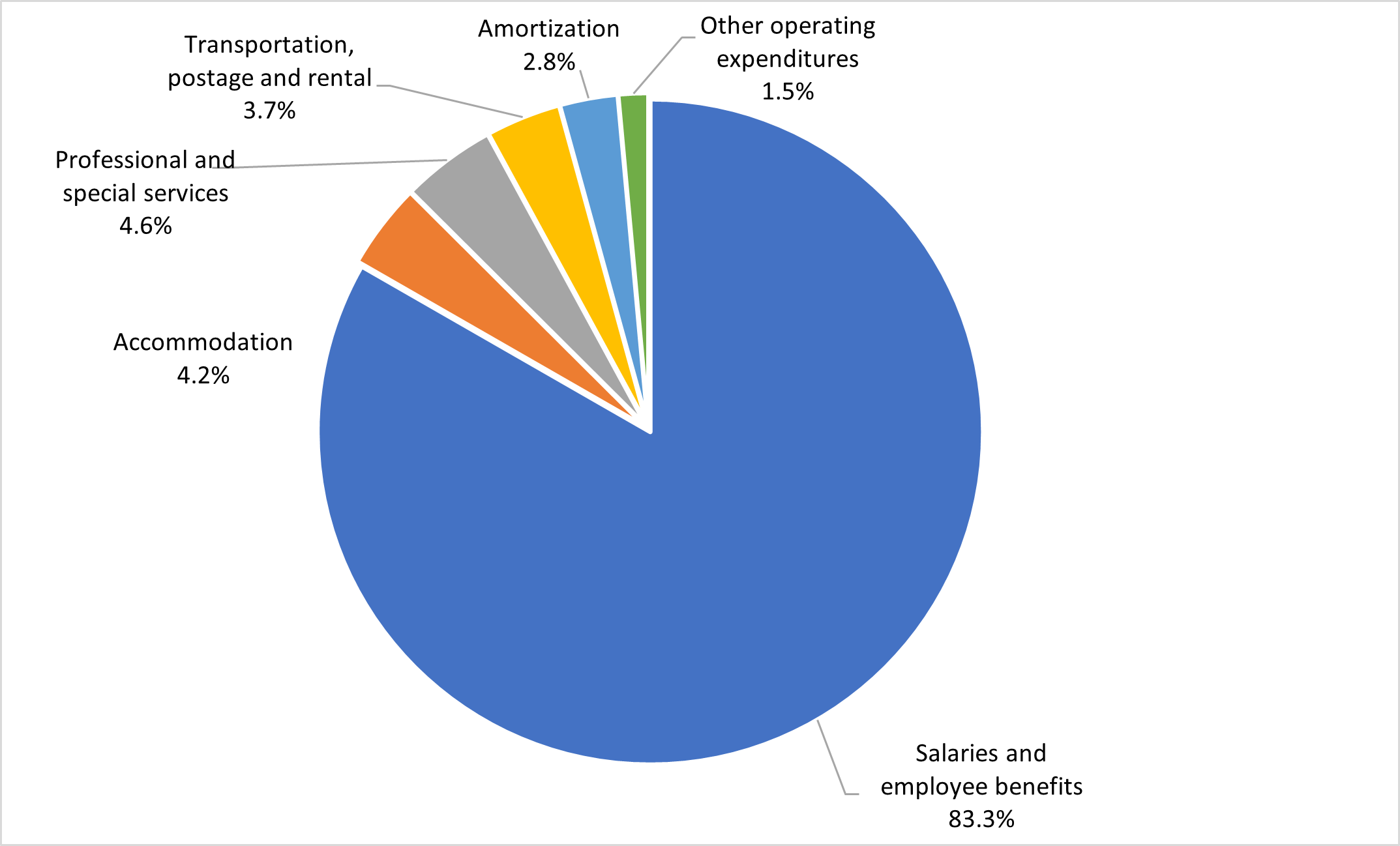

For more information on the distribution of expenses by program and type, see the two charts below.

Gross expenditures by core responsibility

Total expenses, including services provided without charge by federal government departments, were $950.8 million in 2022–23. These expenses comprised $832.2 million (87.5%) for statistical information and $118.6 million (12.5%) for internal services.

Gross expenditures by type

Statistics Canada spent $950.8 million in 2022–23. These expenses mainly comprised $792 million (83.3%) for salaries and employee benefits; $43.7 million (4.6%) for professional and special services; $39.7 million (4.2%) for accommodation; $34.8 million (3.7%) for transportation, postage and rental; and $26.8 million (2.8%) for amortization. Other operating expenditures comprised $13.8 million (1.5%) for communication and printing, repairs and maintenance, materials and supplies, etc.

| Financial information | 2022–23 | 2021–22 | Difference (2022–23 minus 2021–22) |

|---|---|---|---|

| Total net liabilities | 143,659,490 | 142,525,338 | 1,134,152 |

| Total net financial assets | 68,883,213 | 67,079,045 | 1,804,168 |

| Departmental net debt | 74,776,277 | 75,446,293 | -670,016 |

| Total non‑financial assets | 155,767,323 | 170,908,816 | -15,141,493 |

| Departmental net financial position | 80,991,046 | 95,462,523 | -14,471,477 |

The 2022–23 planned results information is provided in Statistics Canada's Future-Oriented Statement of Operations and notes for 2022–23. The departmental net financial position was $81 million at the end of 2022–23, a decrease of $14.5 million from $95.5 million in 2021–22.

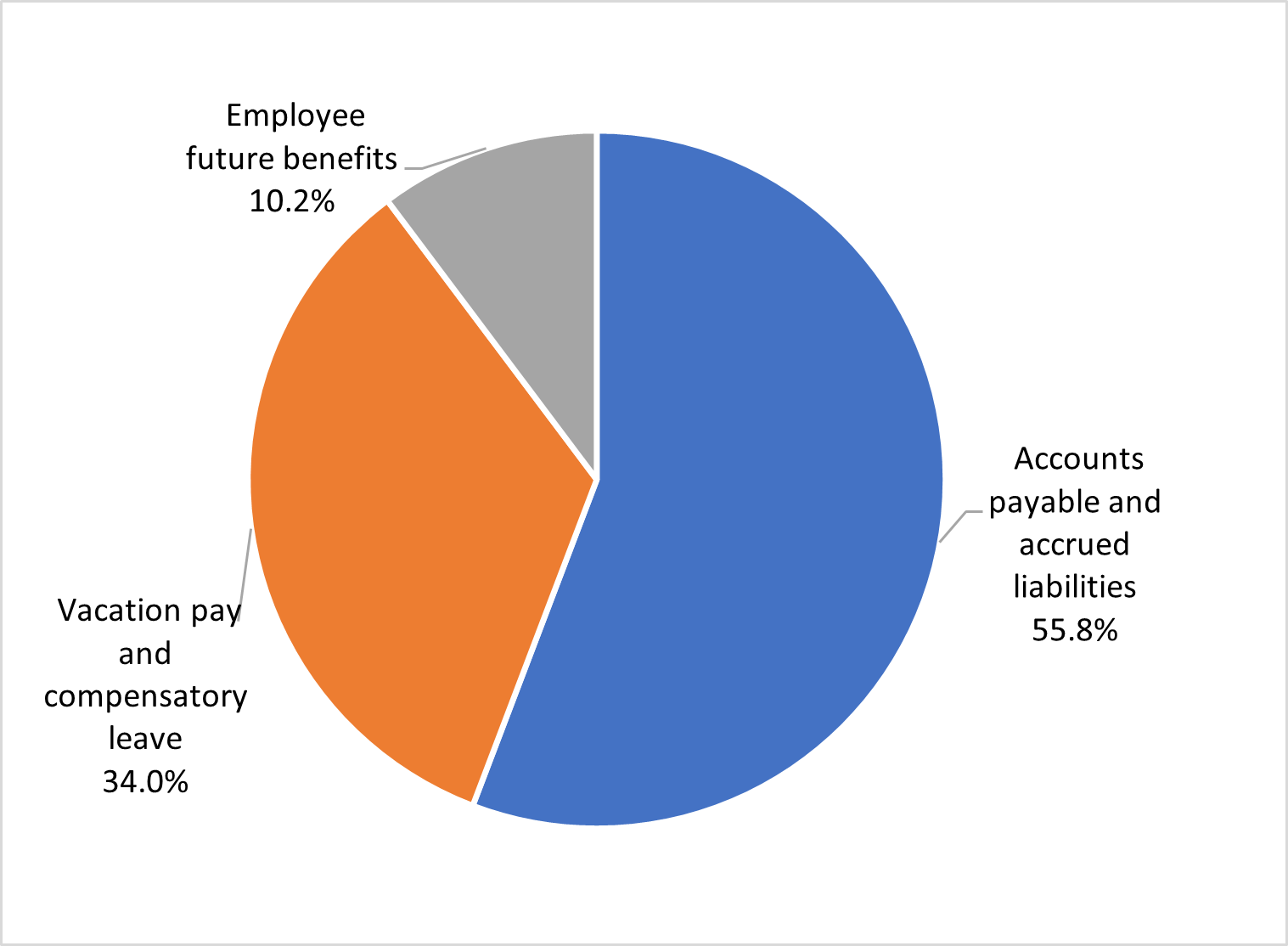

Total net liabilities

The increase in total liabilities of $1.1 million is mainly attributable to an increase in accounts payable and accrued liabilities related to employer contributions to employee benefit plans and accrued salaries and wages, offset by a decrease in accounts payable to external parties, as well as a decrease in employee future benefits related to severance benefits.

Total net financial assets

The increase in total net financial assets of $1.8 million is mainly attributable to an increase in the amount due from the Consolidated Revenue Fund to discharge accounts payable and accrued liabilities. This is offset by a decrease in accounts receivable and advances.

Total non-financial assets

The decrease in total non-financial assets of $15.1 million is mainly attributable to a reduction in software acquisitions, an increase in write-offs and adjustments for internally developed software.

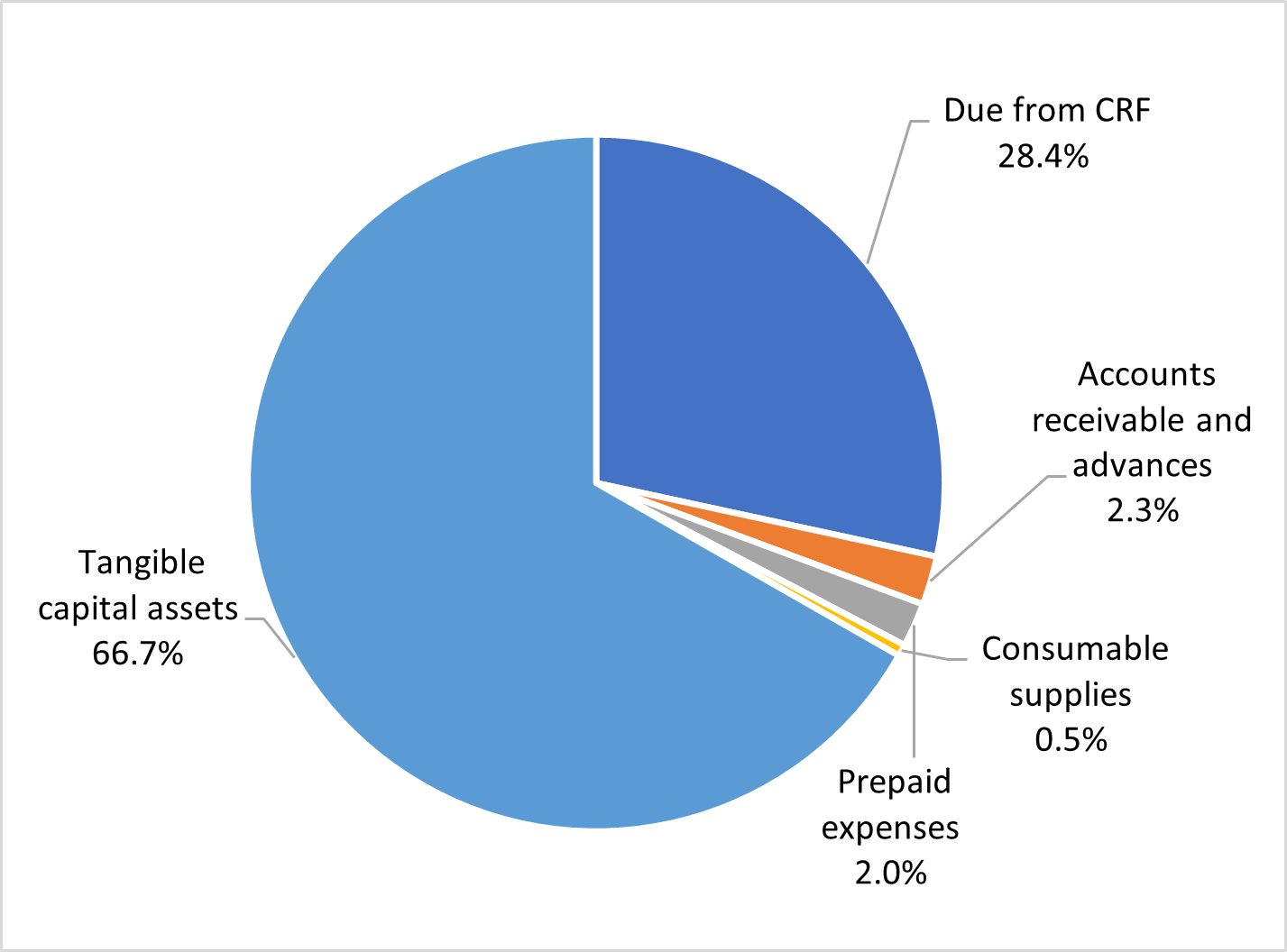

For more information on the distribution of the balances in the statement of financial position, see the two charts below.

Assets by type

Total assets, including financial and non-financial assets, were $224.7 million at the end of 2022–23. Tangible capital assets represented the largest portion of assets, at $150 million (66.7%). They consisted of informatics software ($111 million), software under development ($24.4 million), leasehold improvements ($13.3 million) and other assets ($1.3 million). The remaining portion comprised $63.8 million (28.4%) for amounts due from the Consolidated Revenue Fund, $4.6 million (2.0%) for prepaid expenses, $5.1 million (2.3%) for accounts receivable and advances, and $1.2 million (0.5%) for consumable supplies.

Liabilities by type

Total liabilities were $143.7 million at the end of 2022–23. Accounts payable and accrued liabilities made up the largest portion of liabilities, at $80.1 million (55.8%). They consisted of accounts payable to external parties ($24.1 million), accounts payable to other federal government departments and agencies ($18.5 million), and accrued salaries and wages ($37.5 million). The next-largest portion was vacation pay and compensatory leave, at $48.8 million (34.0%), while employee future benefits made up $14.8 million (10.2%).

Core responsibilities

Statistical Information

Description

Statistics Canada produces objective, high-quality statistical data for the whole of Canada. The statistical information produced relates to the commercial, industrial, financial, social, economic, environmental and general activities and conditions of the people of Canada.

Results

Canadians still count on trusted data and reliable insights, delivered in an accessible and modern way. Statistics Canada continued to provide relevant, timely and high-quality data that informed sound research, analysis and policies to benefit Canadians.

To keep meeting the need for high-quality data, the agency's multi-year modernization journey and its results are built on five guiding principles:

- providing user-centric services

- using leading-edge methods of data collection and integration

- building statistical capacity and fostering data literacy

- collaborating and engaging with partners

- building an agile workforce and workplace.

Canadians value high-quality, efficient and responsive user-centric services, especially since the beginning of the COVID-19 pandemic. With increasing economic uncertainty, they seek data at the community and business levels. To ensure that Canadians have information when and how they need it, Statistics Canada has developed innovative ways to make data more inclusive and easier to access, share and use by

- disseminating results from the 2021 Census—a rich source of population data

- releasing data from the Census of Agriculture

- producing more disaggregated data for a fairer, more inclusive Canada

- developing better data for better outcomes

- producing business data to address lingering economic uncertainties

- further integrating social and business data

- meeting the evolving data needs of official language minority populations

- connecting with Canadians in a digital world

- building and maintaining public trust and understanding

- accelerating research through increased microdata access.

Disseminating results from the 2021 Census: A rich source of population data

- The 2021 Census provided the Government of Canada and all Canadians with a wealth of high-quality information, new and more granular data, products, and new metadata content. Over the past year, Statistics Canada proudly published seven themed major releases of 2021 Census data, with over 350 data tables and 30 analytical products, as well as visualization tools and infographics covering 18 major topics. This gave Canadians access to 31 billion data points—an unparalleled level of detail and insight.

- The agency provided federal briefings, media technical briefings, webinars and press conferences for each release and coordinated more than 150 media interviews. Five releases were covered live on national networks, social media campaigns reached 12.4 million impressions and 311,000 engagements, and more than 50,000 organizations and stakeholders were contacted through email campaigns for the various releases.

- The seven major census releases in 2022 were

- population and dwelling counts (February)

- age, sex at birth and gender; and type of dwelling (April)

- families, households and marital status; Canadian military experience; and income (July)

- language (August)

- Indigenous peoples, and housing (September)

- immigration, place of birth and citizenship; ethnocultural and religious diversity; and mobility and migration (October)

- education, labour, language of work, commuting, and instruction in the minority official language (November).

-

As of March 31, 2023, 1,801 custom census tables had been produced, a significantly higher number than the previous census cycle in 2017–18, in which 1,221 tables were produced. It is projected that 57,471,749,909 data cells will be released from the 2021 Census, compared with 27,596,576,636 for the 2016 Census. This means the agency released more data than ever before, allowing more details to be made available to Canadians and organizations for their future planning needs.

In April 2022, Statistics Canada's Census Communications team was recognized at the Government of Canada Communications Awards of Excellence for its outstanding work on the 2021 Census. The team received the Diamond Award of Communications Excellence.

- The range of topics and granularity of the 2021 Census of Population also went further than ever before. For the first time, the census collected data on gender, making Canada the first country in the world to disseminate census data on transgender and non-binary people. The 2021 Census also provided the first census profile of Canada's military in half a century and new data on children eligible for instruction in the minority official language at the primary and secondary levels.

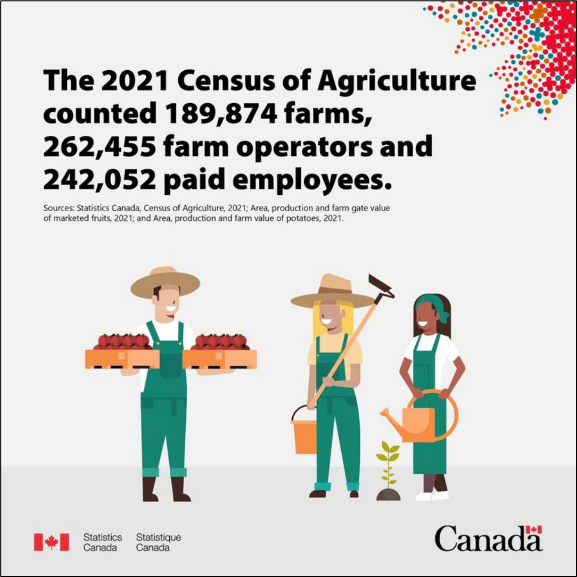

Releasing data from the Census of Agriculture

Description - 2021 Census of Agriculture data

The 2021 Census of Agriculture counted 189,874 farms, 262,455 farm operators and 242,052 paid employees.

Source: Statistics Canada, Census of Agriculture 2021; Area, production and farm gate valye of marketed fruits, 2021; and Area, production and farm values of potatoes, 2021.

- The 2021 Census of Agriculture included new ways to access and visualize data, such as a new mapping tool. It also included new community profiles and a variety of data tables, analytical products and reference materials on the characteristics of Canada's agriculture industry. In 2022, Statistics Canada released multiple products associated with the 2021 Census of Agriculture that were well received by Canadians, including

- Common Output Data Repository tables

- special tabulations

- new dissemination tools

- multiple analytical reports in Canadian Agriculture at a Glance.

- The Census of Agriculture also resulted in a new partnership with the Canadian Agri-Food Policy Institute related to how the results align with major trends in the agriculture industry, to gain a better understanding of the industry.

- For the first time, the 2021 and 2016 microdata were also made available in the Statistics Canada research data centres; this was beneficial to key researchers and partners.

Producing more disaggregated data for a fairer, more inclusive Canada

"Statistics Canada will continue implementing its Disaggregated Data Action Plan and integrating the richness of 2021 Census data into more of its programs."

Anil Arora

Chief Statistician of Canada

- Statistics Canada continued to develop rigorous disaggregated research and analysis to enable Canadians to deepen their understanding of equity, diversity and the inclusion of various groups. The agency used a variety of dissemination products, including flagship publications, infographics and the Research to Insights series, to communicate findings to Canadians.

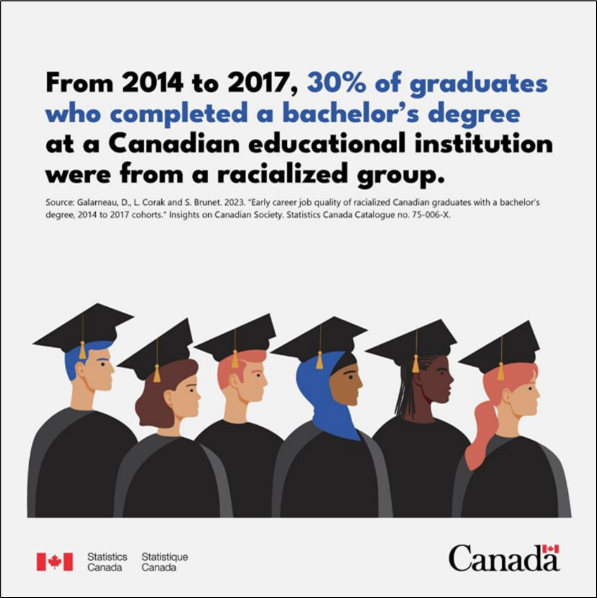

- Statistics Canada's work on the DDAP continued to help critically examine the experiences of various population groups, with a focus on the four employment equity groups: Indigenous people, women, racialized populations and people with disabilities. As a driver of change, the agency's work on the DDAP helped Canada develop policies and promote evidence-based decision making, accounting for the experiences of diverse population groups in Canada.

-

The Gender, Diversity and Inclusion Statistics Hub released several high-quality research and analytical products, to increase knowledge and report to Canadians on the state and progress of gender equality and the experiences and outcomes of various groups of people in Canada. It also facilitated access to disaggregated data, intersectional analysis and insights on diverse population groups. The updated hub includes features such as a data visualization tool. It also makes new releases easier to access for all Canadians, increases engagement and allows users to see data in a more dynamic way.Image

- As part of Canada's Anti-Racism Strategy, Statistics Canada created a new Social Inclusion portal to bring together key statistical information on the inclusion (or exclusion) of ethnocultural groups and immigrants in Canada. The agency also launched a new series of data visualization tools, and over 120 social inclusion indicators were presented for racialized groups in Canada, disaggregated by key sociodemographic characteristics and level of geography.

- The agency created the DDAP Administrative Data Fund to give external partners the opportunity to make changes that, in turn, will provide the agency with enhanced administrative data. This will help optimize the implementation of the DDAP and leverage existing data by making them available in a clearer and more accessible way to Canadians.

- Statistics Canada published an analysis of disaggregated data in Insights on Canadian Society. Its goal was to build understanding and awareness of persistent socioeconomic inequalities in various vulnerable groups and to examine how outcomes vary by racialized population, gender, disability status and Indigenous identity, including intersections of these identities.

-

Statistics Canada also successfully completed data collection for the Indigenous Peoples Survey. Data scheduled for release in August 2024 will provide rich information and fill data gaps for First Nations people living off reserve, Métis and Inuit. The survey will provide detailed information on several topics, including education, employment, health, access to services, language, housing and mobility.Image

Description - 2022 Indigenous Peoples Survey

2022 Indigenous Peoples Survey

If you have been selected, please participate.

Themes covered in this survey

- Child care and services

- Indigenous languages and cultural activities

- Mental and physical health

- Education

- Skills, training and relevant experience

- Interest in government employment

- The agency also successfully delivered on nine cost-recovery Indigenous research projects with federal partners and released statistics on Indigenous peoples from the 2021 Census.

- With the completion of the 2022 Canadian Survey on Disability, Statistics Canada met its commitment to collect information from youth and adults in Canada whose everyday activities are limited because of a long-term condition or health-related problem. The data will be used to plan and evaluate services, programs and policies for Canadians living with disabilities to help enable their full participation in society.

Developing better data for better outcomes

Description - COVID-19 antibodies

From April to August 2022, 98.1% of Canadian adults were shown to have COVID-19 antibodies acquired through vaccination, a previous infection or both.

Source: Statistics Canada, Canadian COVID-19 Antibody and Health Survey, Cycle 2.

- Statistics Canada, in partnership with the Public Health Agency of Canada and the COVID-19 Immunity Task Force, conducted the second cycle of its Canadian COVID-19 Antibody and Health Survey. This survey is designed to help evaluate the health status of Canadians associated with the COVID-19 pandemic. Data were collected from April to October 2022 and provided Canadians with important information about testing practices, rates of past and current infections, awareness of infections, and the prevalence of long-term symptoms among the Canadian population.

- To support the Government of Canada's zero plastic waste agenda, Statistics Canada developed a pilot physical flow account for plastic material. The first release of these data was in March 2022, and updates were made available in March 2023. This project represents one of the first environmental accounts that estimates the flow of plastics through the Canadian economy and will help to inform policy development by providing increasingly accurate statistics. It has already resulted in the development of new approaches for collecting physical flow accounts. It is a key input for partners such as Environment and Climate Change Canada to develop and implement plastics indicators and to contribute to assessing and reporting on the state of plastics and plastic pollution in Canada.

-

After implementing the Quality of Life Framework for Canada in 2021, Statistics Canada developed indicator definitions and products in 2022–23. This work, done in collaboration with several federal partners, including the Treasury Board of Canada Secretariat, the Department of Finance, Environment and Climate Change Canada, and many others, will facilitate more holistic and horizontal evaluations of the well-being of Canadians. Launched in March 2022, the Quality of Life Hub is a one-stop shop for data on the quality of life of people living in Canada, designed to assist policy makers involved in supporting budgeting and decision making. The hub presents the most recent quality of life data and metadata in a non-technical way that is easily accessible for a wide range of users across the data literacy spectrum.Image

Description - Quality of life identifier

This image illustrates the Quality of Life Framework for Canada. It is represented as a circular graphic with the term "Quality of Life" in a circle at its centre. The circular graphic is divided into five segments which represent each of the five domains of the framework: Prosperity, Health, Society, Environment, and Good Governance. The two lenses of the framework, Fairness and Inclusion and Sustainability and Resilience, encircle the image, represented by curved arrows.

- The infographic Hopefulness in Canada illustrated the insights made possible by the Quality of Life Framework (and the new Canadian Social Survey, which collects quarterly data for many quality of life indicators). It examined how hopeful different segments of the Canadian population—including people with disabilities and the LGBTQ2+ population—generally felt about the future.

Producing business data to address lingering economic uncertainties

- To ensure that Canadians have a full and accurate portrait of labour market conditions, the agency launched the Quality of Employment in Canada publication, through the Labour Force Survey (LFS) supplements program. It aims to fill data gaps on quality of employment and other emerging labour market topics to provide Canadians and organizations with a better understanding of employment characteristics in Canada.

-

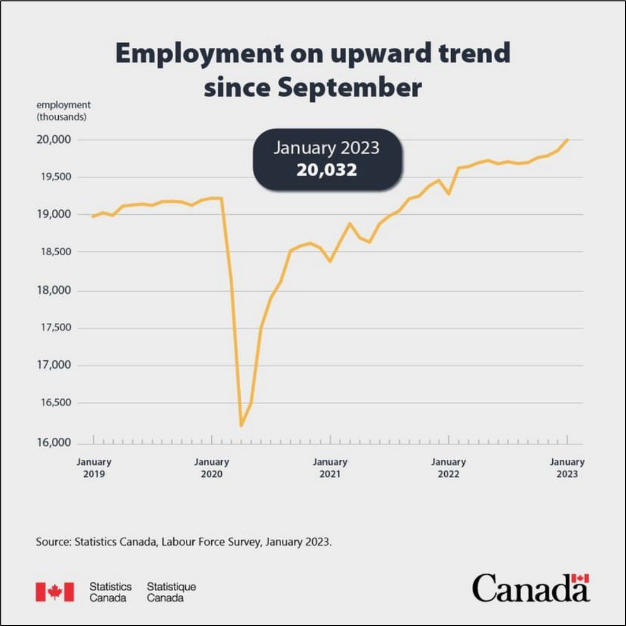

The agency increased the sample size of the LFS by 25%. As a result, Canadians have a fuller portrait of labour market conditions, including more detailed information on the labour market experiences of diverse groups, including Indigenous people and racialized people. To better quantify impacts on quality of life, the agency developed and integrated new questions to measure Black and Indigenous business ownership.Image

Description - Employment in Canada, January 2019 - January 2023

Employment on upward trend since September

January 2023, 20,032

For employment data for January 2019 to January 2023, please see Chart 1 Employment on upward trend since September of Labour Force Survey, January 2023.

- The LFS was also leveraged to provide insights on ongoing adjustments and structural changes following the COVID-19 pandemic, including labour market churn and wage adjustments in the context of a tight labour market and record-high inflationary pressures. In addition, Statistics Canada updated the Canadian Patent Research Database and made new linkages, such as the Intergenerational Income Database and census linkage, available in research data centres. Statistics Canada consulted and engaged with internal and external partners to identify themes and topics for forthcoming data collection, including the LFS supplements program.

- The agency recognized the increasing need of Canadians for timely information as the business community faced several challenges during the COVID-19 pandemic, including with global supply chains, inflation and labour shortages. As a result, Statistics Canada developed the Canadian Survey on Business Conditions. Not only are indicators about these challenges from this survey disseminated on a quarterly basis, but significant portions of the survey content are modified to meet the evolving needs of key stakeholders.

Further integrating social and business data

- In a time of rapid social and economic changes, Canadians saw value in having access to more integrated social and business data.

-

The Longitudinal Business Database was launched, improving the way the agency tracks the lifecycle of businesses. It provides a foundation to produce better and more coherent information about how businesses are doing, what makes them succeed and the extent to which business ownership is diversifying.Image

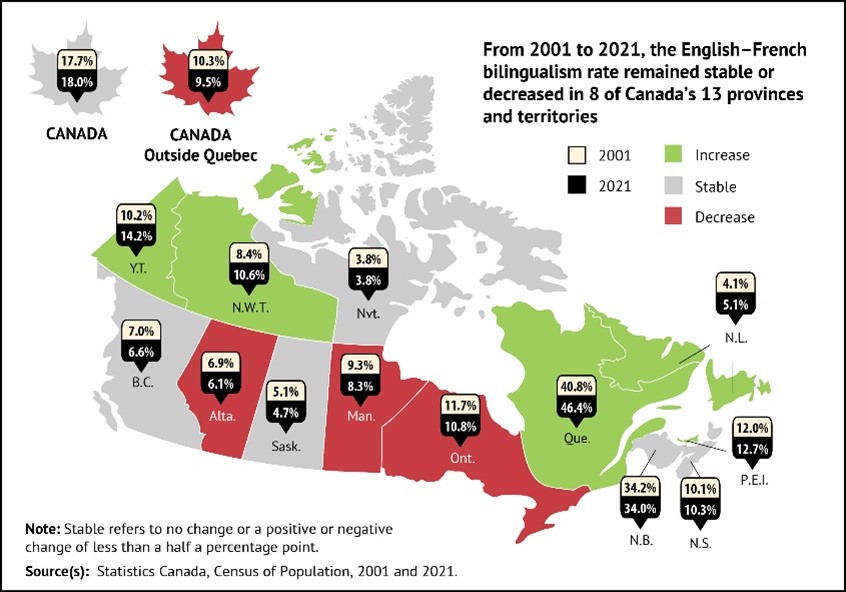

Description - English-French bilingualism rate

From 2001 to 2021, the English–French bilingualism rate remained stable or decreased in 8 of Canada's 13 provinces and territories.

English–French bilingualism rate Rate of bilingualism in both official languages 2001 2021 Change from 2001 to 2021 Canada 17.7 18.0 Stable Canada outside Quebec 10.3 9.5 Decrease Newfoundland and Labrador 4.1 5.1 Increase Prince Edward Island 12.0 12.7 Increase Nova Scotia 10.1 10.3 Stable New Brunswick 34.2 34.0 Stable Quebec 40.8 46.4 Increase Ontario 11.7 10.8 Decrease Manitoba 9.3 8.3 Decrease Saskatchewan 5.1 4.7 Stable Alberta 6.9 6.1 Decrease British Columbia 7.0 6.6 Stable Yukon 10.2 14.2 Increase Northwest Territories 8.4 10.6 Increase Nunavut 3.8 3.8 Stable Note: Stable refers to no change or a positive or negative change of less than a half a percentage point.

Sources: Statistics Canada, Census of Population, 2001 and 2021. - Statistics Canada developed a statistical geomatics vision to give Canadians additional geolocated insights on the environment, society and the economy. Integrating data by geography provides communities with the information they need to make better decisions and allows statistical and geospatial data to be used efficiently. It also enables key internal and external partnerships to be developed in geomatics, ensuring that Statistics Canada continues to be a trusted leader for Canadians in the field of statistical geomatics and geoanalytics.

Meeting the evolving data needs of official language minority populations

- To provide Canadians with evidence-based data on themes affecting official language minority populations, Statistics Canada developed the Survey on the Official Language Minority Population. It was conducted from May to December 2022 in close collaboration with Canadian Heritage. The survey fills data gaps and measures changes in the circumstances of official language minority populations since 2006, when the last similar survey was conducted. The results are scheduled for release in 2024.

- Statistics Canada redesigned the Language Statistics portal in 2022–23 to serve as a one-stop shop for key users of the agency's language data. It provides members of official language minority communities across the country with easy access to a range of data at various geographic levels and on multiple language-related themes. Researchers, academics, government officials and other Canadians can also find a variety of products on languages in Canada.

- In addition, Statistics Canada carried out external outreach and training activities through webinars and other capacity-building activities. For example, as part of its 2021 Census webinar series, Statistics Canada organized two language-specific events open to the public. These provided important information on concepts and definitions; national, provincial and territorial highlights; and guidance on how to access data products and online resources. The Language Statistics Program also actively promoted all analytical products to partners and data users so they could benefit from these data.

Connecting with Canadians in a digital world

Introduced in January 2022, the StatsCAN app is another way the agency has modernized the way data are published. This free mobile application provides trusted, unbiased facts, visuals and key information on demand. It reached over 11,000 downloads within the first year of its launch, enabling users to stay on top of the country's latest statistical news any time they want.

- As Canada's national statistical agency, Statistics Canada needs to remain relevant and reach Canadians with the valuable data they need, in ways that are interesting, informative and easily digestible. To ensure that statistical information reaches more Canadians in more ways, the agency disseminated its products in various media.

-

The agency's Eh Sayers podcast continued into its second year and remained dedicated to meeting the people behind the data and exploring the stories behind the numbers. Eh Sayers reached the top spot in Canada on the Apple Podcasts Government chart, beating out the BBC, The Financial Times, CBS News and the Lincoln Project in 2022. Eh Sayers was highlighted in the 29th Annual Report to the Prime Minister on the Public Service of Canada as an example of innovation and the power of using new storytelling tools to reach Canadians.Image

- StatsCAN Plus, the agency's second official release vehicle, alongside The Daily, continued to ensure that Canadians were on top of the country's statistical news throughout the day. Its short stories cover a wide range of topics of interest to Canadians. In 2022, more than 250 stories were published, which received over 100,000 visits.

- Statistics Canada advanced the Connecting with Canadians: Publishing Strategy to evolve and modernize the way in which it communicates with Canadians. Under the strategy, the agency continued to adapt its publishing model to meet the changing needs and behaviours of Canadians and ensure they are getting the data they need, in a timely and flexible manner that suits them.

- An innovative communications campaign was launched to promote the 2021 Census of Population and Census of Agriculture data releases not only to regular users, but also to the public, schools, universities, libraries, non-profit organizations, businesses and municipalities. The campaign's reach was further extended through collaborations with federal partners, statistical organizations and social media influencers. Various tools, such as an interactive census game, school and community supporter toolkits, lifestyle articles, webinars, and events, were used to present informative and engaging data insights.

Building and maintaining public trust and understanding

- Statistics Canada's Trust Centre remained an important focus. It aims to increase the transparency of the agency and maintain and consolidate the relationship of trust it has with Canadians, and it is continuously maintained and kept up to date. By providing information on data collection and use, privacy, and more, the Trust Centre is a useful tool for survey respondents, data providers and the media, who can find answers to their questions or concerns on the platform.

Accelerating research through increased microdata access

- Statistics Canada and the Canadian Chamber of Commerce established the Business Data Lab (BDL) to put data to work for Canadian businesses and help them tap into the agency's wealth of economic data. The BDL hosts multiple sources of data on a secure platform to generate important information and provide access to it for businesses and policy makers. Additional tools will be developed for the BDL to closely monitor economic activity as the business community continues to recover from the impacts of the pandemic and new economic uncertainties.

- Leveraging the BDL and its partnership with the Canadian Chamber of Commerce, Statistics Canada recognized the importance of increasing access to microdata. Thanks to this unique partnership, the chamber recently released a new suite of dashboards, called the Business Conditions Terminal, where users can find detailed insights on business activity taking place in major Canadian cities since the beginning of the COVID-19 pandemic.

To respond to the increasing need for integrated analysis and insights in a fast-changing world, Statistics Canada continued to leverage its expertise in these areas to ensure that it remained a world-leading agency producing data that Canadians can trust. Statistics Canada integrated data from multiple sources on society, the economy and the environment to develop a better understanding of the complexity of modern-day Canada. The agency worked toward this goal through these initiatives:

- modernizing survey collection methods

- streamlining business processes

- preparing for the 2026 Census

- maintaining world-class frameworks and practices for privacy, data ethics and data stewardship

- increasing capabilities to turn data into insights

- using data to support the recovery of the tourism sector

- monitoring a highly fluid economy with real-time estimates

- leading the development of the world's first Census of Environment

- monitoring sudden shifts in business conditions.

Modernizing survey collection methods

- As part of the ongoing AgZero initiative, Statistics Canada minimized response burden on farmers by replacing survey data typically collected by the Agriculture Statistics Program with data obtained using alternative methods. The initiative also leveraged data and advanced technologies such as Earth observation and machine learning. In 2022–23, the agency successfully replaced a field crop survey that traditionally involved 11,500 farmers. This new approach uses alternative sources and modelling techniques to deliver the same high-quality information while reducing the number of surveys crop farmers need to complete. Additionally, through a partnership with the Canadian Pork Council, AgZero used PigTRACE data to generate reports on interprovincial hog movements without directly contacting farmers.

Streamlining business processes

- The agency continued to optimize and harmonize the process flows, concepts and classifications used to produce the Canadian System of Macroeconomic Accounts (CSMA), while strengthening and modernizing the information technology (IT) infrastructure required for current and future efforts. This will improve data sharing through harmonization and data system interoperability with international statistical organizations.

- In 2022‒23, the agency worked to enhance the catalogue of data available under the Statistical Data and Metadata Exchange (SDMX), an international initiative that aims to improve the exchange of data between organizational units, other government departments and international partners. The initiative introduced a preliminary Canadian System of National Accounts Data Structure Definition under the SDMX framework, with standardized classifications to be used as building blocks for future development. Also, through this initiative, the initial IT platform was deployed, and two CSMA program components were recreated as prototypes in the new environment.

Preparing for the 2026 Census

- As planning begins for the 2026 Census of Population, Statistics Canada identified responsible and innovative ways to reuse information that Canadians have already provided. This will help increase efficiency and time savings for both the agency and Canadians.

- To meet ever-increasing needs for varied and detailed data while enabling the efficient use of cloud services and the robust protection of Canadians' private information, a new internal service—the Statistical Building Register—was implemented. It replaces the existing Address Register, which successfully supported census collection for 30 years. The updated register will be a central data infrastructure tool for the 2026 Census.

- Statistics Canada engages in a formal consultation process at the start of each census cycle, when it invites data users, stakeholders and the public to provide feedback on what information they use, for what purpose they use it, and whether there are emerging data needs that the agency should consider addressing in the next census cycle. This allows Canadians to have a hand in how the agency supports them.

- The agency held hybrid consultation sessions with partners from all levels of government, as well as key census data users, who also received an electronic questionnaire.

- Over a three-month period, Statistics Canada engaged 24 federal departments and stakeholders in consultations. This led to almost 3,000 responses, an improvement from the previous cycle.

Maintaining world-class frameworks and practices for privacy, data ethics and data stewardship