Linking the 2011 National Household Survey and the 2016 long-form Census data to Nunavut incident Tuberculosis (TB) data (2010 to present) (001-2023)

Linking the 2011 National Household Survey and the 2016 long-form Census data to Nunavut incident Tuberculosis (TB) data (2010 to present) (001-2023)

Purpose: The goal of the project is to develop methodology to predict residential households or groups of households at high risk of developing active TB disease. This will concentrate efforts on community-wide screening using an Inuit-specific prediction score that goes beyond traditional biological risk factors that often do not apply to Inuit living in this remote region of Canada in a reproducible, standardized, automated approach that local health care practitioners can use.

Output: The linked datasets (2011 NHS-TB and 2016 long-form Census-TB) will be used for analysis by the Taima TB research group at UOttawa. Members of the team will be made deemed employees for this purpose. The datasets will contain geocoordinates for houses in Nunavut, which are direct identifiers. To minimize the risk of disclosure and breach of confidentiality, the Centre of Indigenous Statistics and Partnerships (CISP) will be custodians for the datasets, the data will only be accessed at a StatCan office, and any dissemination will be subject to disclosure control guidelines developed by StatCan methodologists. The source datasets will be anonymized and will respect variable restrictions in effect for them.

Only aggregate data that conforms to the confidentiality provisions of the Statistics Act will be released outside of Statistics Canada. The household level data will be used in regression models and outputs such as aggregate distribution of the derivation and validation cohorts, regression coefficients, Receiver Operating Characteristics curves, list of variables that will make up the risk scores, a histogram of risk score and predicted risk of TB will be released in publications and presentations.

Firm technology adoption, its determinants, and impacts (003-2023)

Firm technology adoption, its determinants, and impacts (003-2023)

Purpose: The purpose of this project is to better understand what causes firms to adopt new technology and the consequences it has on firms and workers. To do so, a microdata linkage will be established between firm-level surveys on technology adoption (Survey of Business Innovation and Strategy, Survey of Advanced Technology, and Survey of Digital Technology and Internet Use) and employer-employee database (Canadian Employer-Employee Dynamics Database) as well as other databases (Census of Population and data on union representation votes for Canadian firms).

This project can help better inform Canadians on technology adoption and its impacts on the economy and labour market. In addition, it will provide relevant evidence and information to the academic community and policy-makers, which helps support the development of policies and programs to promote equal technology adoption and diffusion among businesses so as to increase Canada’s competitiveness and the benefit of people living in Canada.

Output: The output of this project will include several analytical reports that address the following questions:

- What are the main factors that drive a firm’s decision to adopt technology?

- How different are the patterns of technology adoption by businesses owned by subpopulation groups such as women and immigrants? Do they experience additional hurdles for technology adoption?

- What is the relationship between unionization and technology adoption? Do unions act as facilitator or inhibitor of technology adoption?

- What are the impacts of technology adoption on firm performance?

- What are the outcomes of technology adoption on workers such as job displacement, changes in wages and inequality etc.?

The analytical file, without identifiers, will be made available via Statistics Canada Secure Access Points (such as Research Data Centres), and access will be granted to Statistics Canada deemed employees following the standard approval process.bation standard.

Linking the Level of Supervision and Official Language Variables to the ESDC Employee Wellness Survey (ESDC EWS) (004-2023)

Linking the Level of Supervision and Official Language Variables to the ESDC Employee Wellness Survey (ESDC EWS) (004-2023)

Purpose: The overall objective of the ESDC Employee Wellness Survey is to assess conditions in the work environment at ESDC and inform strategies that meet the needs of employees and optimize their well-being.

The purpose of the linkage is to add two variables to the ESDC EWS share file, which would be used to subset the data by Level of supervision and by official language. This would allow for analysis of principal survey results that would provide for a more in-depth analysis of these subgroups of respondents’ potentially different experiences to be understood and addressed in the form of improved people management practices.

Output: The planned outputs are a ESDC EWS Share file, and non-confidential aggregate statistics in the form of Excel tables and a Power BI dashboard, for Employment and Social Development Canada (ESDC). Statistics Canada will enter into a data sharing agreement with ESDC who in signing the agreement, agrees to keep the information shared confidential, and only use it for statistical and research purposes. Respondents to the ESDC EWS were informed of the sharing with ESDC at the time of collection, and only those respondents that agreed to share their information will be included in the ESDC EWS Share file. No direct identifiers, including personal identifiers, will be included on the ESDC EWS Share file. The ESDC EWS Master file placed in the Research Data Centres (RDCs) will not include the two linked variables. Only non-confidential aggregate statistics will be released outside of Statistics Canada.

Surrey Opioid Data Collection and Community Response Project: Linking Surrey Opioids data with Census, income, health and immigration data to generate privacy-enhancing synthetic data (005-2023)

Surrey Opioid Data Collection and Community Response Project: Linking Surrey Opioids data with Census, income, health and immigration data to generate privacy-enhancing synthetic data (005-2023)

Purpose: Building on the purpose of the 008-2018 linkage project, which was to build the capacity for identifying the primary risk factors and the sub-populations at greatest risk of an overdose. To create a better understanding of the characteristics of those individuals at the heart of the opioid crisis-particularly for those individuals using and dying in their residence. To aid in the effort to understand the roots of the illicit drug epidemic and the individuals most at risk of overdose. In addition to the policy perspective, if successful, synthetically generated opioid data can be used by researchers, health-care developers and clinical scientists to develop innovative health-care solutions and use it for teaching and training purposes.

This new project will utilize the same referenced cohort (008-2018 linkage project) to produce a generative Machine-Learning model for generation of privacy-enhancing synthetic datasets. Several Machine Learning models will be assessed to identify one which optimally balances privacy risks disclosures with data utility. Development and assessments of models and synthetic datasets will be a collaborative work between Statistics Canada and UQAM University researchers.

In addition, should the proof-of-concept be successful in balancing privacy and confidentiality risks against the data utility, it will allow useable privacy-enhancing granular-level synthetic data and study outcomes to a wider group of researchers and policymakers could encourage innovation through active collaboration and facilitate a broader and faster advancement of solutions to the opioid crisis. Synthetic patient data that preserves the relationship among study variables but contains no records that represents or identifies an actual individual in the cohort would be a viable solution to this problem.

Output: A comprehensive technical report summarizing the methodology, assessment of the generative algorithms, key findings, lessons learned and recommendations for next steps (if any). High-level findings may be reported in the form of presentations to various Public Safety Canada partners. Deemed employees of Statistics Canada will only have access to the data with an anonymized linkage ID, but NOT the direct identifiers, and use only authorised devices from Statistics Canada secure access points during this project.

A well-documented code repository for the project under Statistics Canada’s existing and future policies. As part of Open Science initiative, free access to the open-source tool and libraires will be rendered to public. Code will not contain sensitive information and will undergo appropriate assessments before release.

A pre-trained generative model that can produce a high-quality data in a differentially private setting. Such an approach in production could guide the development of targeted approaches for prevention, treatment, and identification of possible intervention points for the high-risk population in opioid-toxicity studies. This model will be capable of generating novel synthetic data instances not found in the original dataset which maintains the privacy of the members of the original dataset, while maintaining key properties that respect the data distribution.

No confidential Statistics Canada micro-data will be made publicly available during or after the completion of the research collaboration under this agreement. This term also extends to Machine Learning (pre-trained) models and prototypes that may in turn divulge confidential information.

Linkage of the Census of Agriculture across census years, 1986 to 2011 (006-2023)

Linkage of the Census of Agriculture across census years, 1986 to 2011 (006-2023)

Purpose: Relatively little analysis has been undertaken to measure farm-level productivity in Canada. This work will examine the degree that productivity growth is driven by improvements within continuing farms compared to how much results from the reallocation of resources like land between farms. This serves to inform policy aimed at improving the productivity of the agriculture sector.

Output: Only non-confidential aggregate statistical outputs and analyses that conform to the confidentiality provisions of the Statistics Act will be released outside of Statistics Canada. The information will be presented in the form of tables of regression results and summary statistics related to the project’s goal.

Analytical datasets will be placed in the Research Data Centres (RDCs) and access will be granted following the standard RDC approval process. The source datasets will be anonymized and will respect variable restrictions in effect for the source datasets. Access to the analytical file is restricted to researchers who have become deemed employees of Statistics Canada.

Linkage of the Survey of Before and After School Care in Canada, 2022 to the 2020 T1 Family File, 2021-2022 Canadian Child Benefit File, the Longitudinal Immigration Database. (007-2023)

Linkage of the Survey of Before and After School Care in Canada, 2022 to the 2020 T1 Family File, 2021-2022 Canadian Child Benefit File, the Longitudinal Immigration Database. (007-2023)

Purpose: The purpose of this linkage is to respond to the data needs of the Government of Canada’s Multilateral Framework for Early Learning and Child Care. This framework identifies key priorities for child care, including child care that is inclusive and flexible.

This microdata linkage will augment the 2022 Survey of Before and After School Care in Canada with information on income and employment characteristics, family structure and immigrant status in order to explore more fully characteristics associated with the use of child care in Canada.

Output: A linked microdata file will be available within Statistics Canada and will be placed in the Research Data Centres (RDCs) where access will be granted following the standard RDC approval process. Aggregate findings will be reported in research papers, internal and external reporting documents, presentations at workshops and conferences, as well as external publications (e.g., academic manuscripts).

Assessing socio-demographic and health characteristics of people who received Medical Assistance in Dying (MAID). (009-2023)

Assessing socio-demographic and health characteristics of people who received Medical Assistance in Dying (MAID). (009-2023)

Purpose: The purpose of this project is to create a linked dataset that will allow the study of socio-demographic and health characteristics of people who have accessed MAID. In order to achieve this purpose, decedent information from Health Canada will be linked to the T1FF to obtain income and employment data, the Discharge Abstract Database (DAD) to obtain hospital discharge records, and the National Ambulatory Care Reporting System (NACRS) and the Ontario Mental Health Reporting System (OMHRS) to obtain information on use of health care services. The MAID data will also be linked to the Canadian Vital Statistics Death Database (CVSD) to obtain coded cause of death data, as well as the Canadian Cancer Registry to obtain information cancer diagnosis and treatment. Linking the MAID data to other data sources at Statistics Canada will allow the identification of possible barriers and inequalities in accessing MAID supports in Canada.

Output and Dissemination Plan: Only non-confidential aggregate statistics and analyses that will not result in the identification of an individual person, business or organization will be released outside of Statistics Canada. Exact outputs and products are still to be determined but will be based on needs to address key research questions. It is anticipated that high-level findings will be shared with Health Canada in the form of reports, presentations, data tables, and data visualization dashboards. It is possible that high-level findings may also be published for public use through reports, web tables, data dashboards or other means. The analytical file, without identifiers, will be made available via Statistics Canada Secure Access Points (such as Research Data Centres), and access will only be granted to Statistics Canada deemed employees following the standard approval process.

Comparing the innovation performance of multinational and non-multinational enterprises (010-2023)

Comparing the innovation performance of multinational and non-multinational enterprises (010-2023)

Purpose: The goal of this project is to measure the contribution of multinational enterprises (MNEs) and non-multinational enterprises (non-MNEs) to innovation, advanced technology use and the high-tech sector in Canada. The analysis can provide insights into factors that contribute to innovation success and inform policies that promote innovation and competitiveness in all types of firms.

In the initial usage of this linkage Statistics Canada's Investment, Science and Technology Division will analyze the differences between MNE and non-MNEs across a variety of indicators. This will allow statistics Canada to analyse to what extent MNEs contribute to the structural changes in the economy. Particularly, as it pertains to the adoption and implementation of innovation, and the usage of advanced technology.

Output: Only non-confidential aggregate statistical outputs and analysis that conform to the confidentiality provisions of the Statistics Act will be released outside Statistics Canada. These outputs will include aggregate statistical tabulations showing the difference in MNEs and non-MNEs in terms of innovation rate, advanced technology use, and patents for high-tech and non-high-tech sectors.

Estimating participation in the tax and benefit system (011-2023)

Estimating participation in the tax and benefit system (011-2023)

Purpose: The purpose of this project is to investigate the participation of specific groups in the Canadian tax and benefit system, and these groups’ access to this system. More specifically, it will attempt to evaluate how many low-income earners may be missing out on the Canada workers benefit by not filing a tax return. It will also examine the filing rates for social assistance recipients to estimate whether this behaviour precludes this vulnerable population from receiving certain benefits.

The information will help improve targeted outreach efforts to increase uptake of specific benefits and encourage Canadians to file a tax return.

Outputs: Non-confidential aggregate tables will be produced to summarize filing rates for individuals with low earnings and social assistance recipients. The initial products will be two analytical papers that will compare limited sociodemographic characteristics, including age, gender, presence of children and geography. Only non-confidential aggregated data estimates that conform to the confidentiality provisions of the Statistics Act will be released outside Statistics Canada.

Linkage of the Canadian COVID-19 Antibody and Health Survey (CCAHS) to census and immigration data (012-2023)

Linkage of the Canadian COVID-19 Antibody and Health Survey (CCAHS) to census and immigration data (012-2023)

Purpose: Expansion of the Canadian COVID-19 Antibody and Health Survey (CCAHS) dataset through data linkage will allow for complex investigations, descriptive and inferential, on the demographic, socioeconomic and health-related variables that contributed to the experience of Canadians during the COVID-19 pandemic. The collection of biospecimens as part of CCAHS, both Dried Blood Spot (DBS) and Saliva (PCR) samples, will provide information about the virus, including how the presence of antibodies from infection and vaccination varied across time in the Canadian population. The linkage aims to extend the level of disaggregation of the survey findings across Canadian subpopulations based on immigration characteristics, known and spoken languages, and income levels. This is particularly important as the CCAHS cycle 2 collected information on chronic disease prevalence and the longer-term impacts of SARS CoV-2 infections, including which Canadians might be at a greater risk of experiencing the post-COVID-19 condition. The findings may lead to the identification of populations at risk during and following a pandemic, as well as provide evidence to enact effective policies and mitigation strategies that support greater health equity for Canadians.

Output: Only non-confidential statistical aggregates will be released outside of Statistics Canada.

The linkage will produce separate analytical files.

- Research file: an analytical file without identifiers will be accessible for research purposes via Statistics Canada’s secure access points following the standard approval process for access, including becoming Statistics Canada deemed employees.

- Linked analytical share files, without identifiers, will be accessed via Statistics Canada secure access points by the Public Health Agency of Canada (PHAC) and by the Covid-19 Immunity Taskforce (CIT), who have signed data sharing agreements under the Statistics Act and where respondents have consented to share their information. Where applicable a disclosure order under the Statistics Act will be in place to disclose tax information to PHAC where respondents have consented. Access will require researchers from PHAC and CIT to become Statistics Canada deemed employees.

Exploring the socioeconomic factors associated with contact with police, courts, and correctional services (013-2023)

Exploring the socioeconomic factors associated with contact with police, courts, and correctional services (013-2023)

Purpose: The purpose of this project is to explore the extent and nature of new criminal justice system contacts among groups of people who have had a previous contact with the criminal justice system, as well as the demographic and socio-economic factors associated with criminal justice system contacts (for example, employment, education, household composition, health, and use of social services). Previous research has shown that a small group of people is responsible for a disproportionate amount of crime, and that this group is more likely to be economically marginalized, have higher mortality rates, and be hospitalized more frequently. Therefore, understanding the characteristics associated with criminal justice system contacts is important for criminal justice policy, programs, and initiatives aimed at preventing and reducing crime.

Output: Linked analytical files and anonymized linking keys will be used by Statistics Canada to produce non-confidential aggregate statistical tables and analytical reports, such as reports for Statistics Canada’s flagship justice and public safety publication, Juristat. The analytical files and linking keys, without identifiers, will be made available via Statistics Canada Secure Access Points (such as RDCs). The collection of these analytical files and linking keys will be called the Criminal Justice Relational Database and access will only be granted to Statistics Canada deemed employees following the standard approval process.

Gender-based analysis plus of federal tax expenditures using microdata linkage between Census 2021 and tax data (014-2023)

Gender-based analysis plus of federal tax expenditures using microdata linkage between Census 2021 and tax data (014-2023)

Purpose: The purpose of this project is to conduct a Gender-based plus impact analysis of federal personal income tax expenditures for racialized groups, immigrants and Indigenous peoples using information resulting from a linkage between census and tax microdata. This project aims to provide a better understanding of the income characteristics among specific identity groups.

As part of this cost-recovery project, Statistics Canada will be linking select variables from the 2021 Census to income and tax deduction data from the T1 Family File and the T1 Personal Master File. Immigration, ethnicity and gender variables from the Census will be merged with income and claims information to estimate the share of Canadians with immigration and ethnocultural characteristics who are claiming and benefiting from various available federal tax expenditures among Canadians.

Output: The final linked analytical files without personal identifiers will be made available within Statistics Canada secure access points. Access will only be granted to Statistics Canada deemed employees following the standard approval process. Research reports and presentations will be generated from the analysis files. Only non-confidential aggregate statistics and tables conforming to the confidentiality provisions of the Statistics Act and any applicable requirements of the Privacy Act will be released outside of Statistics Canada

Linkage of the Canadian Health Survey on Children and Youth (CHSCY) to explore the neurological adverse effects of air pollution on children (016-2023)

Linkage of the Canadian Health Survey on Children and Youth (CHSCY) to explore the neurological adverse effects of air pollution on children (016-2023)

Purpose: The purpose of the project is to examine the association of air pollution exposure both pre-conception and during the prenatal period (based on the mother’s address in the Canadian Vital Statistics - Births database and the T1FF tax file) with health outcomes of children (based on the Canadian Health Survey on Children and Youth). Future research could also use the linked file to examine the association of perinatal outcomes with other child health outcomes. This project will enhance our understanding about associations between air pollution and child health outcomes.

Output: Only aggregate statistical outputs that conform to the confidentiality provisions of the Statistics Act will be disseminated. All products specifically delivered to Health Canada will contain aggregate outputs (no microdata). All products from the linked data will be disseminated in accordance with Statistics Canada's policies, guidelines and standards. The analytical file will not contain any personal identifiers. Outputs from this file may include a wide range of data and analytical products

Production of demographic analyses to support the preparation of population projections using the Demosim microsimulation model (017-2023)

Production of demographic analyses to support the preparation of population projections using the Demosim microsimulation model (017-2023)

Purpose: As part of the microsimulation Population Projections Program, we aim to link data that will be used to produce various demographic analyses, which, in turn, will serve to produce projection parameters and assumptions required to update the population projections, produced with the Demosim microsimulation model, of several sub-groups of the Canadian population, such as Indigenous populations, immigrant populations, racialized groups, language groups, etc. These projections will be used by a wide variety of users inside and outside Statistics Canada, including partners from various federal and provincial departments, researchers, academics, and the general public. The project also aims at documenting the demographic analyses produced during the preparation of the projections and at publishing the results of these analyses in different formats, including scientific articles, technical reports, feasibility studies, internal or external presentations, etc.

Output: Only aggregate data that conform to the confidentiality provisions of the Statistics Act will be released outside Statistics Canada. The different datasets will be anonymized and will respect the restrictions specific to each dataset (e.g., vital statistics, Indian Register). The key results from the demographic analyses will be used to produce projection assumptions and parameters, and will be published as technical documents, analytical reports, scientific articles and/or presentations.

Linkage of the 2022 Canadian Survey on Disability to the 2021 Census of Population (018-2023)

Linkage of the 2022 Canadian Survey on Disability to the 2021 Census of Population (018-2023)

Purpose: The main objective of the microdata linkage is to create a detailed statistical portrait of persons with disabilities in Canada. The Canadian Survey on Disability (CSD) analytical file is used in part to estimate disability rates, but also to compare the characteristics of persons with and without a disability at various levels of geography.

Output: Only aggregate statistical estimates that conform to the confidentiality provisions of the Statistics Act will be released outside of Statistics Canada. Linked information from the 2022 CSD and the 2021 Census of Population will be used in analytical articles and other data products released from the 2022 CSD, beginning with the initial release of the data on December 1st, 2023. This coincides with the International Day for Persons with Disabilities (IDPD).

To support the first release on December 1st, 2023, and subsequent releases taking place in March 2024, researchers from Employment and Social Development Canada will sign a Microdata Service Contract to give them access, as Statistics Canada deemed employees, to a preliminary 2022 CSD file linked with 2021 Census data. This will enable them to provide expertise in data validation for certain variables, as well as conduct data development and analysis. All work undertaken by deemed employees will take place in Statistics Canada’s Federal Research Data Centre.

The final linked file is released to the Statistics Canada Research Data Centres in the winter of 2024, and used to support projects such as the SPSD-M (microsimulation model for persons with disabilities).

All products containing linked data will be disseminated in accordance with Statistics Canada’s polices, guidelines and standards.

Addition of the National Household Survey to the Linkable File Environment (LFE) of Statistics Canada (019-2023)

Addition of the National Household Survey to the Linkable File Environment (LFE) of Statistics Canada (019-2023)

Purpose: The proposed activity would link the enterprises in the Linkable File Environment (LFE) of the Centre for Special Business Projects (CSBP) to the National Household Survey.

The initial usage of the linkage of the NHS and the LFE is a part of the Business Innovation and Growth Support project between the Treasury Board Secretariat of Canada (TBS) and Statistics Canada. BIGS requires the linkage of the NHS to the LFE so that TBS can evaluate whether the federal government support programs to businesses are efficient, equitable, diversified, and inclusive for specific population groups, such as women, indigenous peoples, visible minorities, people with disabilities, single parents, and members of official language minority communities.

Output: Analytical datasets will be placed in Statistics Canada’s Research Data Centres (RDCs) and access will be granted following the standard RDC approval process. No analytical datafile will be released. Only non-confidential aggregate statistical outputs and analyses that conform to the confidentiality provisions of the Statistics Act will be released outside Statistics Canada. Access to the linked microdata will be restricted to Statistics Canada employees and Statistics Canada deemed employees whose assigned work duties require such access. Deemed employees may access the anonymized microdata in short-term projects following the standard approval process for access via Statistics Canada’s RDCs.

Outputs will include data tables which provide more detailed descriptive statistics regarding the types of entrepreneurs and workforce of Canadian enterprises for specific population groups benefiting from federal government support. TBS, Innovation, Science and Economic Development Canada, and other government bodies and researchers will utilize these outputs to build and enhance policies, programs and tools that promote fairness, equity, and inclusion across the diversity of entrepreneurs and employees, with the goal of boosting Canada’s economic health, sustainability, and productivity.

Linkage of the Canadian Employer-Employee Dynamics Database to Pension Plans in Canada to conduct analysis on the labour market impacts of employer-pension plans (020-2023)

Linkage of the Canadian Employer-Employee Dynamics Database to Pension Plans in Canada to conduct analysis on the labour market impacts of employer-pension plans (020-2023)

Purpose: The first goal of this project is to determine the characteristics of firms offering pensions plans and how employer-pensions have been shaped by public policies. The second goal is to assess how these pensions affect the type and pace at which workers join and exit these firms. Finally, the project will look at how these pensions affect the earnings of workers of different ages. The findings of the study will help identify gaps in pension coverage across Canadian society and provide valuable information for the design of pension legislation.

Output: Only non-confidential aggregate statistical outputs and analyses that conform to the confidentiality provisions of the Statistics Act will be released outside of Statistics Canada. The release of the vetted outputs will be done by Statistics Canada staff. The information will be presented in the form of tables of regression results and summary statistics related to the project’s goal. The anonymized analytical file will be made available through Statistics Canada Secure Access Points (such as research data centres), and access will be granted to Statistics Canada deemed employees following the standard approval process. The clients will also have to become Statistics Canada deemed employee to access the data through an approved secure access point.

Linkage of beneficiary enterprises of R&D and innovation grants from the Ministry of the Economy, Innovation and Energy of the Government of Quebec from 2013-2014 to 2018-2019 to the Linkable File Environment (021-2023)

Linkage of beneficiary enterprises of R&D and innovation grants from the Ministry of the Economy, Innovation and Energy of the Government of Quebec from 2013-2014 to 2018-2019 to the Linkable File Environment (021-2023)

Purpose: This project aims to link beneficiary enterprises of R&D and innovation grants from the Ministry of the Economy, Innovation and Energy of the Government of Quebec from 2013-2014 to 2018-2019 to the Linkable File Environment of Statistics Canada. The linked list of enterprises will then be used to produce custom tables of non-confidential aggregated statistics and an analytical report on the impact of R&D, innovation grants and tax credits on business productivity by comparing, between the receipt of support and after support, observed outcomes between beneficiary enterprises from the treatment group and non-beneficiary enterprises from the control group.

Output: The final output will be custom tables of non-confidential aggregated statistics and an analytical report on the impact of R&D, innovation grants and tax credits on business productivity by comparing, between the receipt of support and after support, observed outcomes between beneficiary enterprises from the treatment group and non-beneficiary enterprises from the control group.

Only non-confidential aggregated statistical results and analysis in compliance with the Statistics Act will be released outside of Statistics Canada.

Linkage of the Canadian Internet Use Survey to tax, immigration and Census data for the addition of other statistical variables (023-2023)

Linkage of the Canadian Internet Use Survey to tax, immigration and Census data for the addition of other statistical variables (023-2023)

Purpose: The purpose of the linkage is to respond to the data needs of the Government of Canada to measure the digital economy, including informing the Universal Broadband Fund. As the barriers to accessing digital technologies and their impacts can vary by different socioeconomic and demographic characteristics, it is important to include this perspective when producing statistics where possible to inform relevant policies and programs. Income, language and Immigration statistics are important when looking at differences in Internet access and use to determine barriers and to address gaps specific to the different demographics which influence the digital divide. These data are not collected in the questionnaire and can only be obtained through microdata linkage.

This linkage offers the opportunity to reduce response burden by not having to asking additional questions, and increases data quality through the use of administrative data.

Output: Only aggregate data that conform to the confidentiality provisions of the Statistics Act will be released outside of Statistics Canada. Findings are expected to be used to inform policy, for research papers, internal and external reporting documents, presentations at workshops and conferences, and external publications.

An anonymized analytical dataset, will be made available via Statistics Canada Secure Access Points, and access will only be granted to Statistics Canada deemed employees following the standard approval process. In addition, a public use microdata file (PUMF) will be made available through Statistics Canada’s PUMF platform.

Linkage of the Canadian Internet Use Survey to tax, immigration and Census data for the addition of other statistical variables (025-2023)

Diversity indicators for businesses participating in the Canada Digital Adoption Program (025-2023)

Purpose: The goal of this project is to fill a data gap for Innovation, Science and Economic Development Canada (ISED) on the number of businesses participating in the Canada Digital Adoption Program (CDAP) that are owned by Employment Equity groups.

To undertake this project, a list of businesses participating in CDAP will be linked to Statistics Canada’s Business Register and the Canadian Employer Employee Dynamics Database. The resulting linked data will be used to produce counts of businesses by province or territory and industry for the following groups based on majority ownership: Indigenous peoples, racialized groups (and sub-groups, if possible), women, persons with disabilities, and newcomers to Canada (within the last five years).

Output: Statistics Canada will provide tables to ISED containing counts of businesses by province/territory and industry for the following groups based on majority ownership: Indigenous peoples, racialized groups (and sub-groups, if possible), women, persons with disabilities, and newcomers to Canada (within the last five years, determined using the year of landing in Canada based on the Longitudinal Immigration Database).

Only non-confidential aggregate statistical outputs that conform to the confidentiality provisions of the Statistics Act will be released outside of Statistics Canada.

Social Linkage of the Agriculture Population to determine the social characteristics of those employed in the agriculture sector and farm owners (027-2023)

Social Linkage of the Agriculture Population to determine the social characteristics of those employed in the agriculture sector and farm owners (027-2023)

Purpose: The Social Linkage of the Agriculture Population will provide a wealth of socio-economic data on farm operators and the people who work in agriculture, without increasing respondent burden. The linkage will enable a detailed analysis on social indicators (disability, immigration status, sex) that are present among agriculture employees and farm operators. The linkage will provide a wealth of information to develop informed policy and address diversity and inclusion priorities for the farming community.

Output: Only aggregate statistical estimates that conform to the confidentiality provisions of the Statistics Act will be released outside of Statistics Canada. Outputs will include Common Output Database Repository (CODR) tabulations to be released on the Statistics Canada website, ad-hoc data requests from clients on demand, as well as other analytical, research or technical articles that may be released.

Record linkage between tax data and the 2021 Census to examine the characteristics of emigrants (028-2023)

Record linkage between tax data and the 2021 Census to examine the characteristics of emigrants (028-2023)

Purpose: The goal of the linkage is to identify and establish the demographic and socioeconomic profile of emigrants for 2021. This linkage will provide high-quality information on emigrants and on their characteristics that cannot be found elsewhere while reducing costs and response burden on the Canadian population.

Product: The linked data will be used to compute estimates that will feed analytical products. Only aggregate statistics and analyzes that comply with the Statistics Act will be disseminated outside Statistics Canada.

Study on mortality and cancer diagnoses in Quebec employees of the Rio Tinto Alcan primary aluminum refinery, update of the linkage between the Rio Tinto Alcan Workers file and the Canadian Vital Statistics – Death database (CVSD) (030-2023)

Study on mortality and cancer diagnoses in Quebec employees of the Rio Tinto Alcan primary aluminum refinery, update of the linkage between the Rio Tinto Alcan Workers file and the Canadian Vital Statistics – Death database (CVSD) (030-2023)

Purpose: This study follows on a series of four epidemiological studies on mortality and new cancer diagnoses in workers at Rio Tinto Alcan’s Quebec aluminium smelters. It is an update (as at December 31, 2019) of data on mortality and cancer incidence in workers hired between January 1, 1950 and December 31, 2019.

Output: The research team will receive de-identified files from Statistics Canada (deaths), from the Quebec Cancer Registry (cancers incidence) and from Rio Tinto Alcan (demographic data; work experience; exposure to PAHs; tobacco use), each with a unique identifier key created for this study. Only members of the Institut de recherche Robert-Sauvé en santé et en sécurité du travail (IRSST) research team who signed a confidentiality agreement will look at, analyze and use these microdata files. These files will be accessed through Statistics Canada’s research data centres in accordance with the required standard approval process. The source datasets will be anonymized and in compliance with the restrictions in place related to the variables for source datasets (e.g., hospitals, vital statistics and the assessed record file). The data from these files will help to produce mortality rate and cancer incidence indicators. The results of the analysis will be presented in the form of aggregated tables, in a study report and in scientific articles in accordance with the requirements of the Statistics Act.

The CHIRP (Children with IncarceRated Parents) Study: Microdata Linkage of Corrections Data with Vital Statistics, Child Tax Benefits and Hospital Discharge Data (031-2023)

The CHIRP (Children with IncarceRated Parents) Study: Microdata Linkage of Corrections Data with Vital Statistics, Child Tax Benefits and Hospital Discharge Data (031-2023)

Purpose: The main objective of the CHIRP (Children with IncarceRated Parents) Study is to identify children who experience parental incarceration, using data from the Canadian Correctional Services Survey (CCSS), the Canadian Vital Statistics database, the Discharge Abstract Database, and the Canadian Child Tax Benefits database. Through this data linkage, an estimate of the actual number of children experiencing parental incarceration can be determined, as well as he health status and outcomes of this population relative to general population. This project will address data gaps regarding the lack of population-level data on the number of children who experience parental incarceration. The findings of this project could be used to increase the visibility of this population in national and provincial policies, and ultimately to inform the design and delivery of initiatives to better support children who experience parental incarceration.

Output: Only non-confidential aggregated tables, conforming to the confidentiality provisions of the Statistics Act, will be released outside of Statistics Canada. The analytical file, without personal identifiers, will be made available via Statistics Canada’s Secure Access Points (such as Research Data Centres) and access will only be granted to Statistics Canada deemed employees following the standard approval process. Academic researchers involved in the CHIRP project are planning to author an article in a peer-reviewed academic journal detailing the results of their analysis using the linked data from Statistics Canada. In addition, to help facilitate wider public access, a plain language summary of the findings will be developed and posted to the Elizabeth Fry Society of Canada and the Canadian Coalition for Children with Incarcerated Parents (CCCIP) websites.

Government cleantech programs and environmental innovation (032-2023)

Government cleantech programs and environmental innovation (032-2023)

Purpose: The proposed activity would link enterprises in the Business Linkable File Environment (LFE) of the Centre for Special Business Projects (CSBP) to Canadian businesses from Environment and Climate Change Canada' Greenhouse Gas Reporting Program open database, as part of the Business Innovation and Growth Support (BIGS) project between the Treasury Board Secretariat of Canada (TBS) and Statistics Canada. BIGS requires descriptive statistics and data models to better understand determinants of intellectual property development to evaluate government programs and expenditures, with the goals of optimizing Canadian innovation, environmental footprints, patents, inventions, research and development, and employment in research and development.

Output: Only non-confidential aggregate statistical outputs and analyses that conform to the confidentiality provisions of the Statistics Act will be released outside Statistics Canada. Access to the linked microdata will be restricted to Statistics Canada employees and Statistics Canada deemed employees whose assigned work duties require such access. The linked microdata file will not contain identifiers. Deemed employees will access the linked microdata files in Statistics Canada’s secure password-protected server located at the head office using their Statistics Canada laptops from their secure remote work location.

Outputs will include data tables providing descriptive statistics of enterprises related to environmental innovation, and potentially data models to better understand determinants of environmental innovation. TBS will utilize these data products to tailor policies, programs and tools to help Canadian enterprises innovate and improve their environmental footprints and R&D, with the ultimate goal of boosting Canada’s economic prosperity through green innovation.

Linkage of the Canadian Agricultural Loans Act Program to the Business-Linkable File Environment (034-2023)

Linkage of the Canadian Agricultural Loans Act Program to the Business-Linkable File Environment (034-2023)

Purpose: The main objective of this project is to estimate the effect of the Agriculture and Agri-Food Canada’s (AAFC) Canadian Agricultural Loans Act (CALA) program on the financial performance of the recipients. The initial phase will involve preparing profiles of program participants and comparing them to eligible non-participants using the variables in the Business-Linkable File Environment (B-LFE) and the Diversity and Skills Database (DSD). The second phase will involve the use of matching to build a control group, and the use of regression models to study the effect of the program on the financial performance of the recipients (e.g., revenues).

Output: The output will be in the form of summary tables and a fix effects model which will examine the economic performance of businesses that received AAFC financing support to non-supported businesses. The linked AAFC list of businesses will be housed at Statistics Canada’s Centre for Special Business Project (CSBP).

A research dataset will be produced and the full integrated database will be used by a deemed employee research team to produce an analysis and custom-designed table of non-confidential aggregate statistics for AAFC. The output will be analysed for confidentiality by CSBP employees. The output of this project will not be sent to the Canadian Centre for Data Development and Economic Research (CDER).

Only non-confidential aggregate statistical outputs and analyses that conform to the confidentiality provisions of the Statistics Act will be released outside of Statistics Canada.

2022 Indigenous Peoples Survey to the 2021 Census of Population, and 2022 Annual Person Income Masterfile (037-2023)

Linkage of the Canadian Cancer Registry to Statistics Canada administrative data on child and mother to explore outcomes among pediatric cancer patients (036-2023)

Purpose: The aim of this study is to evaluate the association between environmental pollutant exposures during pregnancy and childhood and paediatric cancer incidence using population-based data linking the Vital Statistics Birth Data (1992-2021) and the Canadian Cancer Registry (1992-2021). This project will enhance our understanding about associations between air pollution and child health outcomes.

Output: Only aggregate statistical outputs that conform to the confidentiality provisions of the Statistics Act will be disseminated. Access to the linked microdata will be restricted to Statistics Canada employees and Statistics Canada deemed employees whose assigned work duties require such access. All products specifically delivered to Health Canada will contain aggregate outputs (no identifiable microdata). All products from the linked data will be disseminated in accordance with Statistics Canada's policies, guidelines and standards. The analytical file will not contain any personal identifiers. Outputs from this file may include a wide range of data and analytical products. A file will be prepared for use in Statistics Canada Research Data Centres, with appropriate vetting rules.

Linkage of the 2022 Canadian Survey on Disability to Tax Data to Generate Enhanced Statistics on People with Disabilities (039-2023)

2022 Indigenous Peoples Survey to the 2021 Census of Population, and 2022 Annual Person Income Masterfile (037-2023)

Purpose: This project is part of Stream 5 of Indigenous Services Canada’s Transformational Approach to Indigenous Data (TAID) which relates to leveraging Statistics Canada’s expertise to support the Indigenous Delivery Partners (IDPs) in building Indigenous data capacity and to improve the visibility of Indigenous People in Canada’s national statistics. The objective of the TAID is to support First Nations, Inuit, and the Métis Nations to build the sustainable data capacity they will need to deliver effective services to their citizens, and to participate meaningfully with other levels of government.

By integrating data pertaining to income, market rents and shelter costs with the 2022 IPS content, indicators for low-income, housing affordability and core housing need will be produced. Outputs from this linkage will support IDPs in building Indigenous data capacity and to improve the visibility of Indigenous People in Canada’s national statistics. This project will meet the objective of improving the visibility of Indigenous People in Canada’s national statistics as the outputs include research products related to key Indigenous priorities.

Output: The analytical file, without identifiers, will be made available via Statistics Canada Secure Access Points, such as Research Data Centres (RDCs) where access will only be granted following the standard approval process. Only non-confidential aggregated data and analytical products that conform to the confidentiality provision of the Statistics Act and any applicable requirements of the Privacy Act will be released outside of Statistics Canada.

Outputs for this project will be centred on Core Housing Need and will be disseminated via CODR tables, new variables on the Indigenous Peoples Survey Masterfile and an infographic

Linkage of the 2022 Canadian Survey on Disability to Tax Data to Generate Enhanced Statistics on People with Disabilities (039-2023)

Linkage of the 2022 Canadian Survey on Disability to Tax Data to Generate Enhanced Statistics on People with Disabilities (039-2023)

Purpose: The Canadian Survey on Disability (CSD) analytical file will be used in part to estimate disability rates for various geographies but also to compare characteristics of persons with and without disabilities, which includes analyses of the financial situation and income support gaps faced by persons with disabilities in Canada. The main objective of the proposed record linkage is therefore to enhance Statistics Canada’s capacity to provide these statistics, through a linkage between the 2022 CSD and tax data.

Output: Results from this data linkage will inform around the current economic context for persons with disabilities in Canada and be used in the development of the Government of Canada’s Disability Inclusion Action Plan. The analytical file, with no personal identifiers, will be made available to deemed employees (researchers) within the Research Data Centers (RDC) and the Federal Research Data Centre (FRDC) that have a valid research topic for the production of statistical materials. Only non-confidential aggregated data and analytical products that conform to the confidentiality provision of the Statistics Act and any applicable requirements of the Privacy Act will be released outside of Statistics Canada.

Linking the Home Care Reporting System to Tax Data to provide Insights into Publicly Funded Home Care for Seniors (040-2023)

Linking the Home Care Reporting System to Tax Data to provide Insights into Publicly Funded Home Care for Seniors (040-2023)

Purpose: The objective of the project is to estimate the prevalence of publicly funded formal long-term home care use among Canadian seniors, examine the main demographic and income characteristics of senior home care clients, document the ability of senior home care clients to perform basic daily selfcare activities, assess the availability of informal care to these clients and present several important metrics related to their access to formal home care services. The study will also examine the financial well-being of long-term senior home care client and provide aggregate statistics related to income and income sources. For this purpose, data from the Home Care Reporting System (HCRS) will be linked to the T1 Family File (T1FF).

Output: Non-confidential aggregate data will be used for possible dissemination products such as research article(s), presentation decks, and/ or reports to stakeholders. The main output of the study will be in the form of a comprehensive technical report summarizing the methodology and key findings. Only non-confidential aggregate statistical outputs and analyses that conform to the confidentiality provisions of the Statistics Act will be released outside Statistics Canada.

Access to the linked microdata will be restricted to Statistics Canada employees. The linkage will be performed at Statistics Canada by Statistics Canada staff, and the linked files will be kept on a secure, password-protected server. The linked microdata file will not contain identifiers.

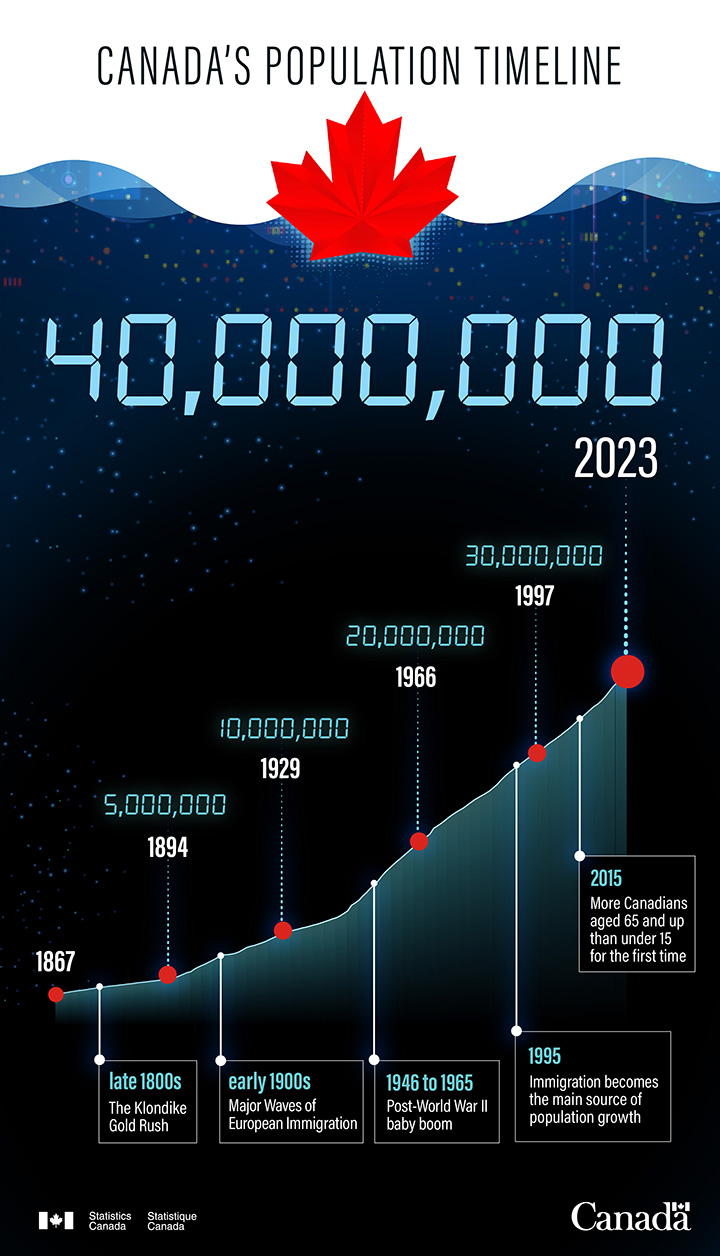

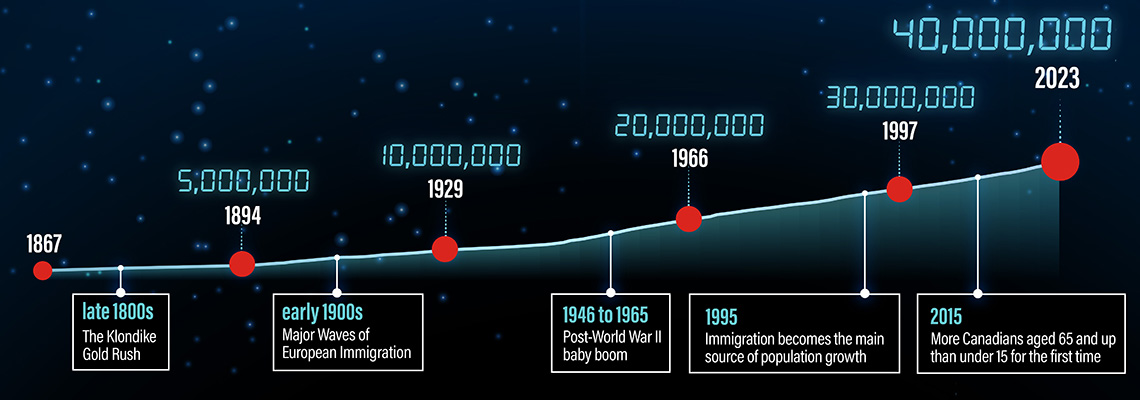

Video - Canada by the million

Video - Canada by the million