Supplement to Statistics Canada's Generic Privacy Impact Assessment related to the Pilot Study on Everyday Well-Being

Date: September 2021

Program manager:

- Director, Centre for Social Data Integration and Development

- Director General, Social Data Insights, Integration and Innovation

Reference to Personal Information Bank (PIB)

Personal information collected through the Pilot Study on Everyday Well-being using the Experience Sampling Method is described in Statistics Canada's "Special Surveys" Personal Information Bank. The Personal Information Bank refers to information collected through Statistics Canada's ad hoc surveys, which do not form part of the regular survey taking activity of the Agency. They cover a variety of socio-economic topics including health, housing, labour market, education and literacy, as well as demographic data.

The "Special Surveys" Personal Information Bank (Bank number: StatCan PPU 026) is published on the Statistics Canada website under the latest Information about Programs and Information Holdings chapter.

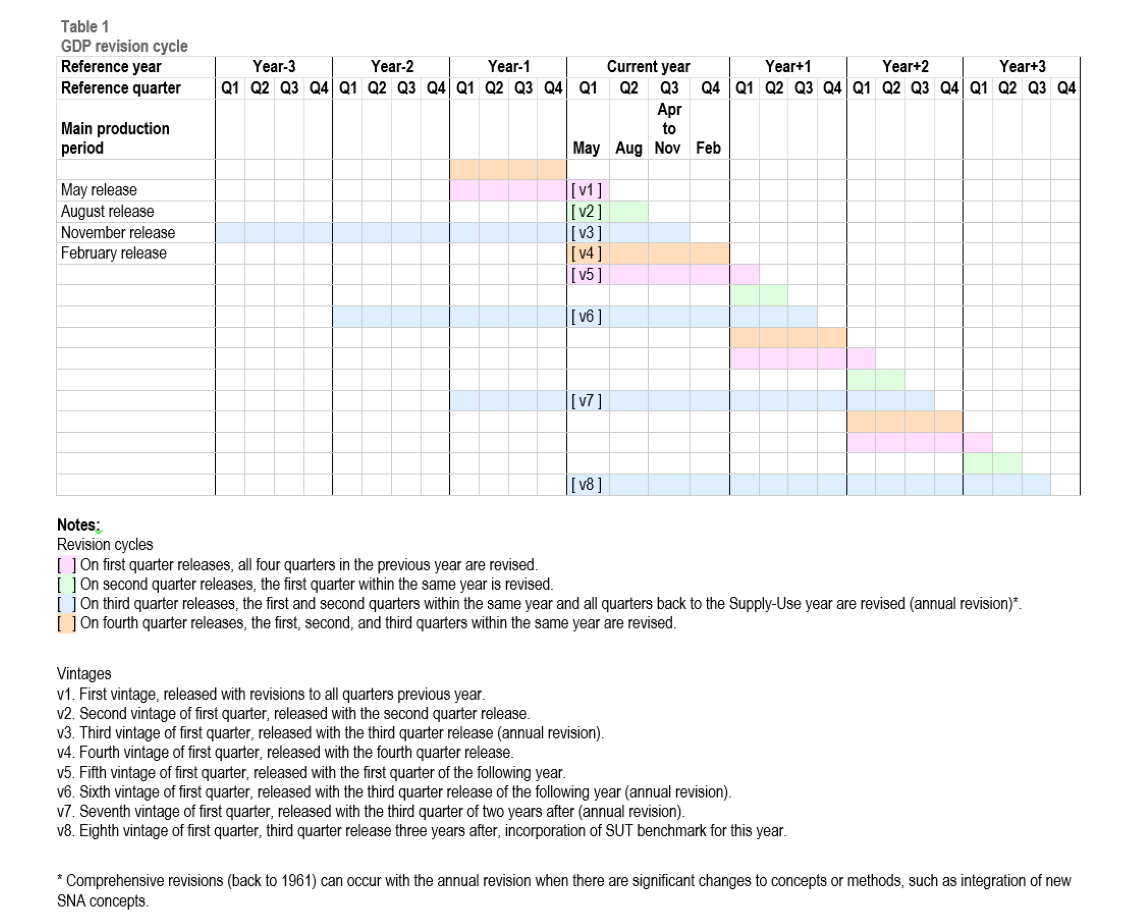

Description of statistical activity

In partnership with Canadian Heritage and the Canada Council for the Arts, Statistics CanadaFootnote 1 is conducting, under the authority of the Statistics Act , a voluntary pilot study on well-being using a short-term longitudinal collection method entitled "Experience Sampling Method" (ESM). ESM is a data collection technique where respondents are prompted to respond to a questionnaire multiple times throughout the day, and typically for multiple days. This allows for the collection of in-the-moment data on the activities of participants. It is used to measure what people do, feel and think during their daily lives. The use of the ESM for the Pilot Study on Everyday Well-being will allow respondents to provide their subjective assessment of their own well-being in real-time rather than retrospectively, and will facilitate the measurement of the effect on well-being of participation in various activities, particularly culture activities, which is the main focus of this pilot.

While ESM was developed in the 1990s, and was included in the Organisation for Economic Co-operation and Development's (OECD) 2013 Guidelines for Measuring Subjective Well-Being as a gold standard for measuring affective components of personal well-being, costs and logistical challenges have prevented its widespread use. To address this impediment, Statistics Canada has developed a mobile application (called Vitali-T-Stat) that will prompt respondents and direct them to Statistics Canada's secure collection infrastructure and the Pilot Study on Everyday Well-being questionnaire. The mobile application will not be collecting any personal information itself. It will only provide respondents with information on the study and will allow them to customize the prompting settings, such as the number of daily-prompts they wish to receive and the time of day when these prompts are sent. They can also choose to opt-out of the study at any time. The risks associated with the mobile application have been assessed in a specific Privacy Impact Assessment (PIA).

This pilot study is comprised of two phases. The first phase is a test of the questionnaire and application with 100 employees of Statistics Canada, Canadian Heritage and the Canada Council for the Arts. Employees will voluntarily provide their e-mail accounts associated with their personal devices and will then receive an official invitation from Statistics Canada to test the questionnaire and application for seven days. At the end they will be asked to answer a short set of feedback questions. Answers to these feedback questions will inform final improvements to the questionnaire and application before the second phase.

The second phase is a pilot collection, where voluntary participation will be sought in three ways. First, Statistics Canada will send an invitation letter, including a secure access code (see Appendix A) to respondents from a probabilistic sample. This letter will contain instructions for downloading the application and will include a brochure about the study and the mobile application (see Appendix B). Second, a two-pronged crowdsourcing campaign will start two weeks after the probabilistic sample receives their invitations. Electronic outreach materials and messages prepared by Statistics Canada will be forwarded by Canadian Heritage and the Canada Council for the Arts via e-mail to a range of organizations from the culture sector; these will include a common code indicating the invitation was sent from the culture sector (see Appendix C). The general public will also be invited to participate via a Statistics Canada outreach and social media campaign, without any codes. Respondents will be informed that entering a code is optional and that it will serve to assess response rates for the different types of invitations. The code will not identify specific individuals, only the collection group. This will allow Statistics Canada to better understand which invitation method to participate in this type of survey is more efficient.

If they choose to participate in the survey, respondents will be instructed to download the app from Google Play or the Apple Store, select "Start" then read the Terms and Conditions of the survey. If they accept the Terms and Conditions, participants will be directed to the survey questionnaire housed on Statistics Canada's secure anonymous collection portal. Respondents will be informed that they can stop participating in the survey or remove the app from their mobile devices at any time, and they will be provided with instructions on how to do so. This information will be included in the invitation letter and accompanying brochure and will be available on Statistics Canada's website.

Once they have left the application and entered Statistics Canada's secure anonymous collection portal, respondents will be asked to complete a short one-time preliminary questionnaire that will collect demographic information that will help Statistics Canada assess what factors could impact well-being. These questions are mostly drawn from standard questions used regularly by Statistics Canada. Some were developed specifically for this survey but were tested by Statistics Canada to ensure that they comply with the high standards of the Agency in regards to clarity, necessity and proportionality.

The one-time preliminary questionnaire includes:

- A set of questions that will help ensure survey results are representative of the general population and its sub-groups, as well as allow the linking of survey results to tax information in order to get a fuller picture of what could affect participants' well-being. Linking to a respondent's tax information will be done only with their consent.

- First and last name

- Date of birth

- Number of household members

- Number of household members 15 years and older

- Postal code

- Sex at birth and gender

- The following questions that will help further understand whether certain demographics could affect participants' well-being. ·

- Self-reported Indigenous identity, visible minority, and disability status

- Language(s) most spoken at home

- In light of the continued disruption to Canadians' lives due to the COVID-19 pandemic the following questions will also be asked in order to assess any of its overall impacts on well-being and more accurately contextualize and understand daily responses. This will also serve to create a baseline for comparison with any possible future uses of the app post-pandemic.

- Impact of COVID-19 on usual daily routine (on a scale ranging from no impact at all to major impact)

- Impact of COVID-19 on mental health (on a scale ranging from no impact at all to major impact)

- Impact of COVID-19 on ability to meet financial obligations or essential needs (on a scale ranging from no impact at all to major impact)

Respondents will then receive random notifications between two and five times per day according to their settings preference, during a 30-day period, inviting them to respond to a short questionnaire comprised of 8 questions (respondents can also choose not to receive notifications and can respond at times of their choosing):

- Five questions asking how happy, relaxed, focused, in control of emotions, and anxious they feel at the moment (on a scale ranging from 0 to 10). The questions invite respondents to think about what they were doing just before opening the Vitali-T-Stat app.

- One question about where they are, chosen from a pre-determined drop-down menu of generic location options such as at home, at work, outdoors.

- One question about what they are doing, chosen from a pre-determined drop-down menu of generic activity options such as paid work activities, chores, watching television.

- One question about who they are with, chosen from a pre-determined drop-down menu of generic relationship options such as on my own, with spouse, pet, children.

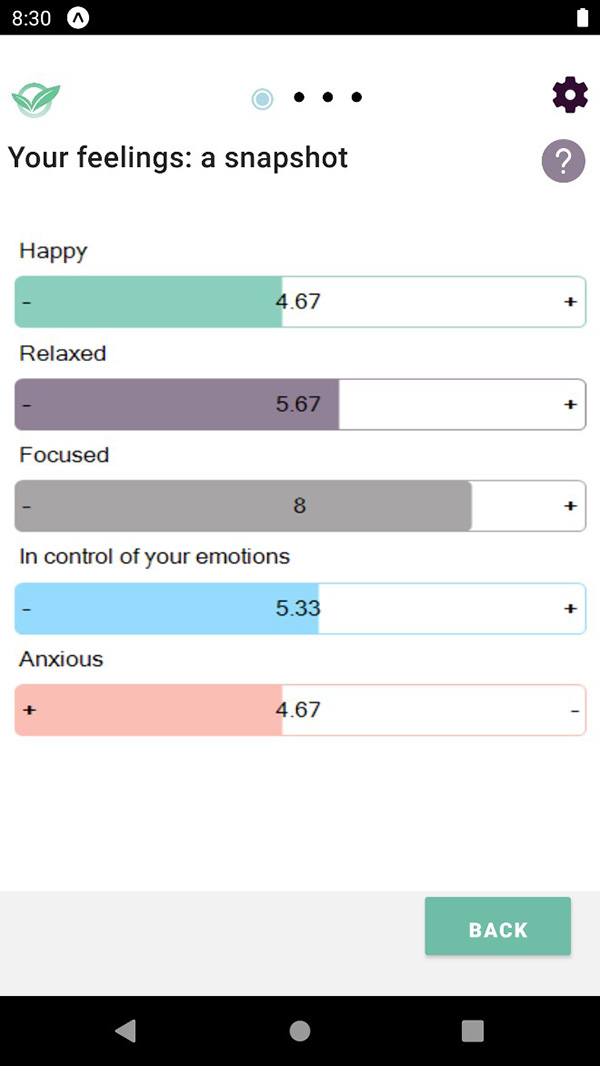

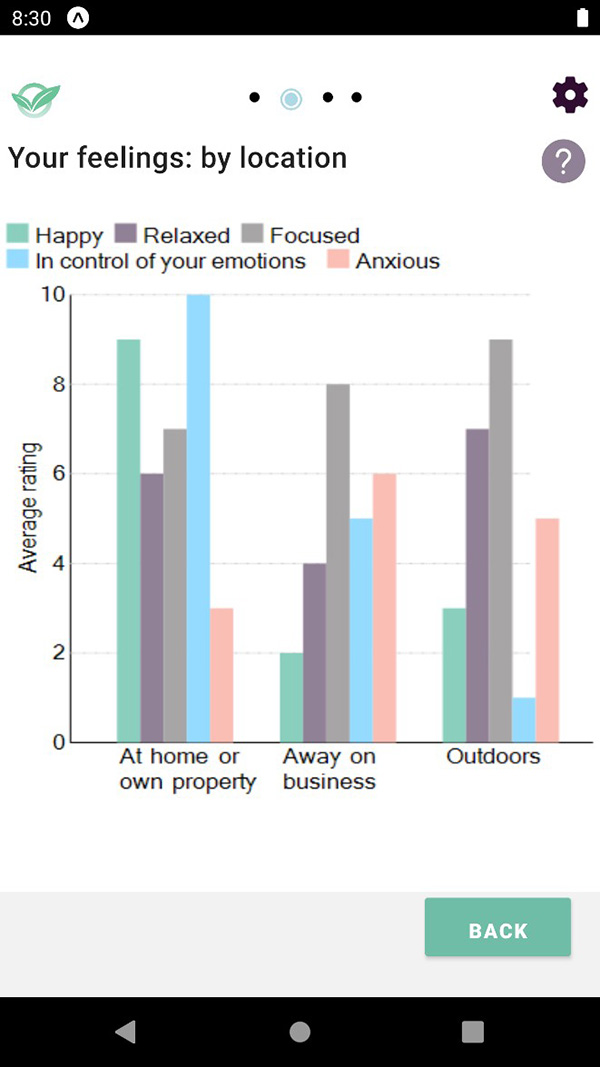

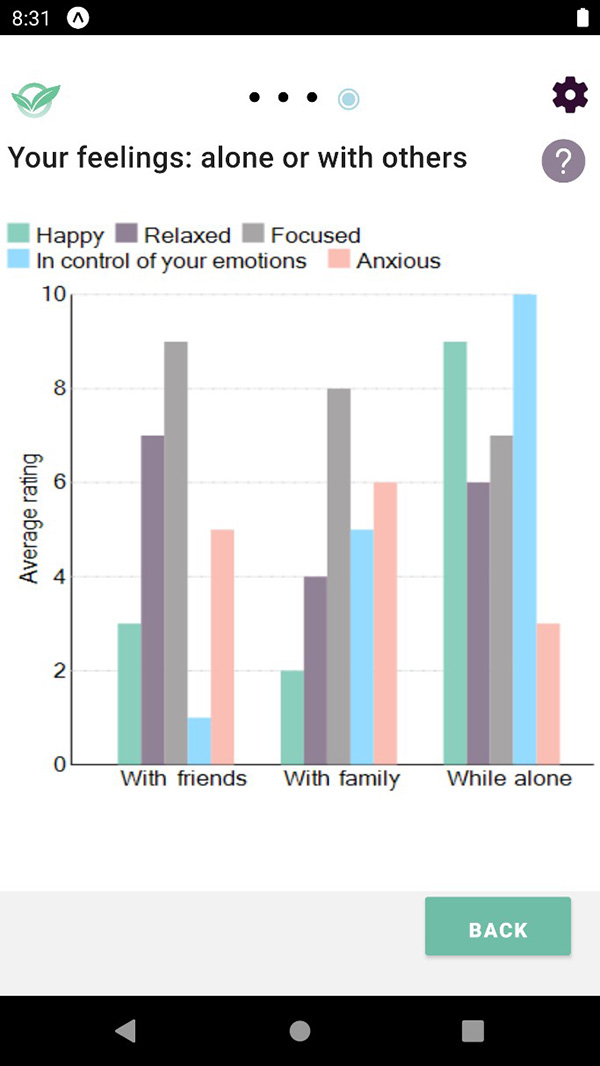

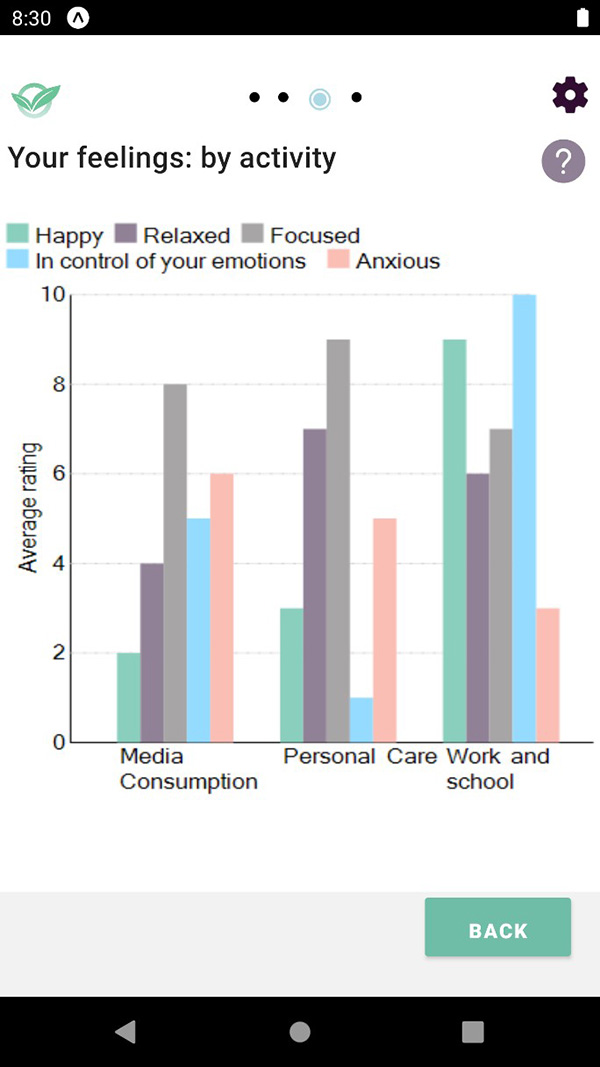

Throughout the data collection period, respondents will be able to view a personal dashboard in the mobile app displaying regularly updated graphs of their own cumulative responses to the survey. In addition to improving response rates, the practice of providing respondents with dashboards of their responses in the context of other surveys has shown to be generally appreciated. The graphs only include cumulative averages of the individual's responses to the five questions on how they were feeling, and on their feelings related to what they were doing, where they were and who they were with. They do not contain any individual responses to the survey, or any responses from other individuals. The dashboard graphs are generated on Statistics Canada servers each time a respondent submits answers to the eight short questions. Then an image of the graph is securely transmitted to the app on that respondent's mobile device (see Appendix D) where it can be viewed. The graphs remain stored on Statistics Canada secure servers.

The dashboard graphs are not accessible on screen readers. A note is included in the dashboard description that advises respondents who use these technologies to contact Statistics Canada in order to set up a unique secure Electronic File Transfer (EFT) account for them to receive their dashboard. These respondents will receive an email from Statistics Canada providing them with an account name and a one-time password that they must change at first log on. Once these credentials are established with the respondent, their survey responses as presented in the dashboard can be securely exchanged between Statistics Canada and the respondent.

Reason for supplement

While Statistics Canada's Generic Privacy Impact Assessment (PIA) addresses most of the privacy and security risks related to statistical activities conducted by Statistics Canada, this supplement describes additional measures (see Mitigation factors) being implemented to manage respondent burden associated with the use of the Experience Sampling Method (ESM) by way of the mobile application, and to limit intrusiveness. It also demonstrates the necessity and proportionality related to the collection of this personal information. As is the case with all PIAs, Statistics Canada's privacy framework ensures that elements of privacy protection and privacy controls are documented and applied.

Necessity and Proportionality

The collection and use of personal information for the Experience Sampling Method (ESM) and the Pilot Study on Everyday Well-being can be justified against Statistics Canada's Necessity and Proportionality Framework:

1. Necessity:

The Pilot Study on Everyday Well-Being seeks to fill a gap in quality national and regional estimates of subjective well-being in-the-moment, and complements existing data holdings on subjective well-being. Data on how individuals feel while partaking in particular activities offers the possibility to assess potential impacts of various activities on individuals' well-being, and in the context of this pilot, particularly on the impacts of participating in culture programs. The results can inform governments' decisions regarding publicly-funded cultural and other programs that contribute to Canadians' well-being.

TThis pilot will also assess the viability of using a mobile application as an alternative to diary-based collection. Diary-based collection consists in asking respondents to record detailed information about their everyday lives in a log, diary or journal regarding the activity or experience being studied, for example on their use of time or household spending. When carried out using telephone or web-based collection modes, it creates significant burden for respondents, which can be alleviated through the use of a mobile application that redirects them to Statistics Canada's secure anonymous collection portal.

2. Effectiveness:

The Pilot Study on Everyday Well-being allows for the collection of in-the-moment affect data. This eliminates the need for respondents to remember and report on activities after they have occurred, and the risk of respondents not remembering correctly, thus improving data quality. While data collection occurs over a 30-day period, the short questionnaire length and repeated content will result in a lower cognitive load and burden.

3. Proportionality:

The probabilistic sample to which an invitation letter will be sent is comprised of 50,000 households, representative of existing households in Canada. This sample size was determined based on various demonstrated methodological considerations such as the absence of follow-up for non-respondents, and the coverage limitations of the mobile app, given that not every household has a mobile device that will function with the mobile application. Most importantly, this sample size is necessary to ensure a sufficient number of respondents will provide responses regarding participation in culture activities, which is a key focus of this pilot. The survey design eliminates the need to send follow-up verifications to ensure the correct respondent is participating. In addition, the survey design ensures households easily understand which member is being asked to participate. This approach reduces the number and type of questions that need to be asked, while still enabling Statistics Canada to carry out proper methodological validation and analysis of the pilot results.

Proportionality has also been considered based on data sensitivity and ethics:

- Sensitivity: While the data do reflect the self-assessed emotional state of individuals at given points in time, it is no more sensitive than other subjective well-being data collected by Statistics Canada, and adheres to appropriate guidelines established by the Organisation for Economic Co-operation and Development (OECD) on measuring subjective well-being. Sensitivity of the data is further mitigated using generic response categories for the location, activity and respondent's companions which prevents the inclusion of identifying information in survey responses.

- Ethics: This approach reduces response burden compared to retrospective data collection or diary-based collection. The data collection approach is modelled on international studies using the Experience Sampling Method with an app. The collection design provides maximum information and control to the respondent prior to, during, and following their participation in the study. This includes no non-response follow-up, the ability for the respondent to alter or disable numerous parameters, and providing the respondent with their data. Specifically, for the random notifications, the default has been set to the minimum required (two per day) to ensure the methodological integrity of the study, but the respondent is able to fully customize the parameters – including increasing the number of notifications per day, setting the times in a day when they want to receive notifications or disabling the notifications altogether. Additionally, the respondent can remove the app from their device and cease participation in the study at any time. Taken together, these measures ensure the transparency of the data collection process and puts informed control in the hands of respondents.

4. Alternatives:

Collecting in-the-moment data is a data collection methodology that has been in existence for some time but has limitations if done without the use of a mobile application. Alternative ways of contacting respondents and collecting in-the-moment data include either sending them randomly pre-established schedules and asking them to log into Statistics Canada's secure collection infrastructure to complete the survey at those specific times, or calling them at random times to collect the data by phone. These alternatives are inconvenient and more intrusive. Another alternative is to use a diary-based collection method where respondents are asked to think back and report on how they were feeling at certain times throughout the day, in combination with what they were doing, where they were and who they were with at that time. This methodology is burdensome as respondents need to carry the diary with them, and it introduces the risk of them not accurately recalling where they were and how they felt. The information regarding where respondents are could also be collected through sensors on participants' phones such as location, but this is deemed to be disproportionately intrusive. The method being used in this pilot aims to give respondents full control over their participation, to minimize burden, and obtain the most accurate sense of their well-being.

Mitigation factors

While privacy risks are deemed manageable with existing Statistics Canada safeguards associated with its secure collection environment and mobile application, the following additional mitigation measures were implemented to manage respondent burden associated with the use of the Experience Sampling Method (ESM) by way of the mobile application, and to limit intrusiveness:

- No non-response follow-up with additional letters or telephone calls.

- Using Statistics Canada's secure anonymous collection portal to directly collect responses. No survey responses are being stored on respondents' mobile devices.

- Not using data from sensors on mobile devices such as GPS.

- Using drop-down menus with generic response categories to eliminate the possibility of respondents including personally-identifying or sensitive data.

- The ability for the respondent to configure their notification settings at any time to limit when they are eligible to receive notifications.

- The ability for respondents to opt out of the survey at any time.

- The ability for respondents to uninstall the app from their mobile device at any time.

- The cessation of notifications after four days of inactivity, even if notification settings are not modified.

- Respondents' dashboard graphs are only produced and stored on Statistics Canada's secure servers, and securely transmitted to the app on the individual respondent's mobile device where it can be viewed. They only include the respondent's own personal cumulative responses to the survey.

- The requirement of password protection on the mobile application to prevent unauthorized access and viewing of respondent's dashboard graphs.

The questions pertaining to the impact of COVID-19 on mental health and on the ability to meet financial obligations or essential needs could be considered sensitive and could lead some respondents to experience various levels of distress. The overall risk of harm to the survey respondents has been deemed manageable with existing Statistics Canada safeguards as well as with the following measures:

- The questions are formulated for response on a scale range.

- An FAQ has been developed to respond to this concern, informing respondents where they can turn to for help if they feel distress.

Conclusion

This assessment concludes that, with the existing Statistics Canada safeguards and additional mitigation factors listed above, any remaining risks are such that Statistics Canada is prepared to accept and manage the risk.

Formal approval

This Supplementary Privacy Impact Assessment has been reviewed and recommended for approval by Statistics Canada's Chief Privacy Officer, Director General for Modern Statistical Methods and Data Science, and Assistant Chief Statistician for Social, Health and Labour Statistics.

The Chief Statistician of Canada has the authority for section 10 of the Privacy Act for Statistics Canada, and is responsible for the Agency's operations, including the program area mentioned in this Supplementary Privacy Impact Assessment.

This Privacy Impact Assessment has been approved by the Chief Statistician of Canada.

Appendix A – Invitation Letter

This is provided as an example; the version sent to respondents might be slightly different.

Dear household member:

Your household has been selected to participate in the Pilot Study on Everyday Well-being, an innovative pilot study that uses Statistics Canada's Vitali-T-Stat app to ask questions about your emotions throughout the day.

Your participation is important

This pilot study asks Canadians in-the-moment questions about their activities and feelings. Our goal is to gain a better understanding of the factors that influence well-being, particularly arts and culture activities, which are the main focus of this pilot. This initiative is in collaboration with Canada Council for the Arts and Canadian Heritage. The data will provide insight on the connections between activities and well-being, and could be used to develop programs that enhance people's lives.

Although voluntary, your participation is appreciated and will help ensure we gather accurate information about the well-being of Canadians.

Who from your household should complete this study?

- If you are the only person in your household who is 15 years of age or older, you have been selected to participate in the study.

- If your household has two members 15 years of age or older, the older member has been selected.

- If your household has three or more members 15 years of age or older, list those members in order of oldest to youngest. The second person on the list has been selected.

- 1.

- 2.

- 3.

Download the app to get started!

- Visit the Google Play or App store, search for Vitali-T-Stat by Statistics Canada and download the app onto your mobile device (Android or Apple).

- Open the app – read the Getting Started instructions, accept the Terms and Conditions, create a password and customize your notifications.

- Click START and answer the first questionnaire. You will be asked if you received an invitation from Statistics Canada. Click YES and enter the code provided in this invitation letter (found in the box at the top right) then continue participating.

After you set up the app, for the next 30 days you'll receive two notifications daily to answer a few questions about what you are doing and how you are feeling in that moment. If you like, you can increase the notifications up to five per day.

Your information is confidential

This survey is conducted under the authority of the Statistics Act, which ensures that the information you provide will be kept confidential, and used only for statistical and research purposes.

For general enquiries and technical assistance

Visit Pilot Study on Everyday Well-Being, or contact us Monday to Friday (except holidays), from 8:00 a.m. to 7:00 p.m. (Eastern Time):

- 1-877-949-9492 (TTY: 1-800-363-7629*)

- infostats@canada.ca

*If you use an operator-assisted relay service, you can call us during regular business hours. You do not need to authorize the operator to contact us.

Thank you,

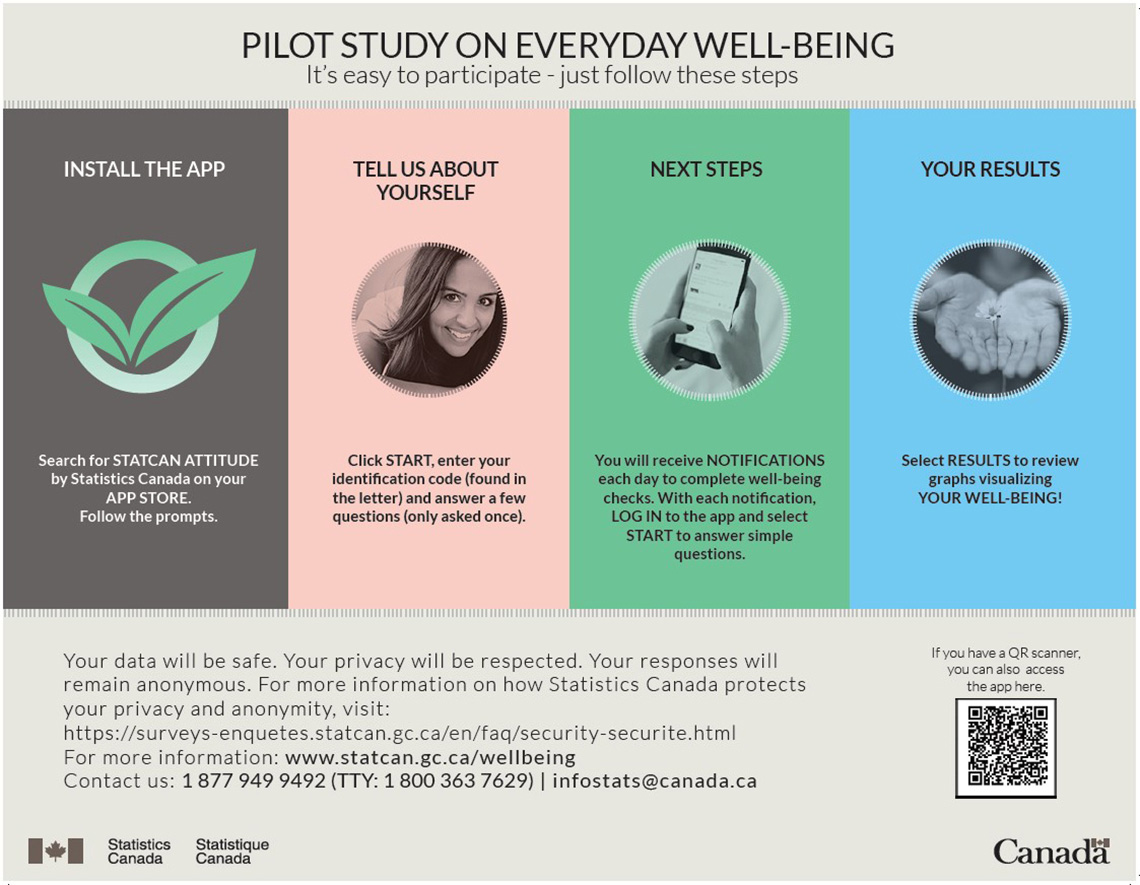

Appendix B – Brochure

This is provided as an example; the version sent to respondents may be slightly different.

Pilot Study on Everyday Well-being

PILOT STUDY ON EVERYDAY WELL-BEING

It's easy to participate – just follow these steps

INSTALL THE APP

Search for STATCAN ATTITUDE by Statistics Canada on your APP STORE. Follow the prompts.

TELL US ABOUT YOURSELF

Click START, enter your identification code (found in the letter) and answer a few questions (only asked once).

NEXT STEPS

You will receive NOTIFICATIONS each day to complete well-being checks. With each notification, LOG IN to the app and select START to answer simple questions.

YOUR RESULTS

Select RESULTS to review graphs visualizing YOUR WELL_BEING!

Your data will be safe. Your privacy will be respected. Your responses will remain anonymous. For more information on how Statistics Canada protects your privacy and anonymity, visit:

Security

For more information: Pilot Study on Everyday Well-Being

Contact us: 1 877 949 9492 (TTY: 1 800 363 7629) / infostats@canada.ca

Appendix C – Targeted Crowdsourcing Invitation

This is provided as an example; the version sent to respondents may be slightly different.

SUBJECT/OBJET: Invitation to participate in Statistic Canada's app-based project: Pilot Study on Everyday Well-being / (Le français suit.)

Dear xxx:

Your household is being invited to participate in the Pilot Study on Everyday Well-being,an innovative pilot study that uses Statistics Canada's Vitali-T-Statapp to ask questions about your emotions throughout the day.

Your participation is important

This pilot study asks Canadians in-the-moment questions about their activities and feelings. Our goal is to gain a better understanding of the factors that influence well-being, particularly arts and culture activities, which are the main focus of this pilot. This initiative is in collaboration with Canada Council for the Arts and Canadian Heritage. The data will provide insight on the connections between activities and well-being, and could be used to develop programs that enhance people's lives.

Although voluntary, your participation is appreciated and will help ensure we gather accurate information about the well-being of Canadians.

Who from your household should complete this study?

- If you are the only person in your household who is 15 years of age or older, you have been selected to participate in the study.

- If your household has two members 15 years of age or older, the older member has been selected.

- If your household has three or more members 15 years of age or older, list those members in order of oldest to youngest. The second person on the list has been selected.

- 1.

- 2.

- 3.

Download the app to get started!

- Visit the Google Play or App store, search for Vitali-T-Stat by Statistics Canada and download the app onto your mobile device (Android or Apple).

- Open the app – read the Getting Started instructions, accept the Terms and Conditions, create a password and customize your notifications.

- Click START and answer the first questionnaire. You will be asked if you received an invitation from Statistics Canada. Click YES and enter the code provided in this invitation letter (found in the box at the top right) then continue participating.

After you set up the app, for the next 30 days you'll receive two notifications daily to answer a few questions about what you are doing and how you are feeling in that moment. If you like, you can increase the notifications up to five per day.

Your information is confidential

This survey is conducted under the authority of the Statistics Act, which ensures that the information you provide will be kept confidential, and used only for statistical and research purposes.

For general enquiries and technical assistance

Visit Pilot Study on Everyday Well-Being, or contact us Monday to Friday (except holidays), from 8:00 a.m. to 7:00 p.m. (Eastern Time):

- 1-877-949-9492 (TTY: 1-800-363-7629*)

- infostats@canada.ca

*If you use an operator-assisted relay service, you can call us during regular business hours. You do not need to authorize the operator to contact us.

Thank you,

Signature

Appendix D – Screenshots of respondent dashboard

Your feelings: a snapshot

Graph showing average on scale of 1 to 10

Happy

Relaxed

Focused

In control of your emotions

Anxious

Your feelings: by location

Graph showing average rating on scale of 1 to 10 of

How Happy, Relaxed, Focused, In control of your emotions, Anxious

When At home or own property, Away on business, Outdoors

Your feelings: alone or with others

Graph showing average rating on scale of 1 to 10 of

How Happy, Relaxed, Focused, In control of your emotions, Anxious

When With friends, With family, While alone

Your feelings: by activity

Graph showing average rating on scale of 1 to 10 of

How Happy, Relaxed, Focused, In control of your emotions, Anxious

When doing Media Consumption, Personal Care, Work and school