Archived – Quarterly Financial Report for the quarter ended September 30, 2013

Statement outlining results, risks and significant changes in operations, personnel and program

A) Introduction

Statistics Canada's mandate

Statistics Canada is a member of the Industry portfolio.

Statistics Canada's role is to ensure that Canadians have access to a trusted source of statistics on Canada that meet their highest priority needs.

The Agency's mandate derives primarily from the Statistics Act. The Act requires that the Agency collects, compiles, analyzes and publishes statistical information on the economic, social, and general conditions of the country and its people. It also requires that Statistics Canada conducts the Census of Population and the Census of Agriculture every fifth year, and protects the confidentiality of the information with which it is entrusted.

Statistics Canada also has a mandate to co-ordinate and lead the national statistical system. The Agency is considered a leader, among statistical agencies around the world, in co-ordinating statistical activities to reduce duplication and reporting burden.

More information on Statistics Canada's mandate, roles, responsibilities and programs can be found in the 2013–2014 Main Estimates and in the Statistics Canada 2013–2014 Report on Plans and Priorities.

The quarterly financial report:

- should be read in conjunction with the 2013–2014 Main Estimates, the Quarterly Financial Report for the quarter ended June 30, 2013, and Canada's Economic Action Plan 2012 (Budget 2012)

- has been prepared by management, as required by Section 65.1 of the Financial Administration Act, and in the form and manner prescribed by Treasury Board

- has not been subject to an external audit or review.

Statistics Canada has the authority to collect and spend revenue from other government departments and agencies, as well as from external clients, for statistical services and products.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the agency's spending authorities granted by Parliament and those used by the agency consistent with the Main Estimates for the 2013-2014 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

As part of the Parliamentary business of supply, the Main Estimates must be tabled in Parliament on or before March 1 preceding the new fiscal year. Budget 2012 was tabled in Parliament on March 29, after the tabling of the Main Estimates on February 28, 2012. As a result, the measures announced in Budget 2012 could not be reflected in the 2012–2013 Main Estimates.

In fiscal year 2012-2013, frozen allotments were established by Treasury Board authority in departmental votes to prohibit the spending of funds already identified as savings measures in Budget 2012. In 2013-2014, the changes to departmental authorities were reflected in the 2013–2014 Main Estimates tabled in Parliament.

The Agency uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

B) Highlights of fiscal quarter and fiscal year-to-date results

This section highlights the significant items that contributed to the net decrease in resources available for the year, as well as actual expenditures for the quarter ended September 30.

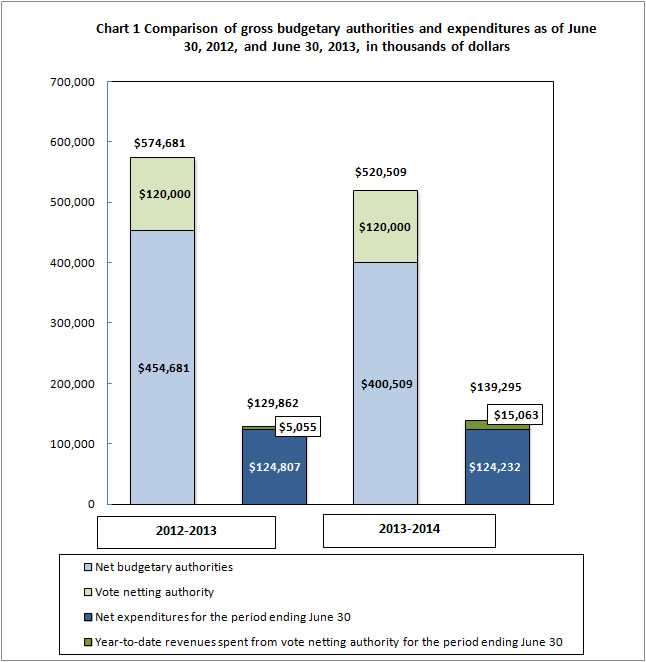

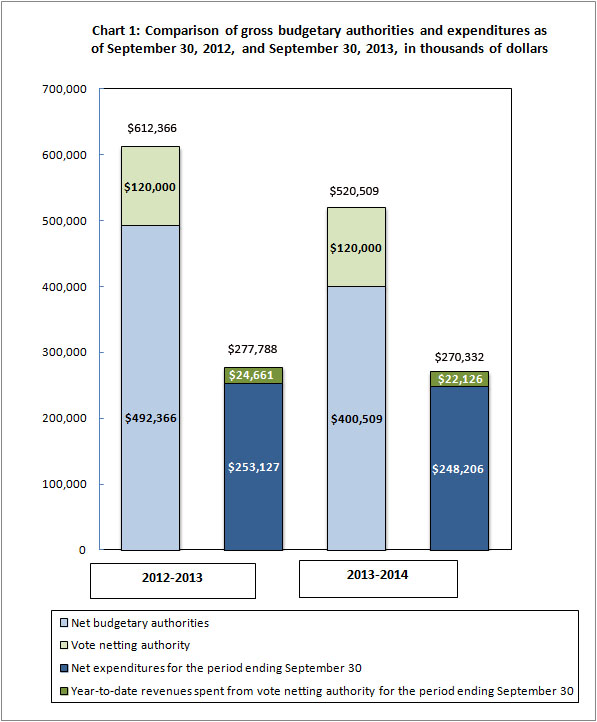

Chart 1 outlines the gross budgetary authorities, which represent the resources available for use for the year as of September 30.

Significant changes to authorities

There were no changes to Statistics Canada's authorities in the second quarter.

Total authorities available for 2013-2014 have decreased by $91.9 million, or 15%, from the previous year, from $612.4 million to $520.5 million (Chart 1). This net decrease was mostly the result of the following:

- decreased funding for the 2011 Census of Population and the National Household Survey ($43.3 million), as well as the 2011 Census of Agriculture ($1.9 million) as the programs are winding down

- reductions related to Budget 2012 ($18.3 million), which were included in the 2013–2014 Main Estimates

- the carry-forward amount has not been received as of the end of the second quarter of 2013-2014 as it was in 2012-2013

- partly offset by an increase in funding for collective agreements ($9.2 million).

In addition to the appropriations allocated to the Agency through the Main Estimates, Statistics Canada also has vote net authority within Vote 105, which entitles the Agency to spend revenues collected from other government departments, agencies, and external clients to provide statistical services. Vote netting authority is stable at $120 million in each of the fiscal years 2012-2013 and 2013-2014.

Significant changes to expenditures

Total expenditures recorded for the second quarter, ending September 30, 2013, decreased $16.9 million, or 11%, from the same quarter of the previous year, from $147.9 million to $131.0 million. Year-to-date expenditures recorded to the end of the second quarter decreased $7.4 million, or 3%, from $277.8 million to $270.3 million. (See Table A: Year-to-year Variation in Departmental Expenditures by Standard Object.)

Statistics Canada spent approximately 52% of its authorities by the end of the second quarter, compared with 45% in the same quarter of 2012-2013.

| Variation in Departmental Expenditures by Standard Object | Q2 year-to-date variation | |

|---|---|---|

| $'000 | % | |

| Note: Explanations are provided for variances of more than $1 million. | ||

| (01) Personnel | -10,830 | -4.2 |

| (02) Transportation and communications | -831 | -14.3 |

| (03) Information | -5 | -2.6 |

| (04) Professional and special services | 949 | 21.3 |

| (05) Rentals | 532 | 9.3 |

| (06) Repair and maintenance | 131 | 98.5 |

| (07) Utilities, materials and supplies | 306 | 41.4 |

| (08) Acquisition of land, buildings and works | - | - |

| (09) Acquisition of machinery and equipment | 2,340 | 436.6 |

| (10) Transfer payments | - | - |

| (12) Other subsidies and payments | -48 | -87.3 |

| Total gross budgetary expenditures | -7,456 | -2.7 |

| Less revenues netted against expenditures | ||

| Revenues | -2,535 | -10.3 |

| Total net budgetary expenditures | -4,921 | -1.9 |

01) Personnel: In early 2013-2014, Statistics Canada incurred expenditures for severance liquidations related to the signing of collective agreements. These expenditures were offset by reduced payments related to the Workforce Adjustment Directive and by lower salary expenditures resulting from a smaller workforce.

09) Acquisition of machinery and equipment: The increase was the result of acquiring computer equipment in the first quarter.

The decrease in revenues was primarily the result of timing differences between years for the receipts of funds and scheduled key deliverables.

C) Risks and uncertainties

Budgetary pressures, arising from reduced appropriations and reduced cost-recovery revenues, resulted in financial and human resource management challenges in 2012-2013. To manage human resource risks, the Agency opted to move quickly to implement all mandated program adjustments and corresponding workforce reductions. To manage financial risks, given uncertainties over the timing of costs arising from workforce adjustment and the speed of implementation of program adjustments, additional controls were implemented on non-salary expenditures and a number of significant expenditures were re-profiled.

In 2013-2014, Statistics Canada plans to continue to meet these challenges with the following actions and mitigation strategies:

- additional analysis, monitoring and validation of financial and human resources information through a modified monthly financial package for budget holders

- review of monthly project dashboards in place across the Agency to monitor project issues, risks and alignment with approved budgets

- continued realignment and reprioritization of work.

D) Significant changes to operations, personnel and programs

2011 Census of Population and the National Household Survey

Data quality studies for the 2011 Census and National Household Survey will continue through 2013-2014. Major releases for the 2011 National Household Survey occurred on May 8th, June 26th, and September 11th 2013, and are now complete.

E) Budget 2012 implementation

This section provides an overview of the savings measures announced in Budget 2012 that are being implemented to refocus government and programs, make it easier for Canadians and businesses to deal with their government, as well as modernize and reduce the back office.

Statistics Canada's savings target as announced in Budget 2012 Economic Action Plan is $33.9 million by 2014-2015. This reduction is being implemented progressively, beginning with $8.3 million on April 1, 2012, rising to $18.3 million on April 1, 2013, in order to achieve the full reduction by April 1, 2014. The reductions, as of April 1, 2013, have been reflected in Statistics Canada's Main Estimates. To meet this target, Statistics Canada has focused resources where they are most needed.

The savings incurred through these program adjustments represent moderate reductions in the production of statistics to support development, administration, and evaluation of policy, while continuing to meet the public's highest priority needs. In some cases, the information will continue to be available in a different format. A full list of program adjustments is available online.

Expenditures in the current quarter of 2013-2014 are lower than in the same quarter of the previous fiscal year. The reduction is mainly the result of the reduced workforce required after implementing the program adjustments mentioned above.

There are no financial risks or uncertainties related to these reductions.

Approval by senior officials

The original version was signed by

Wayne R. Smith, Chief Statistician

Stéphane Dufour, Chief Financial Officer

| Fiscal year 2013-2014 | |||

|---|---|---|---|

| Planned expenditures for the year ending March 31, 2014 | Expended during the quarter ended September 30, 2013 | Year-to-date used at quarter-end | |

| in thousands of dollars | |||

| Expenditures | |||

| (01) Personnel | 419,449 | 119,296 | 249,327 |

| (02) Transportation and communications | 26,173 | 2,581 | 4,972 |

| (03) Information | 2,656 | 120 | 189 |

| (04) Professional and special services | 33,940 | 3,553 | 5,404 |

| (05) Rentals | 9,224 | 4,000 | 6,248 |

| (06) Repair and maintenance | 11,951 | 231 | 264 |

| (07) Utilities, materials and supplies | 12,355 | 577 | 1,045 |

| (08) Acquisition of land, buildings and works | - | - | - |

| (09) Acquisition of machinery and equipment | 4,586 | 677 | 2,876 |

| (10) Transfer payments | - | - | - |

| (12) Other subsidies and payments | 175 | 2 | 7 |

| Total gross budgetary expenditures | 520,509 | 131,037 | 270,332 |

| Less revenues netted against expenditures | |||

| Revenues | 120,000 | 7,063 | 22,126 |

| Total revenues netted against expenditures | 120,000 | 7,063 | 22,126 |

| Total net budgetary expenditures | 400,509 | 123,974 | 248,206 |

| Fiscal year 2012-2013 | |||

|---|---|---|---|

| Planned expenditures for the year ending March 31, 2013 * | Expended during the quarter ended September 30, 2012 | Year-to-date used at quarter-end | |

| in thousands of dollars | |||

| Expenditures | |||

| (01) Personnel | 462,103 | 137,635 | 260,157 |

| (02) Transportation and communications | 36,595 | 2,927 | 5,804 |

| (03) Information | 4,812 | 117 | 195 |

| (04) Professional and special services | 45,908 | 2,976 | 4,455 |

| (05) Rentals | 11,603 | 3,423 | 5,717 |

| (06) Repair and maintenance | 21,345 | 112 | 132 |

| (07) Utilities, materials and supplies | 17,984 | 296 | 739 |

| (08) Acquisition of land, buildings and works | - | - | - |

| (09) Acquisition of machinery and equipment | 11,213 | 430 | 536 |

| (10) Transfer payments | 561 | - | - |

| (12) Other subsidies and payments | 242 | 10 | 55 |

| Total gross budgetary expenditures | 612,366 | 147,926 | 277,788 |

| Less revenues netted against expenditures | |||

| Revenues | 120,000 | 19,606 | 24,661 |

| Total revenues netted against expenditures | 120,000 | 19,606 | 24,661 |

| Total net budgetary expenditures | 492,366 | 128,320 | 253,127 |

| Fiscal year 2013-2014 | |||

|---|---|---|---|

| Total available for use for the year ending March 31, 2014* | Used during the quarter ended September 30, 2013 | Year-to-date used at quarter-end | |

| in thousands of dollars | |||

| * Includes only authorities available for use and granted by Parliament at quarter-end. | |||

| Vote 105 – Net operating expenditures | 338,342 | 108,432 | 217,122 |

| Statutory authority – Contribution to employee benefit plans | 62,167 | 15,542 | 31,084 |

| Total budgetary authorities | 400,509 | 123,974 | 248,206 |

| Fiscal year 2012-2013 | |||

|---|---|---|---|

| Total available for use for the year ended March 31, 2013*,** | Used during the quarter ended September 30, 2012 | Year-to-date used at quarter-end | |

| in thousands of dollars | |||

| * Includes only authorities available for use and granted by Parliament at quarter-end. ** Total available for use does not reflect the measures announced in Budget 2012. |

|||

| Vote 105 – Net operating expenditures | 423,208 | 111,030 | 218,547 |

| Statutory authority – Contribution to employee benefit plans | 69,158 | 17,290 | 34,580 |

| Total budgetary authorities | 492,366 | 128,320 | 253,127 |