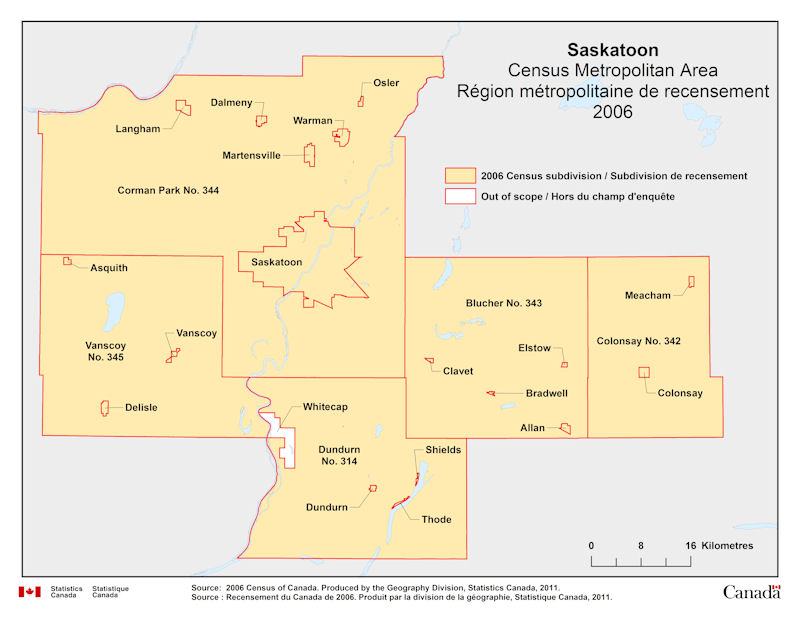

Geographical map of 2006 Census Metropolitan Area of Saskatoon, Saskatchewan

Geographical map of 2006 Census Metropolitan Area of Saskatoon, Saskatchewan. The following Census subdivisions and Out of scope are listed within this region:

Census subdivisions: Allan, Asquith, Blucher No. 343, Bradwell, Clavet, Colonsay, Colonsay No. 342, Corman Park No. 344, Dalmeny, Delisle, Dundurn, Dundurn No. 314, Elstow, Langham, Martensville, Meacham, Osler, Saskatoon, Shields, Thode, Vanscoy, Vanscoy No. 345, Warman.

Out of scope: Whitecap.

Source: 2006 Census of Canada. Produced by the Geography Division, Statistics Canada, 2011.