Preface

The Standard Geographical Classification (SGC) is Statistics Canada's official classification for geographical areas in Canada.

Established in the early 1960s, the Standard Geographical Classification was released as a working manual for 1964, 1966 and 1972. In 1974, the manual became an official publication of Statistics Canada and it was subsequently issued for 1976, 1981, 1986, 1991, 1996 and 2001. This 2006 version is the eighth edition.

The classification consists of two volumes, each available separately. Volume I describes the classification and related standard areas and provides an alphabetical index of place names. It also explains the changes between the 2006 edition of the SGC and the 2001 edition that impact directly upon the SGC , such as changes in name, type, or code, and indicates how the new and old codes relate to one another. Volume II contains reference maps showing the locations and boundaries of the standard geographical areas in the classification. The maps are available for a fee in a paper version or can be downloaded for free in PDF format from our website.

The 2006 Standard Geographical Classification is published by Standards Division, under the guidance of Alice Born, Director. The publication was prepared by Richard Fortin and Guy Auger under the supervision of John Crysdale. Major contributors included Geography Division, which was responsible for the source data for the tables and definitions as well as for the preparation of the maps; and Dissemination Division, which was responsible for setting PDF table and text formats as well as printing.

Introduction

The Standard Geographical Classification (SGC) is a classification of geographical areas used to collect and disseminate statistics.

Following a description of the SGC itself, other geographical unitsFootnote 1 and related entities used for the collection and dissemination of statistics are presented. An outline of the content of the two volumes that constitute the Standard Geographical Classification is then presented.

The Standard Geographical Classification

The Standard Geographical Classification (SGC) was developed to enable the production of integrated statistics by geographical area. It provides a range of geographical units that are convenient for data collection and compilation, and useful for spatial analysis of economic and social statistics. It is intended primarily for the classification of statistical units, such as establishments or households, whose activities are normally associated with a specific location.

The SGC is based on a classification system originally developed for the dissemination of statistics from the Census of Population.

The SGC conforms to the basic principles of classification. It consists of a set of discrete units that are mutually exclusive and, in total, cover the entire universe. Usually, a classification appears as a hierarchy, each level of which satisfies the above-mentioned principles and is defined by the uniform application of a single criterion. Applied to geography, these principles result in a classification consisting of geographical areas whose boundaries are specifically delimited in accordance with well-defined concepts and which, in total, cover the entire landmass of Canada. The classification appears as a three-level hierarchy of geographical units identified by a seven-digit numerical coding system.

The SGC is one of a family of statistical standards, approved and promulgated by Statistics Canada. These standards provide the basic definitions which, when adopted for data collection and dissemination, result in statistics that are comparable among series and over time. Even non-standard units, when defined by reference to the standard, are enhanced by better definition of content and relevance to other series.

The geographical units

Two criteria were used in the selection of geographical units for the SGC . The first was that they be easily recognized by the respondents who are asked to report geographical detail. Administrative units were chosen because respondents routinely conduct business with administrative units such as a municipality, county or province.

The second criterion was the usefulness of the geographical units for general statistical purposes. Once again, administrative units are suitable because they are significant users of statistics in establishing and implementing programs involving the expenditure of public funds and also because the general public can readily associate statistics on this basis with the names and boundaries of administrative units.

The SGC identifies three types of geographical unit:

- province or territory,

- census division,

- census subdivision.

In SGC 2006, there are 13 provinces and territories, 288 census divisions and 5,418 census subdivisions.

(1) Province or territory (PR)

Reflecting the primary political subdivision of Canada, provinces and territories are the most permanent level of the SGC . From a statistical point of view, province and territory are basic areas for which data are tabulated. Canada is divided into ten provinces and three territories.

The provinces, territories, and their codes and abbreviations are presented in Table A.

Table A

List of provinces and territories with codes and abbreviations, 2006

| Province or Territory |

SGC Code |

Alpha CodeFootnote 1 |

AbbreviationFootnote 1 |

|---|

| Newfoundland and Labrador |

10 |

NL |

N.L. |

|---|

| Prince Edward Island |

11 |

PE |

P.E.I. |

|---|

| Nova Scotia |

12 |

NS |

N.S. |

|---|

| New Brunswick |

13 |

NB |

N.B. |

|---|

| Quebec |

24 |

QC |

Que. |

|---|

| Ontario |

35 |

ON |

Ont. |

|---|

| Manitoba |

46 |

MB |

Man. |

|---|

| Saskatchewan |

47 |

SK |

Sask. |

|---|

| Alberta |

48 |

AB |

Alta. |

|---|

| British Columbia |

59 |

BC |

B.C. |

|---|

Yukon Territory

(Yukon since Oct. 2008) |

60 |

YT |

Y.T. |

|---|

| Northwest Territories |

61 |

NT |

N.W.T. |

|---|

| Nunavut |

62 |

NU |

Nvt. |

|---|

Footnotes

- Footnote 1

-

On October 21, 2002, the alpha code for the province of Newfoundland and Labrador changed from NF to NL. In addition, the English abbreviation for Newfoundland and Labrador, which was provisional in the SGC 2001 changed from Nfld.Lab. to N.L..

Return to footnote 1 referrer

|

(2) Census division (CD)

Census division is a general term for provincially legislated areas ( e.g. , county, "municipalité régionale de comté" and regional district) or their equivalents. Census divisions are intermediate geographical areas between the province and territory level and the municipality ( i.e. , census subdivision). Usually they are created for the purposes of regional planning and managing common services ( e.g. , police or ambulance services).

In Newfoundland and Labrador, Manitoba, Saskatchewan, Alberta, Yukon Territory (Yukon since Oct. 2008), Northwest Territories and Nunavut, provincial/territorial law does not provide for such administrative geographical areas. Therefore, Statistics Canada, in co-operation with these provinces and territories, has created equivalent areas called census divisions for the purpose of collecting and disseminating statistical data. In the Yukon Territory (Yukon since Oct. 2008), the census division is equivalent to the entire territory.

In New Brunswick, six municipalities ( i.e. , census subdivisions) straddle the legal county boundaries. In order to maintain the integrity of component municipalities, Statistics Canada modified the census division boundaries. Specifically, the following six municipalities straddle county boundaries and the first county in brackets indicates the CD in which these municipalities are completely located:

- Belledune (Restigouche/Gloucester)

- Fredericton (York/Sunbury)

- Grand Falls (Victoria/Madawaska)

- Meductic (York/Carleton)

- Minto (Queens/Sunbury)

- Rogersville (Northumberland/Kent)

Census division boundaries tend to be relatively stable over many years. For this reason the census division has been found useful for analysing historical data on small areas.

Census divisions (CDs) are classified into 13 types. Eleven of these types were created according to official designations adopted by provincial or territorial authorities. The other two types – the "census division" (CDR) and the "territory" (TER) – were created as equivalents by Statistics Canada, in co-operation with the affected provinces and the territory, for the purpose of collecting and disseminating statistical data.

Changes to CD types for 2006 include:

- CD types added

- county / comté (CT) in New Brunswick;

- management board (MB) in Ontario;

- "territoire équivalent" (TÉ) in Quebec.

- CD type deleted

- "communauté urbaine" (CU) in Quebec.

- Other change

- the abbreviation for the CD type – census division – was changed from DIV to CDR.

Table B shows CD types, their abbreviated forms, and their distribution by province and territory.

The total number of CD s has not changed from the previous census, however in Newfoundland and Labrador, Statistics Canada created a new CD in co-operation with the Province of Newfoundland and Labrador and the Nunatsiavut Government to represent the Labrador Inuit Settlement Area. The lands covered by this new CD , Division No. 11 ( CD 10 11), were settled under the Labrador Inuit Land Claims Agreement Act, which was passed and received Royal Assent in December 2004. The creation of Division No. 11 increases the number of CD s in Newfoundland and Labrador to 11.

In Quebec, as a result of municipal restructuring (census subdivisions) a new census division type called "territoire équivalent (TÉ)" was created. This new CD type replaces the CD type "communauté urbaine (CU)", of which there were 3 in 2001. And the "municipalité régionale de comté" (MRC) Desjardins ( CD 24 24) has been dissolved. The deletion of the MRC Desjardins decreases the number of CD s in Quebec to 98.

All CD names have had any reference to the associated CD type removed from their names in order to remain consistent with the conventions used for naming all geographical units. For example, Niagara Regional Municipality, RM ( CD 35 26) is now referred to as Niagara, RM and Perth County, CTY ( CD 35 31) is now referred to as Perth, CTY.

(3) Census subdivision (CSD)

Census subdivision is a general term for municipalities as determined by provincial or territorial legislation, or areas treated as municipal equivalents for statistical purposes ( e.g. , Indian reserves, Indian settlements and unorganized territories). Municipalities are units of local government.

Beginning with the 1981 Census, each Indian reserve and Indian settlement recognized by the Census is treated as a separate CSD and reported separately. Prior to the 1981 Census, all Indian reserves in a census division were grouped together and reported as one census subdivision.

For 2006, there is a total of 1,095 Indian reserves and 28 Indian settlements classified as CSD s. These are populated (or potentially populated) Indian reserves, which represent a subset of the approximately 3,100 Indian reserves across Canada. Statistics Canada works closely with Indian and Northern Affairs Canada to identify the reserves and the settlements to be included as CSD s. Furthermore, the inclusion of an Indian settlement is dependent upon the agreement of the provincial or territorial authorities.

There are two municipalities in Canada that straddle provincial boundaries, Flin Flon (Manitoba and Saskatchewan) and Lloydminster (Saskatchewan and Alberta). Each of their provincial parts is treated as a separate CSD . Three Indian reserves also straddle provincial limits, Shoal Lake (Part) 39A and Shoal Lake (Part) 40 (Ontario and Manitoba); and Makaoo (Part) 120 (Saskatchewan and Alberta); and are treated as separate CSD s.

Census subdivisions are classified into 55 types. Fifty-three of these were created according to official designations adopted by provincial, territorial or federal authorities. The other two types – "Subdivision of unorganized" in Newfoundland and Labrador, and "Subdivision of county municipality" in Nova Scotia – were created as equivalents to municipalities by Statistics Canada, in co-operation with the two affected provinces, for the purpose of collecting and disseminating statistical data.

It should be noted that some CSD s have the same geographical name but different CSD types. In these cases, the census subdivision type accompanying the census subdivision name is used to distinguish CSD s from each other ( i.e. , Granby, V [for the "ville" of Granby] and Granby, CT [for the "municipalité de canton" of Granby]).

Changes to CSD types for 2006 include:

- CSD types added

- Community government (CG) in Northwest Territories;

- Crown colonie / Colonie de la couronne (CN) in Saskatchewan;

- "Terres réservées aux Cris" (TC) in Quebec;

- "Terres réservées aux Naskapis" (TK) in Quebec;

- Municipality (MU) in Ontario;

- Municipality / Municipalité (M) in Ontario;

- Town / Ville (TV) in New Brunswick and Ontario.

- CSD type deleted

- "Terres réservées" (TR) in Quebec was replaced by "Terres réservées aux Cris" (TC) and "Terres réservées aux Naskapis" (TK).

- Other changes

- City / Cité (C) is replaced by City / Cité (C), City (CY) and "Cité" (CÉ);

- "Municipalité" (M) in Quebec becomes "Municipalité" (MÉ);

- "Paroisse (municipalité de)" (P) in Quebec becomes "Paroisse (municipalité de)" (PE);

- Parish (PAR) in New Brunswick is replaced by Parish / Paroisse (municipalité de) (P);

- Indian reserve – Réserve indienne (R) becomes Indian reserve / Réserve indienne (IRI);

- Rural community (RC) in New Brunswick becomes Rural community / Communauté rurale (RCR);

- Subdivision of county municipality (SCM) in Nova Scotia becomes Subdivision of county municipality / Subdivision municipalité de comté (SC);

- Indian settlement – Établissement indien (S-E) becomes Indian settlement / Établissement indien (S-É);

- Settlement (SET) in Yukon Territory (Yukon since Oct. 2008) becomes Settlement / Établissement (SÉ);

- Subdivision of unorganized (SUN) in Newfoundland and Labrador becomes Subdivision of unorganized / Subdivision non organisée (SNO);

- Unorganized – Non organisé (UNO) becomes Unorganized / Non organisé (NO).

Table C shows CSD types, their abbreviated forms, and their distribution by province and territory.

The structure of the SGC

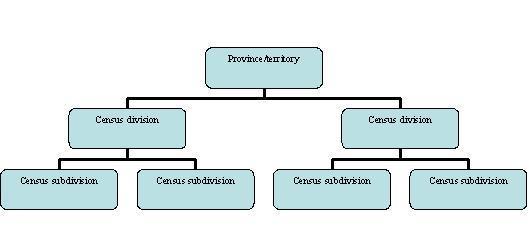

Each of the three levels of the classification covers all of Canada. They are hierarchically related: census subdivisions aggregate to census divisions, which in turn aggregate to a province or a territory. The relationship is illustrated in Figure 1.

This structure is implicit in the seven-digit SGC code as shown in the following illustration, which uses the code for the city of Oshawa.

Structure of the classification of the city of Oshawa

| PR |

CD |

CSD |

|---|

| 35 |

Empty cell |

Empty cell |

Ontario |

|---|

| 35 |

18 |

Empty cell |

Durham (Regional municipality) |

|---|

| 35 |

18 |

013 |

Oshawa (City) |

|---|

Figure 1. The SGC hierarchy

The SGC coding system

At the outset, numerical codes were adopted for ease of use and clarity. The numbers were universally applicable to all of the data processing machines in use at that time.

The use of numerical codes continues but the number of digits in the code changed from six to seven in 1976, when a three-digit code was adopted for census subdivisions because the number of census subdivisions in one census division exceeded 99.

Provinces are numbered from east to west. Because the number of provinces and territories exceeded nine, a two-digit code was adopted. The first digit represents the standard regions of Canada in which the province or territory is located and the second digit denotes one of the ten provinces and three territories. The standard regions are:

- Atlantic

- Quebec

- Ontario

- Prairies

- British Columbia

- Territories

The provincial and territorial codes are shown in Table A.

The following conventions are used in the coding system:

- The codes usually follow a serpentine pattern beginning in the southeast corner of each province, territory or CD . In this way, adjacent code numbers usually represent geographical units that share a common boundary. Exceptions are found in Manitoba and Saskatchewan, where census divisions are numbered in a straight line from east to west, returning to the eastern borderleft when the western borderleft is reached. Also, in Quebec, Saskatchewan, Alberta, and British Columbia, Indian reserve codes are included in the 800 series of numbers, whereas in the other provinces they are accommodated within the serpentine numbering pattern for census subdivisions.

- In order to provide the flexibility required to maintain the coding system over the years, the numbering is not sequential (except for CD s, which are more stable). Gaps in the numbering sequence leave opportunities to incorporate new geographical units within the numbering sequence.

- Codes are not generally used more than once. However, a code may be reused if at least two editions of the classification have appeared. For example, a code deleted in 1991 may be reused in 2006.

- Component parts of codes are preserved as much as possible. For example, when a new CD is created, the original CSD codes are retained where possible.

Naming geographical units

The following procedure is applied in selecting names for geographical units:

- Official names are used where they are available. The names of incorporated local and regional municipalities are taken from provincial and territorial gazettes, where official notifications of acts of incorporation for new municipalities and changes to existing municipalities are published.

- Most official names are accepted as published, but many are edited by Statistics Canada for the sake of consistency and clarity. For example, Statistics Canada drops the CSD type and uses the geographical name only ( i.e. , the official name City of Ottawa appears in the SGC as Ottawa).

- Six municipalities ( i.e. , census subdivisions) in Canada have different official names in English and French: Beaubassin East / Beaubassin-est, and Grand Falls / Grand-Sault in New Brunswick; and Greater Sudbury / Grand Sudbury, French River / Rivière des Français, The Nation / La Nation, and West Nipissing / Nipissing Ouest in Ontario. For English products, the official name in English is used ( i.e. , Greater Sudbury), for French products, the official name in French is used ( i.e. , Grand Sudbury), and for bilingual products, the bilingual name is used with English followed by French ( i.e. , Greater Sudbury / Grand Sudbury).

- The remaining geographical names are created by Statistics Canada in co-operation with provincial, territorial and federal officials ( e.g. , when creating names for most economic regions).

- Some statistical areas ( e.g. , census metropolitan areas and census agglomerations) straddle provincial boundaries ( e.g. , the census metropolitan area [CMA] of Ottawa–Gatineau). In such a case, when data are presented for the provincial parts, the name of the province must follow the name of the statistical area. For the CMA of Ottawa–Gatineau, each part of the CMA will be identified as Ottawa–Gatineau, Ontario part and Ottawa–Gatineau, Quebec part.

Guidelines for Census Metropolitan Area (CMA) name change requests

Language form of census division (CD) and census subdivision (CSD) types

Where the CD or CSD type ( e.g. , town, city, county) is part of the legal name of the CD or CSD as legislated by provincial or territorial governments, Statistics Canada uses the language form of the legal name. In all other cases, where the CD or CSD type is not embedded in the legal name, Statistics Canada uses the language of the publication. As a consequence, this means that in an English language publication there may be some French language type names, and that in French language publications there may be some English language type names. For example, in the case of Bathurst, New Brunswick, the legislation specifies that the legal name is "City of Bathurst". Accordingly, the type is presented as City (CY) in English publications; City (CY) in French publications; and as City (CY) in bilingual publications.

Table D and Table E provide the standard abbreviations and titles for all CD and CSD types for English, French and bilingual publications respectively.

Maintenance of the SGC

The 2006 SGC presents standard geographical areas as of January 1, 2006. It includes any changes to municipalities, effective on that date or earlier, received by Statistics Canada before March 1, 2006.

Information received after March 1, 2006, has not been included, therefore provincial or territorial authorities may notice some small discrepancies compared to their official records.

Several hundred changes are made to census subdivisions every year. These changes may affect boundaries, codes, names, or types. Changes to the census division level also occur periodically. Most changes originate from provincial legislation (revised statutes and special acts), changes to Indian reserves originate with Indian and Northern Affairs Canada, and other changes come from Statistics Canada.

Legislated changes are effective as of the date proclaimed in the legislation. Other changes are effective January 1, usually of the reference year for the SGC .

The Standard Geographical Classification is published every five years, coincident with the Census of Population. For most statistical applications, holding the geography in a statistical series constant for this length of time is an acceptable compromise between stability and existing reality. Observations at five-year intervals are suitable for historical trend analysis, yet for current series, a tolerable degree of distortion occurs.

An annual summary of changes is available from the Geography Division, upon request. This may be of interest to data collectors wishing to compile data that reflect the actual boundaries of census subdivisions.

The 2006 SGC presents a complete summary of the changes affecting the SGC between January 2, 2001 and January 1, 2006. Volume I of the 2006 SGC contains three concordance tables for that period, on the changes that impact directly upon the SGC , such as changes in code, name, or type, and indicates how the new and old codes relate to one another. In addition, a fourth table provides 2001 Census population counts based on the census subdivision boundaries of each January and July 1st for each census subdivision affected by a boundary change during the period 2001 to 2006.

The other changes such as partial annexations, and boundary and population revisions, which do not affect the SGC codes and usually involve very small areas and populations, are not shown in the concordance tables. They are available, however, in the "Interim List of Changes to Municipal Boundaries, Status and Names" published by Geography Division.

Census Division Changes

In Newfoundland and Labrador, the creation of Division No. 11 occurs in two parts, excluding one small area south of the town of Nain, which remains part of Division No. 10 ( CD 10 10). Seven census subdivisions (CSDs) are affected by the creation of Division No. 11. Two of these CSD s, which are of the CSD type subdivision of unorganized (SNO), required splitting and name changes to reflect the new CD structure (See concordance tables).

In Quebec, after the dissolution of the "municipalité régionale de comté" (MRC) de Desjardins, the census subdivisions (CSD) of Pintendre, M (24 24 010), Saint-Joseph-de-la-Pointe-de-Lévy, P (24 24 015), and Lévis, V (24 24 020) (now part of CSD Lévis, V [24 25 213]) were annexed to Les Chutes-de-la-Chaudière (now Lévis, TÉ [ CD 24 25]) and the CSD of Saint-Henri, M (24 24 005) was annexed to Bellechasse ( CD 24 19). Also in Quebec, several census divisions (CDR), "municipalités régionales de comté" (MRC) and "territoires equivalents" (TÉ) were affected by boundary changes:

- The CSD of Saint-Lambert-de-Lauzon, P (24 25 005) was taken from Lévis (24 25) and annexed to La Nouvelle-Beauce (24 26).

- The CSD s of Charette, M (24 36 005), Saint-Élie, P (24 36 010), Saint-Mathieu-du-Parc, M (24 36 015) and Saint-Boniface-de-Shawinigan, VL (24 36 020) were taken from Shawinigan (24 36) and annexed to Maskinongé (24 51).

- The CSD of Saint-Étienne-des-Grès, P (24 37 080) was taken from Francheville (24 37) and annexed to Maskinongé (24 51).

- The CSD of Notre-Dame-du-Mont-Carmel, P (24 36 040) was taken from Shawinigan (24 36) and annexed to Francheville (24 37).

- The CSD of Waterville, V (24 43 005) was taken from Sherbrooke (24 43) and annexed to Coaticook (24 44).

- The CSD of Saint-Bruno-de-Montarville, V (24 57 015) (now part of Longueuil, V [24 58 227]) was taken from La Vallée-du-Richelieu (24 57) and annexed to Longueuil (24 58).

- The CSD of Boucherville, V (24 59 005) was taken from Lajemmerais (24 59) and annexed to Longueuil (24 58).

The names or types of 15 CD s in Quebec have been changed (Table F).

Table F

Changes to census division names and types in Quebec

| Former CD name and type |

Revised CD name and type |

SGC code |

|---|

| Les Îles-de-la-Madeleine (MRC) |

Les Îles-de-la-Madeleine (TÉ) |

24 01 |

|---|

| Communauté-Urbaine-de-Québec (CU) |

Québec (TÉ) |

24 23 |

|---|

| Les Chutes-de-la-Chaudière (MRC) |

Lévis (TÉ) |

24 25 |

|---|

| Le Centre-de-la-Mauricie (MRC) |

Shawinigan (TÉ) |

24 36 |

|---|

| Francheville (MRC) |

Francheville (CDR) |

24 37 |

|---|

| La Région-Sherbrookoise (MRC) |

Sherbrooke (TÉ) |

24 43 |

|---|

| Champlain (MRC) |

Longueuil (TÉ) |

24 58 |

|---|

| Laval (MRC) |

Laval (TÉ) |

24 65 |

|---|

| Communauté-Urbaine-de-Montréal (CU) |

Montréal (TÉ) |

24 66 |

|---|

| Mirabel (MRC) |

Mirabel (TÉ) |

24 74 |

|---|

| Communauté-Urbaine-de-l'Outaouais (CU) |

Gatineau (TÉ) |

24 81 |

|---|

| Rouyn-Noranda (MRC) |

Rouyn-Noranda (TÉ) |

24 86 |

|---|

| Vallée-de-l'Or (MRC) |

La Vallée-de-l'Or (MRC) |

24 89 |

|---|

| Le Haut-Saint-Maurice (MRC) |

La Tuque (TÉ) |

24 90 |

|---|

| Le Fjord-du-Saguenay (MRC) |

Le Saguenay-et-son-Fjord (CDR) |

24 94 |

|---|

In Ontario, Frontenac, CTY becomes Frontenac, MB; Haldimand-Norfolk, RM becomes Haldimand-Norfolk, CDR; and Brant, CTY becomes Brant, CDR.

Census Subdivision Changes

The changes affecting CSD s have been grouped into eighteen types, each represented by a particular code. They are listed in Table G below with an indication of which types impact upon the SGC code.

Table G

Change type codes for census subdivisions

| Code |

Type of change |

Change in SGC code? |

|---|

| 1 |

Incorporation |

Yes |

|---|

| 2 |

Change of name |

No |

|---|

| 2C |

Correction of name |

No |

|---|

| 23 |

Change of name and type |

No |

|---|

| 3 |

Change of type |

No |

|---|

| 3C |

Correction of type |

No |

|---|

| 4 |

Dissolution |

Yes |

|---|

| 5 |

Annexation of part of |

No |

|---|

| 5A |

Complete annexation and part annexed of |

No |

|---|

| 6 |

Part annexed to |

No |

|---|

| 7 |

Revision of SGC code |

Yes |

|---|

| 7C |

Correction of SGC code |

Yes |

|---|

| 8 |

Part taken from (revision from population challenge) |

No |

|---|

| 8C |

Part taken from (cartographic correction) |

No |

|---|

| 9 |

Part lost to (revision from population challenge) |

No |

|---|

| 9C |

Part lost to (cartographic correction) |

No |

|---|

| 10 |

Population taken from (revision) |

No |

|---|

| 11 |

Population lost to (revision) |

No |

|---|

A legend is provided to explain the appropriate codes (codes 1, 2, 2C, 23, 3, 3C, 4, 5A, 6, and 7) used in the concordance tables. A more detailed explanation follows.

New SGC codes (code 1) are assigned to newly created CSD s. Such CSD s are:

- created out of another census subdivision, typically a municipality created from a populated area located in a rural or unorganized census subdivision; or

- created when two or more census subdivisions amalgamate.

In the latter case the entries, including SGC codes, for all of the census subdivisions contributing to the newly created census subdivision are deleted (code 4).

Also affecting the SGC code are revisions arising from structural changes, such as the reorganization of CD s. This type of change (codes 7 and 7C) simply indicates a revised code number, with no other change having affected the CSD .

Changes in CSD name (codes 2 and 2C), CSD type (codes 3 and 3C), or CSD name and type (code 23) do not affect the SGC code, but the Classification file is updated.

The most numerous changes are partial annexations (codes 5 and 6), boundary revisions (codes 8, 8C, 9 and 9C) and population revisions (codes 10 and 11), which do not affect the SGC codes, and usually involve very small areas and populations. These changes are not listed in the concordance tables, but they can be found in the publication entitled "Interim List of Changes to Municipal Boundaries, Status and Names".

CSD s that have been affected by a change occurring from January 2, 2001 to January 1, 2006 are identified by a flag. This is done to warn users updating their geographic files or doing trend or longitudinal analysis that the areas being compared could have changed over time. However, by comparing the final population counts from the previous census to the adjusted counts, the user can establish if there was a boundary change, a revision of boundary or a revision of population counts. Information on 2001 Census population counts of CSD s affected by such changes can be found in the 2006 SGC and in the "Interim List of Changes to Municipal Boundaries, Status and Names".

Since January 2, 2001, a total of 2,738 CSD changes have been recorded. These changes affected 1,569 of the 5,600 CSD s that existed in 2001, and resulted in a net reduction of 182 CSD s over the period. Of the total number of changes, 537 affected the CSD code mainly due to municipal restructuring in Quebec (340 dissolutions, 158 incorporations and 39 revisions of code), 89 affected the name, 106 affected the status and 15 affected both the name and status. Boundary changes and revisions (1,918), and population revisions (73) accounted for the remaining 1,991 changes. Since 2001, CSD boundary changes affected 106 census divisions.

Table H presents the number of census subdivision changes by type and by province and territory.

Other geographical entities

Although the SGC is the basic system of geographical units used for collecting and disseminating statistics in Statistics Canada, it cannot serve all statistical purposes for which the presentation and analysis of economic and social data are required. Therefore, Statistics Canada uses, in addition to the SGC , a number of other standard geographical entities ( e.g. , census metropolitan areas and census agglomerations, economic regions, health regions, and countries) for the provision of statistics.

Census metropolitan area (CMA) and census agglomeration (CA)

The general concept of these standard units is one of an urban core, and the adjacent urban and rural areas that have a high degree of social and economic integration with that urban core, as measured by commuting flows derived from Census of Population data on place of work.

To form a census metropolitan area (CMA), the urban core must have a population of at least 50,000 and the area ( CMA ) must have a population of at least 100,000. Once an area becomes a CMA , it is retained as a CMA even if the population of its urban core declines below 50,000, or if its total population falls below 100,000.

To form a census agglomeration (CA), the urban core must have a population of at least 10,000. If the population of the urban core of a CA declines below 10,000, the CA is retired.

As of March 2003, CA s are no longer required to have an urban core population count of 100,000 to be promoted to the status of a CMA . Instead, CA s will assume the status of a CMA if they have attained a total population of at least 100,000 and an urban core of 50,000 or more.

A CMA or CA is delineated using adjacent municipalities (census subdivisions) as building blocks. These census subdivisions (CSDs) are included in the CMA or CA if they meet at least one delineation rule. The three principal rules are:

- Urban core rule: The CSD falls completely or partly inside the urban core.

- Forward commuting flow rule: Given a minimum of 100 commuters, at least 50% of the employed labour force living in the CSD works in the delineation urban core as determined from commuting data based on the place of work question in the last decennial census (2001 Census).

- Reverse commuting flow rule: Given a minimum of 100 commuters, at least 25% of the employed labour force working in the CSD lives in the delineation urban core as determined from commuting data based on the place of work question in the last decennial census (2001 Census).

Another rule concerns the merging of adjacent CMA s and CA s. A CA adjacent to a CMA can be merged with the CMA if the total percentage commuting interchange between the CA and CMA is equal to at least 35% of the employed labour force living in the CA , based on place of work data from the decennial census. The total percentage commuting interchange is the sum of the commuting flow in both directions between CMA and CA as a percentage of the labour force living in the CA ( i.e. , resident employed labour force).

A CMA or CA represents an area that is economically and socially integrated. However, there are certain limitations to the manner in which this goal can be met. Since the CSD s, which are used as building blocks in CMA and CA delineation, are administrative units, their boundaries are not always the most suitable with respect to CMA and CA delineation. There are always situations where the application of rules creates undesirable outcomes, or where the rules cannot be easily applied. In these circumstances, a manual override is sometimes applied to ensure that the integrity of the program is retained.

CMA s and CA s are statistically comparable because they are delineated in the same way across Canada. They differ from other types of areas, such as trading, marketing, or regional planning areas designated by regional authorities for planning and other purposes, and should be used with caution for non-statistical purposes.

There are 33 CMA s and 111 CA s in 2006. Six CA s from the previous census became CMA s: Moncton in New Brunswick; Barrie, Brantford, Guelph, and Peterborough in Ontario; and Kelowna in British Columbia. Seven new CA s were created: Bay Roberts in Newfoundland and Labrador; Miramichi in New Brunswick; Centre Wellington and Ingersoll in Ontario; Okotoks and Canmore in Alberta; and Salmon Arm in British Columbia. The 2001 CA of Magog merged with the CMA of Sherbrooke since the commuting interchange between the CMA and CA is equal to at least 35% of the employed labour force living in the CA , based on the 2001 place of work data. Finally, two CA s, Gander and Labrador City in Newfoundland and Labrador, were retired because the population of their urban core dropped below 10,000 in 2001

Between 2001 and 2006, a number of municipalities underwent name changes, amalgamations, annexations, and dissolutions with the result that three CMA s had their names changed: Chicoutimi–Jonquière became Saguenay; Ottawa–Hull became Ottawa–Gatineau; and Greater Sudbury became Greater Sudbury / Grand Sudbury. Two CA s had their names changed: Port Hope and Hope became Port Hope and Haileybury became Temiskaming Shores.

While census metropolitan areas (CMAs) and census agglomerations (CAs) contain approximately 80% of the population of Canada, they cover only 4% of the land area. The census metropolitan area and census agglomeration influenced zone (MIZ) is a concept that geographically differentiates the area of Canada outside CMA s and CA s. Census subdivisions outside CMA s and CA s are assigned to one of four categories according to the degree of influence (strong, moderate, weak or no influence) that the CMA s and CA s collectively have on each of them. Census subdivisions with the same degree of influence, that is based on the percentage of their resident employed labour force that have a place of work in the urban core(s) of CMA s and CA s, tend to be clustered into zones around the CMA s and CA s.

With the introduction of the MIZ concept, it is possible to classify all census subdivisions in the new Statistical Area Classification (SAC) for data dissemination purposes. Indeed, the SAC classifies census subdivisions according to whether they are a component of a census metropolitan area, a census agglomeration, a census metropolitan area and census agglomeration influenced zone (strong MIZ, moderate MIZ, weak MIZ or no MIZ), or the territories (Nunavut, Northwest Territories and Yukon Territory (Yukon since Oct. 2008)). The application of this classification to census subdivision data could reveal previously hidden details and help users to study the diversity of non- CMA / CA areas of Canada.

Economic region (ER)

This is a standard unit created in response to the requirement for a geographical unit suitable for the presentation and analysis of regional economic activity. Such a unit is small enough to permit regional analysis, yet large enough to include enough respondents that, after data are screened for confidentiality, a broad range of statistics can still be released.

The regions are based upon work by Camu, Weeks and Sametz in the 1950s. At the outset, boundaries of regions were drawn in such a way that similarities of socio-economic features within regions were maximized while those among regions were minimized. Later, the regions were modified to consist of counties which define the zone of influence of a major urban centre or metropolitan area. Finally, the regions were adjusted to accommodate changes in CD boundaries and to satisfy provincial needs.

An ER is a geographical unit, smaller than a province, except in the case of Prince Edward Island and the Territories. The ER is made up by grouping whole census divisions, except for one case in Ontario, where the city of Burlington, a component of Halton ( CD 35 24), is excluded from the ER of Toronto and is included in the Hamilton–Niagara Peninsula ER , which encompasses the entire CMA of Hamilton.

ERs may be economic, administrative or development regions. Within the province of Quebec, economic regions are designated by law ("les régions administratives"). In all other provinces, economic regions are created by agreement between Statistics Canada and the provinces concerned.

There were 76 ERs in 2006. ERs are listed with their component census divisions. The following economic regions were affected by changes at the CD and CSD levels:

In Newfoundland and Labrador, the composition of West Coast–Northern Peninsula–Labrador ( ER 10 30) changed due to the creation of the new census division, Division No. 11 ( CD 10 11).

In Quebec, the composition of Chaudière-Appalaches ( ER 24 25) changed due to the dissolution of the CD of Desjardins ( CD 24 24). The component census subdivisions (CSDs) of Pintendre, M (24 24 010), Saint-Joseph-de-la-Pointe-de-Lévy, P (24 24 015), and Lévis, V (24 24 020) were annexed to Les Chutes-de-la-Chaudière ( CD 24 25) and the CSD of Saint-Henri, M (24 24 005) was annexed to Bellechasse ( CD 24 19).

In Manitoba, the boundary between Southwest ( ER 46 30) and Parklands ( ER 46 70) was affected because part of Gambler 63, IRI ( CSD 46 16 025) was taken from Division No. 16 ( CD 46 16) and annexed to Gambler 63 (Part), IRI ( CSD 46 15 049) in Division No. 15 ( CD 46 15).

In British Columbia, the composition of Lower Mainland–Southwest ( ER 59 20) and Thompson–Okanagan ( ER 59 30) were affected because part of Boothroyd 8A, IRI ( CSD 59 09 803) was taken from Fraser Valley ( CD 59 09) and annexed to Boothroyd 8A (Part), IRI ( CSD 59 33 897), in Thompson-Nicola ( CD 59 33). This did not, however, result in a boundary change.

Health regions

Health region refers to a standard geographical unit defined by the provincial ministries of health. Health regions are legislated administrative areas in all provinces. For complete Canadian coverage, each of the northern territories also represents a health region.

Health regions appear as a hierarchy covering all the country. The classification is Health Regions 2005. There is also one variant of the classification. The variant differs from the main classification in its treatment of health regions in the provinces of Ontario and Nova Scotia. In Ontario, in the main classification, health regions are based on Public Health Units (PHUs). In the variant, Ontario's health regions are based on Local Health Integration Networks (LHINs). In the case of Nova Scotia, district health authorities are legislated administrative areas, while zones are aggregations of the nine district health authorities. Currently, zones are the main classification while District Health Authorities (DHAs) are the variant. For both provinces the main and variant classifications are otherwise identical and both are departmental standards.

Health Regions 2005 replaces Health Regions 2003. From 2003 forward, there will be a two-year revision cycle.

Countries of the world

The standard recommended for names and codes identifying countries of the world is a modified version of "Codes for the representation of names of countries and their subdivisions — Part 1: Country Codes, ISO 3166-1:1997", published by the International Organization for Standardization (ISO) in Geneva, Switzerland, in co-operation with the Statistical Office of the United Nations.

ISO 3166-1:1997 offers two and three character alphabetical coding systems (ISO alpha-2 and ISO alpha-3), and a three-digit numerical coding system (ISO numeric-3).

Presentation

The 2006 Standard Geographical Classification is divided into two separate products:

- Volume I The Classification (Catalogue 12-571)

- Volume II Reference Maps (Catalogue 12-572)

Volume I - The classification

Volume I is the basic presentation of the system of geographical units. It is a preliminary release that describes the SGC and the census metropolitan areas/census agglomerations (CMAs/CAs), and displays them in a variety of configurations for easy access and understanding. The introductory text explains the background and context for using standard geographical units.

The SGC is the centrepiece of the classification, providing a complete list of its geographical units. These units are the building blocks for all other standard geographical areas. The SGC provides a code, name, type for each CSD , and indicates if the CSD is a component of a CMA / CA .

The metropolitan areas list all major urban centres in Canada. They are important in analysing current economic activity since most of the economic activity in Canada occurs in these centres.

The metropolitan areas provide easier access to the codes for CMA s and CA s by province/territory and they define CMA s and CA s by reference to CSD s.

All ER names and codes are shown by province and territory with their component CD s, providing the name and code for each component CD . The CD s are listed in numerical order.

For Ontario, the component CD Halton ( CD code 35 24) appears twice, once under the economic region of Toronto ( ER 35 30) and once under Hamilton–Niagara Peninsula ( ER 35 50).

Finally, a list of localities showing alternative place names and repeated place names is included for each census subdivision. Alternative place names include alternative names from history or other languages and alternative spellings of the same name. Repeated place names appear for more than once within a province and reflect the fact that a place name has been used for more than one locality, sometimes not a great distance apart. It also happens when a CSD boundary splits a locality and the place name is repeated for each CSD code.

Volume II - Reference Maps

This product contains a series of 23 provincial and territorial maps depicting the boundaries in effect on January 1, 2006 for census divisions, census subdivisions, census metropolitan areas, and census agglomerations. The boundaries are plotted on base maps, showing water features. The maps identify each CSD by name and code, and CD s and CMA s/ CA s by code.

Also included are five maps of Canada, which are:

- an index to the reference maps;

- the boundaries for census divisions;

- the locations of census metropolitan areas and census agglomerations;

- the spatial distribution of CSD s among CMA s, CA s, CMA - and CA -influenzed zones, and territories;

- the boundaries for economic regions with their component CD s.

Reference

- Standard Geographical Classification 2001

Volume I, The Classification, Catalogue No. 12-571-XPB

Volume II, Reference Maps, Catalogue No. 12-572-XPB

Source: Statistics Canada

Footnotes

- Footnote 1

-

In addition to the geographical units of the SGC ( e.g. , province/territory, census division and census subdivision) Statistics Canada's Policy on Standards recognizes census metropolitan areas, census agglomerations, economic regions, health regions and countries as standard areas.

Return to footnote 1 referrer