Results: what we achieved

Core responsibilities

Statistical Information

Description

Statistics Canada produces objective, high-quality statistical information for the whole of Canada. The statistical information produced relates to the commercial, industrial, financial, social, economic, environmental and general activities and conditions of the people of Canada.

Results

Canadians made it clear that relevant, timely and high-quality data are essential to the country's pandemic response and recovery. Statistics Canada responded to the urgent demand for relevant and trustworthy data by adapting its programs to deliver timely data-driven insights that tracked the social, economic and health impacts of COVID-19 on all population groups, particularly vulnerable groups. These data-driven insights guide leaders as they evaluate policy and program options to help Canada chart a path to recovery.

The modernization work the agency has achieved over the last few years has empowered the agency to transform with purpose. As Statistics Canada continued its modernization journey, the agency redoubled its attention to the following five modernization principles:

- delivering user-centric products and services

- using leading-edge methods

- collaborating and engaging with partners

- building statistical capacity and fostering data literacy

- building an agile workforce and culture.

Delivering user-centric products and services

Delivering user-centric products and services

To diversify the ways it reaches Canadians and to ensure that more Canadians have the information they need, when they need it and in the formats they need it, Statistics Canada developed innovative ways to ensure that data are easier for Canadians to find, share and use, by

- diversifying the formats of products and services

- expanding subject-matter portals and web data services

- enhancing the virtual platform for data scientists and researchers

- customizing client products and services

- strengthening data access for researchers

- redesigning the Trust Centre.

Diversifying formats of products and services

To ensure that statistical information reaches more Canadians and that they can better understand the data, the agency disseminates its products in various media.

-

The agency launched Eh Sayers, a new podcast series dedicated to meeting the people behind the data and exploring the stories behind the numbers. The first episode was shared in November 2021. Eh Sayers was the top government podcast in Canada on Apple Podcasts for its initial releases, was mentioned by Maclean's magazine and was lauded by CBC News reporter Peter Armstrong in his Mind Your Business newsletter.

- Statistics Canada launched a visually rich version of The Daily, its official release bulletin. Over 3.3 million visits were recorded in 2021‒22, surpassing the nearly 3 million visits registered in the first year of the pandemic.

-

The agency successfully launched its second official release vehicle, StatsCAN Plus, in November 2021 to keep up with today's fast-paced news world and to tell its data stories and communicate with Canadians throughout the day.

- The agency has also been working to better relate inflation measures to the personal inflation experiences of Canadians. For example, the Personal Inflation Calculator—an interactive web-based application that allows Canadians to create a personal inflation time series and compare inflation estimates over time in selected geographies—was launched in 2021.

- Statistics Canada introduced mobile applications to its line of products. In January 2022, the Vitali-T-Stat mobile application was launched to collect data for the Pilot Study on Everyday Well-being. This new application invited respondents to access the agency's secure survey collection infrastructure to complete the pilot study. This project helped determine that a mobile application could be used to collect data from, and connect with, Canadians on their mobile devices. Shortly after, the StatsCAN mobile application was launched. Focusing on data, the application allows Canadians to tap into expert analysis, fun facts, visuals, short stories and insight that bring together data, tools and articles.

Expanding subject-matter portals and web data services

To modernize its website, Statistics Canada created several portals to provide access to topic-specific data.

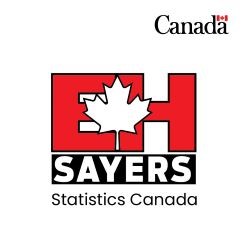

Description - Purpose-based engagement

The agency's Purpose-Based Engagement Strategy has resulted in a more user-centric, modern, relevant and innovative approach to engaging Canadians. The success of the strategy is evident in the numbers from 2021-22

- Social media followers: 512,000 (26% over target)

- Social media engagements: 13.17 million (1,035% over target)

- Social media impressions: 361 million (684% over target)

- Media citations on StatCan data: 140,000 (88% over target)

- The Accessibility Data Hub was launched in partnership with Employment and Social Development Canada (ESDC) in June 2021 to provide users with a single point of access for data tables, analytical articles and infographics related to accessibility.

- The new Sex, Gender and Sexual Orientation Statistics Hub was developed to monitor and report on indicators included in the Gender Results Framework, a framework that represents the Government of Canada's vision for gender equality in Canada. It includes data and analyses on gender and LGBTQ2+ communities.

- The Canadian Centre for Energy Information web portal currently provides links to over 750 energy information products from more than 100 governmental and non-governmental sources.

- The improved Gender, Diversity and Inclusion Statistics Hub, launched in December 2021, contains more information on diverse population groups in Canada. It also includes links to other relevant Statistics Canada hubs and data portals and is a designated space for information and releases related to Statistics Canada's Disaggregated Data Action Plan (DDAP).

Statistics Canada continues to update its Housing Statistics Portal in response to the growing demand for consolidated housing information. With improved access to a variety of housing data, the portal facilitates collaboration between users and data providers and features links to over 700 data products. The Canadian Housing Statistics Program data tables currently contain 68 million estimates that are expanded and updated each year.

Enhancing the virtual platform for data scientists and researchers

The agency launched additional products and components for the Data Analytics as a Service (DAaaS) initiative, a cloud-based platform that gives Canadians powerful tools to access and analyze Statistics Canada data in ways never before possible. The platform is used by researchers, academics, policy makers and anyone who needs a powerful platform to work with data.

DAaaS continued its evolution in 2021‒22 and now has more than two dozen collaborative partners at every level of government, in the private sector and in the research community.

Recognition of Data Analytics as a Service

The Data Analytics as a Service team is being recognized across the Government of Canada and was retained as final contenders for national awards as part of the Government of Canada's Digital Government Community Awards. These include the Excellence in Open Government Award and the Excellence in Building Services for the Users Award.

Customizing client products and services

- To meet the information needs of Canadians in general, and policy makers in particular, Statistics Canada continued to publish high-quality, timely analysis on various issues that affect the lives of Canadians in Insights on Canadian Society (ICS). The publication disseminated 13 research articles in 2021‒22, including the first ICS "light" article on the impact of the COVID-19 pandemic on Canadian seniors.

- Statistics Canada continued to advance the transformation of its Client Relationship Management (CRM) Program, which supports the agency's commitment to become a more client-centric organization. The CRM Program places the client experience front and centre of the agency's business model, prioritizes the client experience at all touchpoints of the customer journey and helps provide seamless access to products and services through a consistent, cross-functional and horizontal approach.

Strengthening data access for researchers

Researchers and academics require access to microdata to conduct their work. All microdata are non-aggregated, carefully modified and reviewed to ensure no individual or business is directly or indirectly identified.

- The Virtual Data Lab was launched in October 2021 to strengthen Statistics Canada's continuum of access to microdata to meet the needs of researchers and academics while providing robust data protection. The platform allows researchers to access information remotely within a secure environment.

- Throughout the year, the agency strengthened the research ecosystem through its close partnerships with the Canadian Research Data Centres Network, member universities and the Digital Research Alliance of Canada.

- The agency leveraged its infrastructure to expand its services to research communities through its research data centres and Federal Research Data Centre, reaching new records of monthly researchers in 2021‒22.

Redesigning the Trust Centre

- The agency redesigned its Trust Centre to provide a platform for ongoing dialogue and transparency with Canadians about how Statistics Canada collects and uses data for public benefit. By the end of 2021‒22, the site had already generated over 37,000 visits, marking a 25% year-over-year increase.

Using leading-edge methods: The impact of COVID-19

Using leading-edge methods: The impact of COVID-19

Canadians need timely and accurate data-driven insights to support evidence-based decision making, particularly in critical times such as the COVID-19 pandemic. The agency responded to the increased demands created by the pandemic by providing more timely data and real-time analysis of trends. Data collection in the following areas is leading to greater insights on the impact of the pandemic on Canadians:

- disaggregated socioeconomic factors

- the economic impact of COVID-19 and the road to recovery

- gaps in public health

- the 2021 Census Program.

Disaggregated socioeconomic factors

-

Announced in Budget 2021, the Disaggregated Data Action Plan (DDAP) will help achieve a more equitable Canada through more representative data collection methods, enhanced statistics on diverse populations that allow intersectional analyses, and support of government and societal efforts to address known inequalities. This initiative will bring considerations of fairness and inclusion into decision making.

Description - The 2021 Census questionnaire included a question on gender

The 2021 Census questionnaire included a question on gender that allowed the transgender and non-binary population to self-identify.

- Within the first year of the DDAP, key statistical programs such as the Labour Force Survey, the Canadian Community Health Survey, the General Social Survey and the new Canadian Survey on Business Conditions were improved and expanded to release new data disaggregated for racialized groups, Indigenous peoples and women. This resulted in improved statistics on labour market participation, health behaviours and outcomes, mental health status, vaccine hesitancy, social inclusion, civic participation, and homelessness. It also improved reporting on the evolving conditions of businesses owned by women, Indigenous people and members of racialized groups. All new data were made available to Canadians through the Gender, Diversity and Inclusion Statistics Hub.

- For many planned activities under the DDAP and other priority areas, Statistics Canada led comprehensive engagements and consultations with multiple stakeholders, including other government organizations, academics and equity-deserving organizations. This work is being done to determine and understand the diverse needs and perspectives of data users and those who are interested in disaggregated data.

- The agency leveraged the Labour Force Survey (LFS) to continue filling information gaps on gender equity, diversity and inclusion. It produced timely statistics disaggregated by gender, racialized group and disability status. Specifically, Statistics Canada

- revised the LFS questionnaire to collect data on gender, in addition to sex at birth

- implemented a new program of LFS supplements in January 2022, permitting monthly analyses of aspects of quality of employment, including for disaggregated groups

- introduced a repository of labour market indicators for racialized groups and released LFS-based labour market indicators for Canadians with disabilities in March 2022.

-

To fulfill Canadians' demand for information on the unequal impacts of economic downturns, particularly in the context of COVID-19, Statistics Canada

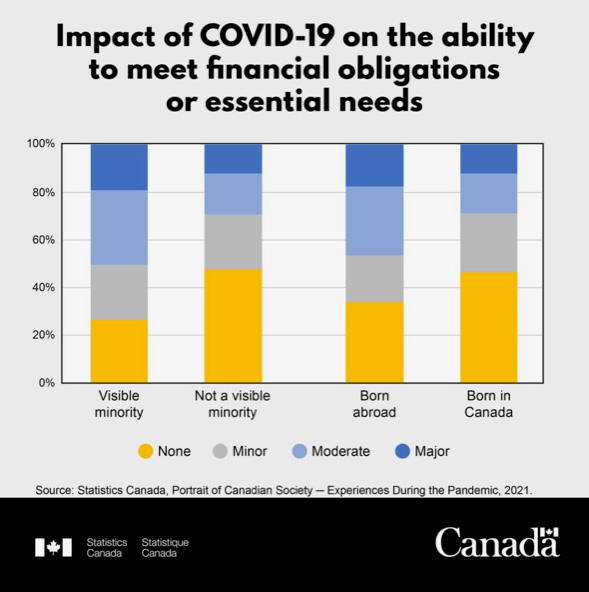

Description - Impact of COVID-19 on the ability to meet financial obligations or essential needs

Impact of COVID-19 on the ability to meet the financial obligations or essential needs No impact Minor impact Moderate impact Major impact Visible minority 27% 23% 31% 19% Not a visible minority 48% 23% 17% 12% Born abroad 34% 19% 29% 18% Born in Canada 46% 25% 17% 12% Source: Portrait of Canadian Society – Experiences During the Pandemic (PCS2), 2021. - continued to provide an insightful picture of the labour market impacts of COVID-19 across multiple societal segments, including sex, age and ethnocultural groups and other vulnerable populations, through The Daily

- delivered a roadmap for labour market systems and indicators to ensure adaptability and flexibility in the measurement of Canada's labour market

- integrated the impact of federal emergency income-support payments on Canadian households in its research and used it in income estimates

- examined the economic participation and social inclusion of racialized groups as part of Canada's Anti-Racism Strategy

- released a series of papers to examine important topics such as housing, unpaid work and the well-being of specific vulnerable groups

- analyzed various social and economic factors and outcomes that particularly affect women, Indigenous people, people living with disabilities, and members of racialized groups and the LGBTQ2+ community.

The economic impact of COVID-19 and the road to recovery

The pandemic has affected many components of Canadian society and the Canadian economy, including employment. The LFS continued to provide important labour market data to help shed light on the impact of the pandemic, but other surveys and tools have been created to provide timely data to Canadians.

- Although child care availability affects the labour market participation of many Canadians and could influence the pace of Canada's post-pandemic recovery, little is known about the overall size and characteristics of the child care sector in Canada. To address this gap, Statistics Canada piloted, in January 2021, the Canadian Survey on the Provision of Child Care Services (which collected data from March to June 2022), developed a research program to highlight the role of early learning and child care in post-pandemic recovery, and developed a new Early Learning and Child Care Information Hub in collaboration with ESDC to create a central location for information on child care indicators and research.

- Statistics Canada continues to update the Canadian Economic Dashboard and COVID-19, first introduced in March 2020, with monthly commentary pointing to current economic events and impacts on the Canadian economy. The dashboard provides data on many key monthly economic indicators, including real gross domestic product, consumer prices, employment and hours worked, international merchandise trade, retail, and manufacturing. It also provides data on aircraft movement statistics, railway car loadings, and international arrivals of non-residents and returning Canadians.

- The agency also continued to track the impact of COVID-19 on levels of business activity by sector; the financial positions of Canadian companies (and their associated effects on labour force participation); and the economic, social and health impacts on vulnerable populations.

- Statistics Canada provided insights and information to central agencies and federal deputy ministers on the ongoing impacts and structural changes relating to the pandemic. The agency prepared a series of insights on topics such as the social and economic conditions in Canada as it recovers from COVID-19; pandemic and recovery risks to equity, affordability and inclusion; innovation driving economic growth; the digital economy; and the social and economic impacts of climate change on Canadians.

- The agency launched nowcast estimates, scientifically based estimates of key economic indicators based on innovative models. These estimates of the impact of government pandemic relief benefits on low-income families provide evidence—disaggregated by employment equity group—for policy makers to make informed decisions.

Gaps in public health

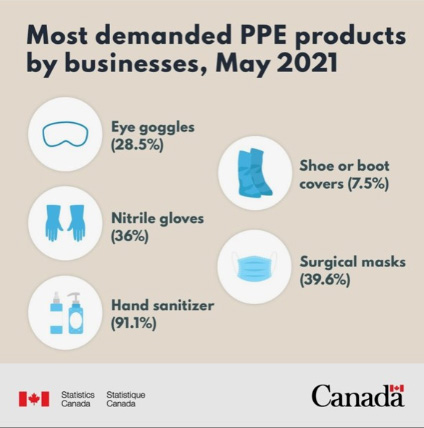

Description - Most demanded PPE products by businesses, May 2021

- Eyes goggles (28.5%)

- Shoe or boot covers (7.5%)

- Nitrile gloves (36%)

- Surgical masks (39.6%)

- Hand sanitizer (91.1%)

The COVID-19 pandemic highlighted data gaps related to personal protective equipment (PPE), vaccine coverage, mental health and residential care.

In 2021‒22,

- Statistics Canada collaborated with Health Canada to address the need for rapid data integration to support public health decisions by visualizing the supply of and demand for PPE. It released nine iterations of data from June 2020 to January 2022, with an average turnaround time of three months. Each release included an analytical paper published in the StatCan COVID-19: Data to Insights for a Better Canada series.

- Statistics Canada conducted the COVID-19 Vaccination Coverage Survey to estimate and track coverage rates in accordance with national public health requirements. The survey was conducted several times to observe trends in coverage rates and respondent knowledge, attitudes and beliefs about COVID-19 vaccination.

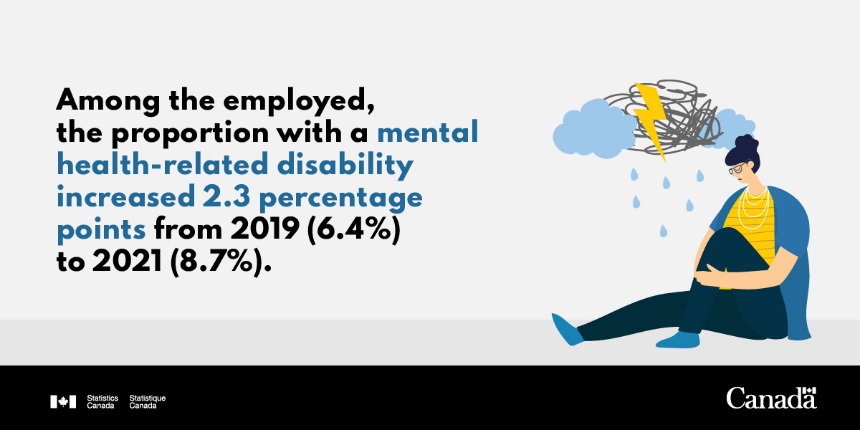

-

The Survey on Mental Health and Stressful Events was conducted to better understand how stressful events, particularly those related to COVID-19, can impact the mental health of Canadians. The data support other government organizations to inform the delivery of mental health services and support to Canadians.

Description - Mental health-related disabilitiies among the employed

Among the employed, the proportion with a mental health-related disability increased 2.3 percentage points from 2019 (6.4%) to 2021 (8.7%)

- The crowdsourcing questionnaire Impacts of COVID-19 on Health Care Workers: Infection Prevention and Control is built on existing data and paints a more detailed picture of the pandemic's impact on the occupational health and safety, as well as the physical and mental health, of health care workers.

- As the agency continued releasing monthly provisional insights on excess mortality during the COVID-19 pandemic, a new interactive dashboard and comprehensive information portal were released to facilitate user access and analysis. New linkages are providing more insights on the impact of the pandemic. For example, linking provisional data on deaths attributed to COVID-19 to data from the 2016 Census resulted in a release in he Daily on identifying the sociodemographic and socioeconomic factors linked to COVID-19 mortality rates. These resources support decision making and continued research related to COVID-19.

- Two significant data initiatives were launched as part of the health care access, experiences and related outcomes initiative: the Mental Health and Access to Care Survey and the Nursing and Residential Care Facility Survey, Cycle 2.

- Planning and development of the Sexual and Reproductive Health Survey began in 2021‒22. This survey captures data on race, household income and sexual orientation to help ensure that governments understand the challenges related to sexual and reproductive health and improve the support they provide.

- Statistics Canada provided timely releases of Canadian Community Health Survey data on Canadians' COVID-19 vaccination willingness, adherence to related public health measures and other related health outcomes.

The 2021 Census Program

2021 Census of Population

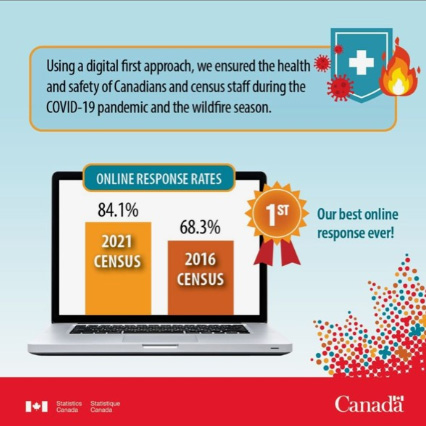

Statistics Canada took all necessary precautions and adapted its approach for the 2021 Census to protect the health and safety of its staff and Canadians while ensuring that information about all Canadians was collected.

Description - Digital first approach for Census 2021

Using a digital first approach, we ensured the health and safety of Canadians and census staff during the COVID-19 pandemic and the wildfire season.

Online Response Rates

- 2021 Census – 84.1%

- 2016 Census – 68.3%

Our best online response ever!

To keep employees and Canadians safe, the agency implemented a no-contact approach, encouraged self-response and minimized travel as much as possible. These new approaches worked around forest fires, floods, travel restrictions and COVID-19 outbreaks—particularly in the 700 Indigenous, northern and remote communities—and the collected data were processed in a shortened timeframe. Despite these numerous challenges, field operations for the 2021 Census of Population were highly successful thanks to the 35,000 census employees (who comprised an unprecedented number of people of diverse ethnic origins, exceeding employment equity targets). The collection targets were thus met, with an overall collection response rate of 98%. The online response rate of 84% represents a new record for online responses and is the highest among global colleagues to date.

Census data are used daily by all levels of government, businesses and individuals to make important decisions, such as evaluating the impact of the COVID-19 pandemic, planning community services (e.g., schools and emergency services), determining consumer and market demand, and making critical investment decisions. The first results of the 2021 Census were released in February 2022, and results will continue to be released throughout the year. These releases will provide a snapshot of Canada's increasing diversity, assist in measuring the country's recovery from the pandemic, and help bring the social and economic impacts on marginalized groups to the core of decision making.

2021 Census of Agriculture

Similarly, there were good response rates for the 2021 Census of Agriculture in terms of industry and regional representation, with a completion rate of 86% and an online response rate of 86% overall. The primary drivers were an extensive engagement strategy and working closely with industry partners to encourage their members to complete the questionnaire. Support from provincial partners and from Agriculture and Agri-Food Canada also proved to be very valuable throughout the entire 2021 Census cycle. Although response burden has historically been an issue for farmers, this was not expressed to the same degree in 2021, despite the pandemic and extreme weather events. This reflects the strong relations the agency has built with industry partners over the past few years and the strong messaging and support from partners demonstrating an understanding of the value of these data. The next steps are to complete the release of additional data products and studies with economic, social and environmental perspectives to maximize value for data users.

2021 Census communications campaign: New and innovative methods

To support the 2021 Census communications campaign, the agency built on partnerships forged during the census collection phase to create tools that respond to the needs of stakeholders, such as non-profit organizations, schools, universities, Indigenous organizations, various levels of government, social media influencers and businesses.

This innovative, award-winning campaign contributed to the success of the first census collection to be held during a pandemic. The 2021 Census's advertising exceeded benchmarks by drawing 503 million impressions and 70 million video views. Twelve thousand organizations were reached before and during the collection period to support recruitment and collection activities for the Census of Population. Census-related social media content was viewed over 326 million times, and there were 12.5 million interactions with content, such as likes, shares and comments. The agency's influencer strategy yielded endorsements from over 200 prominent Canadians, including astronauts, Olympians and Juno Award winners.

The first release of 2021 Census data that occurred in 2021‒22 generated 3,091 media citations. Over 1,000 stakeholders amplified Statistics Canada's social media content, and 28,296 visits were recorded to the Census of Population and dwelling counts article in The Daily.

Using leading-edge methods: Beyond COVID-19

Using leading-edge methods: Beyond COVID-19

Statistics Canada has continued to introduce new leading-edge tools and methods to scale up the use of data science in all its programs to produce sound statistics. The following initiatives demonstrate some of the ways Statistics Canada used a variety of state-of-the-art methods in 2021‒22.

Canadian Social Survey

The agency launched the first omnibus Canadian Social Survey (CSS) in April 2021, and the first release was published in September 2021. The CSS collects information on a variety of social topics such as health, well-being, impacts of COVID-19, activities, time use and emergency preparedness. This information will help inform the delivery of services and supports for Canadians during and after the pandemic and guide policy development on a range of social and economic issues.

Modernizing the Survey of Household Spending

The Survey of Household Spending (SHS) gathers information on the spending habits of Canadians and looks at how much households pay for food, clothing, shelter, transportation, health care and other items. In 2021, the SHS was transitioned to Statistics Canada's integrated data-collection platform, and an electronic questionnaire was added to its modes of data collection. The modernization of collection tools for the SHS brought increased flexibility for its data collection.

Global Environment for the Economic Statistics Ecosystem

The Global Environment for the Economic Statistics Ecosystem is a multi-year project that aims to improve the international framework for recognizing environmental accounting. It also aims to improve data sharing through harmonization and data system interoperability with international statistical organizations. It will harmonize the process flows, concepts and classifications used to produce the Canadian System of Macroeconomic Accounts (CSMA) while also strengthening and modernizing the information technology infrastructure required for current and future efforts.

The vision for this project is for all CSMA data to be produced in a flexible, reliable, traceable and reusable environment to provide data consumers with more easily comparable estimates, consistent metadata infrastructure and continued confidence in the data quality.

In 2021‒22, this initiative worked to bring standardization through the adoption of Statistical Data and Metadata Exchange, an international initiative that aims to improve the exchange of data between countries.

Open Science Action Plan

Description - Statistics Canada Open Science Action Plan - At a glance

- Fair and open data

- Open publications

- Open communications

- Open code

In December 2021, Statistics Canada released its Open Science Action Plan in response to the release of the Roadmap for Open Science in February 2020. The roadmap called on science-based departments and agencies to take the next steps in making federal science open to all, while respecting privacy, security, ethical considerations and appropriate intellectual property.

Census of Environment

Budget 2021 announced the new Census of Environment, and Statistics Canada released an initial study on human activity and the environment, which reported on the extent and condition of Canada's ecosystems and the goods and services derived from these ecosystems. By integrating these environmental data with social and economic information, the agency can paint a picture for Canadians that will help inform sustainable solutions. The Census of Environment will help track Canada's performance toward becoming a world leader in sustainable economic growth.

Justice Data Modernization Initiative

As part of ongoing efforts to address the overrepresentation of Indigenous people and members of racialized groups in the justice system, Statistics Canada is working with Justice Canada to advance Budget 2021's Justice Data Modernization Initiative. This initiative aims to modernize Canada's justice system, support evidence-based policies and ensure accountability within the criminal justice system by improving the collection and use of disaggregated data. In 2021‒22, new data on admissions to correctional institutions among Indigenous people and members of racialized groups were collected and released, further demonstrating their overrepresentation in the justice system.

Modernizing data analytics initiative

The modernizing data analytics initiative takes an agency-wide approach to the transition to a new, more open way of working. It uses a thorough scientific experimentation approach to ensure that the standards, practices and procedures provide value to analysts.

In 2021‒22, clear guardrails were established to fill the gap in ensuring that proper data stewardship and security practices govern internal, analyst-developed solutions across the agency. A Citizen Development Fair was held in the fall of 2021 to showcase open source projects across the agency, promote collaboration and the reuse of solutions across statistical programs, and reinforce best practices for managing internal, analyst-developed solutions. Additionally, a Gamification of Documentation Hackathon took place in early 2022 to build capacity for employees to socialize and adopt the new standards for modern data analytics into their day-to-day work.

Geospatial tools for community safety and health

In its commitment to offering Canadians geo-enabled data down to the smallest level of detail available, the agency collaborated with the British Columbia Office of the Fire Commissioner to create the Community Fire Risk Reduction Dashboard. This pilot geospatial project visually shows the levels of fire risk at the neighbourhood level for the entire province of British Columbia. The aim is to refine the pilot product and advance the National Fire Information Database so that other provinces and territories will also be able to visualize their data.

Web panel surveys

Description - Perception of safety

People belonging to groups designated as visible minorities consider their neighbourhoods less safe for people with a different skin colour, ethnic origin or religion.

Source: Statistics Canada, Portrait of Canadian Society–Experiences During the Pandemic, 2021.

Web panel surveys involve creating a pool of people who agree to complete a series of online surveys over a predetermined period. Statistics Canada continued to experiment and test this collection method by successfully launching its second web panel series, Portrait of Canadian Society, with two releases in September 2021. The first survey of the series focused on perceptions of life during the pandemic, and the second survey focused on experiences during the pandemic.

Administrative data

The agency is using links to tax and other administrative data sources to enhance the current suite of disability data, including information from government support programs such as the disability tax credit and the registered disability savings plan. Administrative data on landed immigrants (settlement data) were added to the Longitudinal Immigration Database.

The agency also worked with federal partners to see how a greater understanding can be gained on the scope of human trafficking, which disproportionately victimizes women. More specifically, Statistics Canada co-led a data working group on human trafficking with Public Safety Canada to explore how best to use the administrative datasets held by other government agencies.

Experimentation

The Treasury Board Secretariat recognized Statistics Canada as the highest-scoring organization for experimentation in 2021 and singled out the agency's Research and Development Board as an enterprise-wide best practice for innovation governance as part of the Management Accountability Framework assessment process. The following are the notable examples for 2021‒22:

- The agency experimented with open source methods and tools for day-to-day statistical production activities. Through experimentation with a tool that automates repetitive data verification tasks, the agency demonstrated that the tool was more accurate and efficient at identifying inconsistencies in data tables than humans. The tool was implemented into production in nine program areas in 2021‒22 and continues to be scaled across the agency in 2022‒23.

- The agency also improved process flows and created new statistical indicators. For example, to create a prototype of weekly income, Statistics Canada enhanced the LFS sample with administrative data and estimated the amounts of benefits.

- The Real-time Local Business Conditions Index was launched in 2021 and expanded in March 2022 to provide experimental statistics on a weekly basis. This index provides a near real-time snapshot of business activities for 15 population centres accounting for approximately 65% of the Canadian population and about 60% of employer businesses.

- Text-to-speech was launched on selected Statistics Canada web pages to pilot the technology on different types of pages and determine the best approach for providing this enhanced service to Canadians. The goal is to ensure that the tool is relevant and user-friendly for all Canadians, particularly readers with visual or learning disabilities.

- The agency led an international project for the United Nations Economic Commission for Europe's (UNECE) High-level Group for the Modernisation of Official Statistics. This project, a hands-on guide, provides recommendations for developing and using synthetic data at national statistical offices and for measuring the quality of these data. Experimental approaches will be used to test the guide's recommendations with real-life synthetic data scenarios. The agency also provided guidance for the UNECE Task Force on Statistics on Children, Adolescents and Youth in the theme areas of violence against children and institutional care.

Collaborating and engaging with partners

Collaborating and engaging with partners

In 2021‒22, the agency expanded its engagement with key partners to ensure that the data it collects from, and with, its partners add value that benefits and enriches a data ecosystem built on responsible use, trust, privacy and confidentiality. This collaboration included

- a wide range of national and international partners

- data strategies for the federal public service and Statistics Canada

- First Nations, Métis and Inuit communities

- contact tracing.

A wide range of national and international partners

- The agency partnered with provincial, federal and international partners and conducted a series of hackathons during 2021‒22, covering a wide range of topics. The past year's successful hackathons include the Ontario Public Service Data Visualization Challenge, the Department of National Defence workplace and employee wellness hackathon, the UNECE Synthetic Data Challenge, and the Gamification of Documentation Hackathon. These hackathons yield tangible results with prototypes and proofs of concepts that advance ideas and thinking on important horizontal questions and challenges.

- The Canadian Survey on Business Conditions continued to provide a timely portrait of business sentiment and outlook during the successive waves of the COVID-19 pandemic. It was foundational in establishing the Business Data Lab—a partnership between the Canadian Chamber of Commerce and the agency—to provide timely business indicators. Its quarterly results are enabling data-driven decision making by providing comprehensive data by geography, industry type, employment size and majority ownership. The agency provided detailed analysis on businesses majority-owned by various subpopulation groups and a number of racialized groups, notably Black-owned and Indigenous-owned businesses.

-

"Statistics Canada is proud to build on a solid foundation of working with the Federation of Canadian Municipalities and its members to help better understand the needs of communities from coast to coast to coast. As we all work to respond to the social and economic impacts of COVID-19, it is more important than ever that we collectively pursue data-driven solutions that work for families, businesses and diverse communities."

Anil Arora,

Chief Statistician of CanadaStatistics Canada strengthened its partnership with the Federation of Canadian Municipalities to enhance awareness for the data-driven insights in evidence-based decision making and to help the agency better understand the data needs of communities of all sizes. For example, the City of Vancouver Data Project is a pilot initiative whose key milestones included

- the delivery of six webinars for municipalities and five data sessions with urban and rural or northern municipal representatives

- the delivery of a series of custom tabulations to 10 cities on key socioeconomic indicators

- the production of an experimental municipal financial dashboard.

- In 2021–22, with respect to partnerships, collaborations and engagement projects, Statistics Canada

- completed consultative engagements with Indigenous and racialized communities across the country to develop options for appropriately collecting and disseminating data on interactions with the police as part of the efforts to respond to the demand for police-reported race-based statistics

- hosted external events with organizations such as the Atlantic Provinces Economic Council and the Northern Policy Institute to showcase relevant regional data related to COVID-19 and economic recovery

- created a Partnerships team to handle the ever-growing demand for the agency's engagement with Indigenous partners.

Data strategies for the federal public service and Statistics Canada

As part of its ongoing collaborations with federal departments, Statistics Canada continues to be a data stewardship leader, ensuring that the federal public service can effectively govern and manage its data assets to better serve Canadians.

Statistics Canada undertook many projects in 2021–22 to support federal departments in their efforts to use data as a strategic asset.

- In October 2021, Statistics Canada released the National Address Register, which is accessible to other federal departments, agencies and partners. This application programming interface provides users with an authoritative list of civic addresses in Canada, in a standardized structure, that allows users to search by unique identifier, address or geography. This tool is being leveraged by ESDC as it revamps its benefit delivery model to improve the accuracy of transfers (specifically for employment insurance and income relief programs) to prevent or reduce overpayments.

-

The agency is leading a whole-of-government approach through the Data Science Network for the Federal Public Service to share knowledge and best practices in data science among all federal public servants. In 2021, the network grew to more than 2,300 members from 70 departments, and 26 federal departments were represented at the directors' steering committee.

- In collaboration with the Canada School of Public Service, Statistics Canada led the planning and coordination of the 2022 Government of Canada Data Conference. The conference brought together the public and private sectors to focus on overcoming data challenges in high-impact areas for policy and program actions with socioeconomic implications. This year's theme supported the government's commitment to provide better data, insights and services for all Canadians. The Conference responded to the urgent need to fill data knowledge gaps in areas such as diversity and inclusion, the environment and economic recovery. Over 7,000 individuals attended the conference from across the public and private sectors.

- To ensure that the Statistics Canada Data Strategy is evergreen, the agency has partnered with ESDC and the Canada Mortgage and Housing Corporation to create joint data strategies. It also partnered with the Privy Council Office and the Treasury Board Secretariat to create a framework for the renewal of the Data Strategy Roadmap for the Federal Public Service.

- Statistics Canada played a key role in the cross-government and cross-jurisdictional effort to develop and subsequently implement a pan-Canadian Health Data Strategy. The agency contributed to the strategy's various working groups and committees and played an active role in preparing to implement the new strategy. The areas of population standards and health data literacy are particularly emphasized.

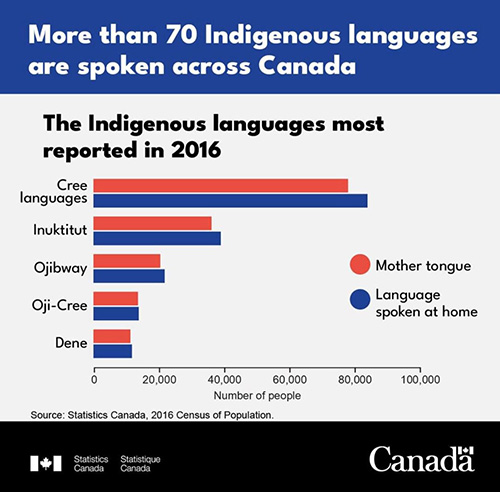

First Nations, Métis and Inuit communities

Description - More than 70 Indigenous languages are spoken across Canada

| Mother tongue | Language spoken at home | |

|---|---|---|

| Cree languages | 78,025 | 83,960 |

| Inuktitut | 36,185 | 39,030 |

| Ojibway | 20,470 | 21,805 |

| Oji-Cree | 13,635 | 13,855 |

| Dene | 11,320 | 11,785 |

| Source: Statistics Canada, 2016 Census of Population. | ||

Statistics Canada is supporting Indigenous organizations and communities as they develop the skills and infrastructure to build and maintain their statistical programs based on their needs. In 2021‒22, the agency met with Indigenous organizations to discuss Indigenous data and research and facilitated the review of 18 research articles.

Statistics Canada also improved access to its existing data assets for Indigenous organizations and communities. In particular, Statistics Canada developed an Indigenous data portal on its website to enable users to easily find, use and share statistics about key topics and population projections for Indigenous people over the next several decades. The agency also provided release notifications of Indigenous content in published research and tables through a monthly newsletter to Indigenous organizations.

Contact tracing

Statistics Canada continued to provide support to the provinces and territories in their fight against COVID-19 by providing surge capacity for contact tracing and follow-up activities. It also conducted calls on behalf of the Public Health Agency of Canada to assist with travel monitoring and follow-up on government-approved accommodation stays. By the end of 2021‒22, the equivalent of 2.7 million 15-minute calls had been made to Canadians.

International cooperation, statistical capacity building and fostering data literacy

International cooperation, statistical capacity building and fostering data literacy

Through newly established partnerships, Statistics Canada supported initiatives to ensure that diverse communities can build and maintain statistical programs grounded in their unique needs. Examples of external engagement initiatives to build statistical capacity and data literacy ranged from international cooperation to training courses that helped users understand the use of data.

International cooperation

Description - International engagement

As a world-class national statistical office (NSO), Statistics Canada is leading and monitoring best practices on the international stage. Among other international leadership efforts, members of the agency chair

- the Conference of European Statisticians

- the Organisation for Economic Co-operation and Development Committee on Statistics and Statistical Policy

- the High-Level Group for the Modernisation of Official Statistics

- the United Nations Statistical Commission

- the United Nations Network of Economic Statisticians

Statistics Canada adhered to international data standards to create, share and integrate data with partner data and other forms of publicly available data. By adopting new standards, the agency ensured that it promotes data interoperability, an important tenet of FAIR (findable, accessible, interoperable, reusable) data, and acts as a catalyst for integrative analyses. The agency continually adopted new versions of open standards, such as Statistical Data and Metadata Exchange, refining how it describes and exchanges data (including geospatial data) and information with its partners and user community.

Statistics Canada continued to play a leadership role in the UNECE Blue Skies Thinking Network (BSTN) and continued to build the BSTN synthetic data working group with more than 25 participants from nine national statistical offices (NSOs).

Statistics Canada became a member of the World Statistics Congress 2023 Steering Committee and is co-chairing the national advisory council for the event. In this respect, Statistics Canada's main activities will be to provide support to the organizers on sponsors, local and national marketing, and volunteers. The agency will also add a Canadian flavour to the event.

The United Nations' 2030 Agenda for Sustainable Development and the Sustainable Development Goals

Since 2015, Statistics Canada has played a leadership role in the United Nations Inter-agency and Expert Group on Sustainable Development Goal (SDG) Indicators. The agency has continued to work closely with core federal partners on advancing the SDGs by sharing open code for progress measures for the SDGs as part of the Open SDG initiative. Statistics Canada has had a leading role in the establishment of the Canadian Indicator Framework to measure domestic progress. The agency also created an innovative data visualization hub to make SDG data more engaging and accessible to Canadians.

Capacity-building in developing countries

Countries with less robust statistical systems lack the data to make sound policy decisions, making it harder for them to withstand a crisis. This is why Statistics Canada provided training and support to enable developing countries to build, maintain and improve their national systems. For example, in 2021‒22, the agency supported Caribbean NSOs in creating and enhancing their websites and dissemination mechanisms.

Strengthening the statistical system

Statistics Canada has built a world-leading framework to protect and safely handle data without compromising confidentiality and the trust of Canadians. The agency's system balances internal governance and external advice from governance bodies, such as the Departmental Audit Committee and the Canadian Statistics Advisory Council (CSAC), to assure Canadians that privacy and confidentiality are embedded in everything the agency produces.

During 2021‒22, the CSAC released its second report—Strengthening the Foundation of Our National Statistical System. The report includes three core recommendations:

- adapt governance and data stewardship to a digital society

- adapt statistical legislation to reflect the needs of a modern digital national statistical system

- leverage opportunities for addressing critical data needs.

The agency started embedding the CSAC's advice in its actions and will continue to implement its recommendations. The agency will also continue to work closely with partners within and outside the federal government to make tangible progress on the recommendations.

Enhanced approaches to protecting privacy

The Necessity and Proportionality Framework was developed to ensure that Statistics Canada collects only the information that is necessary to produce timely, high-quality data, while fully protecting the privacy of Canadians and keeping the collected data safe.

During 2021‒22, this framework was improved to consider more explicitly the ethics, protocols and public engagement that govern the collection of sensitive data. The Necessity and Proportionality Framework 2.0 added more theoretical background to the original framework and is currently at the peer and institutional review stage. It provides more detailed guidance to Statistics Canada's program managers on data-gathering activities and is revised to remain consistent with Canadian privacy laws as they are updated.

Secure Infrastructure for Data Integration

Statistics Canada's new Secure Infrastructure for Data Integration is a set of methods, technologies and protocols developed to enhance the way Statistics Canada combines its existing data with data from other organizations while protecting privacy and confidentiality. By creating a safe environment to combine data, the agency is maximizing the information at its disposal. This can help build a more equitable Canada by bringing fairness and inclusivity to decision-making.

Information and data management

Statistics Canada is continually updating its policies to reflect the current statistical environment. For example, the agency adopted a new information resource management plan, enshrining how it protects the authenticity, reliability, integrity and usability of its information and data over time. Amendments made to policies enhance the agency's risk posture and further ensure the security of the information entrusted to it by Canadians.

The Enterprise Information and Data Management Project seeks to establish a modern framework that will significantly improve processes and governance of the agency's past, present and future data and information assets. The project continues to engage stakeholders to drive its visionary objectives.

Quality of life

Statistics Canada is leading the development of the indicators for the national Quality of Life Framework. Announced in Budget 2021, this framework aims to help modernize the system of national quality of life statistics and its associated conceptual framework and will help the Government of Canada consider all aspects of Canadians' quality of life in its decisions. The beta version of the Quality of Life Hub was released in March 2022 and features metadata, data and visualizations of the 20 headline indicators in the Quality of Life Framework.

Fostering data literacy

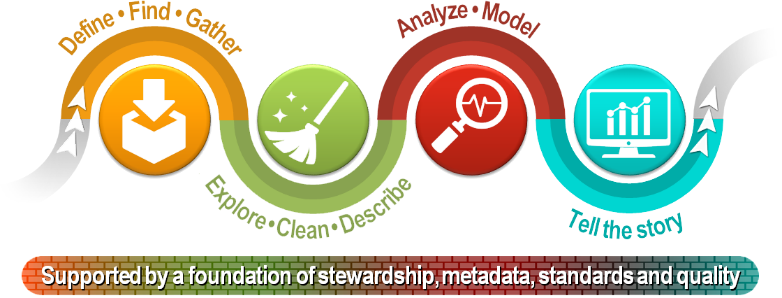

Description - Steps of the data journey

- Define, find, gather

- Explore, clean, describe

- Analyze, model

- Tell the story

Supported by a foundation of stewardship, metadata, standards and quality

Statistics Canada continues to support data literacy among its many stakeholders through the Data Literacy Training Initiative, which continues to grow and includes 16 new training videos, covering eight new topics, released this fiscal year. All are available for free in the agency's learning catalogue, along with the updated Statistics: Power from Data! training tool, designed to assist secondary school students and teachers in getting the most from statistics. To date, the Data Literacy Training Initiative has recorded over 67,000 visitors and 150,000 page views.

The agency partnered with Apolitical to launch a data literacy boot camp, with a full rollout in October 2021. This course is the first of its kind. So far it has been taken by over 5,000 public servants from hundreds of government organizations, with 95% of learners agreeing that their data skills improved as a result. Statistics Canada received the 2021 Apolitical Global Public Service Team of the Year Award for Data and Digital Champions for its work on data literacy.

In support of data literacy, the Power from Data! module on the agency's website was updated to take into consideration changes in the data ecosystem. In 2021‒22, several seminars related to quality and data ethics were given to external stakeholders.

Building an agile workforce and culture

Building an agile workforce and culture

During the last year, the agency built on the success of its Modern Workforce and Flexible Workplace initiative and pursued a hybrid model that will improve services and value to Canadians by

- leveraging a national presence and greater interaction with Canadians through regional offices and data service centres

- strengthening productivity through flexibility with a focus on results, empowerment and informed risk-taking

- recruiting and retaining talent in this highly competitive labour market through a national hiring strategy and diversifying the workforce

- reducing physical space requirements, resulting in cost savings and a reduced environmental footprint.

In its ongoing efforts to ensure that hybrid work arrangements are equitable for all employees, this past year the agency achieved progress on different fronts.

- The agency developed advanced employment and workplace accommodation projects and planning—all included in the agency's first multi-year accessibility plan (2022‒23 to 2024‒25).

- To enable its employees to continue working remotely, securely and safely during the pandemic and to protect Canadians' data, Statistics Canada expanded its network capacity and strengthened its secure digital infrastructure and information management practices. This included deploying new information technology equipment designed to improve the speed and capacity of the agency's network and enabling employees to access virtual desktops through cloud computing services.

- The agency continued its implementation of Microsoft 365, an enterprise-level, cloud-based, integrated suite of tools to promote communication and collaboration in support of Statistics Canada's hybrid work strategy.

- Statistics Canada's greatest asset is its dedicated and high-performing workforce. Thus, the agency continued to provide opportunities for its staff to upgrade their skills and ensured that they were equipped to use next-generation data analytics tools. For example, a partnership with the Privy Council Office and the Treasury Board Secretariat was developed to create a framework and roadmap for the federal public service renewal.

- In its commitment to have a workforce representative of the diversity of Canada, Statistics Canada launched its new 2021 to 2025 Equity, Diversity and Inclusion Action Plan: Moving Forward Together. Progress has been made; over 25 commitments and actions have either started or been completed since its launch.

- For the second straight year, Statistics Canada organized and co-hosted a three-day virtual conference for federal public servants on diversity and inclusion, featuring a panel of experts from Statistics Canada, other government departments, academia and the private sector. This event showcased the results of some departments and agencies in response to the Clerk of the Privy Council's Call to Action on Anti-Racism, Equity, and Inclusion in the Federal Public Service.

Key risks

Statistics Canada continuously monitors its internal and external environment to develop risk mitigation strategies. The agency has identified risks relating to its core responsibility and has established strategies for the coming years. The agency will continue to adapt its governing instruments and oversight frameworks and engage with Canadians using clear, transparent and proactive communication. It will also continue to invest in robust infrastructure—technological and methodological—to ensure the reliability, timeliness, scalability and security of its statistics. The agency has identified six corporate risks and corresponding mitigation strategies.

Accuracy and integrity

Maintaining the accuracy and integrity of data and information holdings—including avoiding major errors—often competes with pressures, such as the need to produce information faster, increasingly complex production environments, the expanding use of multiple data sources and new techniques, and rising information demands.

Among risk mitigation activities, Statistics Canada performed thorough analysis and systematic validation, improved subject-matter intelligence, implemented process-related improvements, engaged key stakeholders for validation purposes, tested new processes thoroughly and enhanced its information management practices.

Privacy and confidentiality

Strict controls and safeguards are essential to securely manage and protect the agency's vast amount of confidential and sensitive information from privacy breaches, wrongful disclosure and cyber security threats.

In addition to a strong culture and value system, Statistics Canada has oversight, governance instruments and processes in place to mitigate this risk. The agency continued to be vigilant by proactively reviewing confidentiality-related processes and procedures, putting in place the Statistics Canada Cyber Security Strategy and Roadmap and applying stringent protection measures (e.g., the Policy on Official Release). Key actions include regularly assessing the information technology security posture and providing privacy and confidentiality training to employees and partners.

Resources

In a highly competitive labour market, the agency faces inherent risks related to the sufficiency of human resources, capacity and expertise to deliver on its vast mandate and broad set of priorities.

Human resources mitigation strategies have been put in place and include increasing the use of flexible assignment programs, pursuing a national hiring strategy and developing a new integrated human resources strategy focused on achieving a diverse, inclusive and bilingual workforce. The agency implemented seed funds and ideation frameworks for new ideas to reduce risk and optimize resource allocation, encouraged citizen co-development and continued its migration to the cloud, enabling access to self-serve, on-demand and scalable infrastructure capacity and solutions.

Relevance

Growing external demands stemming from a continuously evolving environment may require changes to ensure programs are relevant.

To mitigate this risk, Statistics Canada launched its modernization initiative with a focus on user-centric service delivery. By listening to Canadians through numerous mechanisms, including stakeholder engagement, advisory committees, feedback surveys and media monitoring, the agency gave them the information they needed, when they needed it and how they wanted it. Results include easier and broader access to more timely and detailed statistics.

Transformation

Because the agency's modernization initiative is so large and complex, there is a risk that its objectives will not be achieved on a timely basis, and users' heightened expectations will not be met.

To mitigate this risk, Statistics Canada established stronger governance and implemented integrated business processes to provide more aligned and effective planning and oversight. In addition, the agency explored more open data sources, developed quality indicators and identified and addressed skill gaps. It also built strategic relationships with key partners and increased user engagement to better understand needs and refine the transformation.

Public trust

Breaches and wrongful disclosure of information, disinformation campaigns and other factors may impact the public's trust in the agency, resulting in Canadians turning to other sources of information.

The agency's risk mitigation included extensive engagement with Canadians and open and transparent communication to show how Statistics Canada data affect their lives and to raise awareness about the agency's strict confidentiality and privacy protections. The agency worked with experts from around the world to balance the need for information with privacy protection and implemented its new Necessity and Proportionality Framework. It also continued to advance the Trust Centre on its website.

Results achieved

The 2021‒2022 results were impacted by the release of the agency's premier product—the census. The first year of results consists of a much anticipated series of events in the form of data releases, which are extremely relevant to the Canadian population. The agency continued to respond to the demand for evidence-based information by producing numerous new and timely statistical products that were well received by Canadians. This year's focus centred on census data collection. The agency reached 7 of the 10 performance indicator targets for 2021‒22, 4 of which were highly exceeded.

Heading into the 2022–23 fiscal year, the agency continues to integrate performance information into its decision-making processes to ensure that Statistics Canada continues to provide valuable data and insights to Canadians, with resources that are aligned with government priorities.

The following table shows, for statistical information, the results achieved, the performance indicators, the targets and the target dates for 2021–22 and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Target | Date to achieve target | 2019–20 actual results | 2020–21 actual results | 2021‒22 actual results |

|---|---|---|---|---|---|---|

| High-quality statistical information is available to Canadians | Number of post-release corrections due to accuracy | 0 | March 31, 2022 | 1 | 6 | 7Table note 1 |

| Percentage of international standards with which Statistics Canada conforms | 90%Table note 2 | March 31, 2022 | 88% | 88% | 88% | |

| Number of statistical products available on the website | 41,800 | March 31, 2022 | 37,254 | 40,738 | 43,184 | |

| Number of Statistics Canada data tables available on the Open Data Portal | 7,750 | March 31, 2022 | 7,386 | 7,755 | 8,088 | |

| High-quality statistical information is accessed by Canadians | Number of visits to Statistics Canada website | 37,500,000 | March 31, 2022 | 20,285,269 | 28,193,955Table note 3 | 45,972,326Table note 4Table note 5 |

| Percentage of website visitors that found what they were looking for | 78% | March 31, 2022 | 78% | 77% | 74%Table note 6 | |

| Number of interactions on social media | 2,900,000 | March 31, 2022 | 521,441Table note 7 | 1,211,316Table note 3 | 13,174,481Table note 4Table note 5 | |

| High-quality statistical information is relevant to Canadians | Number of media citations on Statistics Canada data | 74,000 | March 31, 2022 | 56,921 | 253,171Table note 3 | 139,078Table note 5 |

| Number of journal citations | 23,000 | March 31, 2022 | 26,505 | 33,596Table note 3 | 40,248Table note 8 | |

| Percentage of users satisfied with statistical information | 80% | March 31, 2022 | 80% | 80% | 80% | |

|

||||||

Financial, human resources and performance information for Statistics Canada's Program Inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for statistical information, budgetary spending for 2021–22, as well as actual spending for that year.

| 2021–22 Main Estimates | 2021–22 planned spending | 2021–22 total authorities available for use | 2021–22 actual spending (authorities used) | 2021–22 difference (actual spending minus planned spending) | |

|---|---|---|---|---|---|

| Gross expenditures | 855,425,655 | 855,425,655 | 972,123,133 | 920,977,524 | 65,551,869 |

| Respendable revenue | -120,000,000 | -120,000,000 | -127,583,773 | -127,583,773 | -7,583,773 |

| Net expenditures | 735,425,655 | 735,425,655 | 844,539,360 | 793,393,751 | 57,968,096 |

Financial, human resources and performance information for Statistics Canada's Program Inventory is available in GC InfoBase.

Human resources (full-time equivalents)

The following table shows, in full‑time equivalents, the human resources the department needed to fulfill this core responsibility for 2021–22.

| 2021–22 planned full-time equivalents | 2021–22 actual full-time equivalents | 2021–22 difference (actual full-time equivalents minus planned full‑time equivalents) | |

|---|---|---|---|

| Gross expenditures | 6,026 | 7,186 | 1,160 |

| Respendable revenue | -1,231 | -1,542 | -311 |

| Net expenditures | 4,795 | 5,644 | 849 |

The difference between planned spending and actual spending is the result of an increase in resources for several new initiatives from Budget 2021. These initiatives include better data for better outcomes, strengthening long-term care and supportive care, enhancing business condition data and better understanding our environment.

Funding was carried forward from 2020‒21, allowing the agency to meet the needs of its cyclical programs and invest in its integrated strategic plans. Additional salary price increases, retroactive pay and other payments from the ratification of collective agreements are included.

The increases are partially offset by budget carried forward to 2022–23.

Furthermore, full-time equivalents vary slightly because of differences between the actual salary rates paid and the estimated average salary rates used to forecast planned spending.

Financial, human resources and performance information for Statistics Canada's Program Inventory is available in GC InfoBase.

Internal services

Description

Internal services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal services refers to the activities and resources of the 10 distinct service categories that support program delivery in the organization, regardless of the internal services delivery model in a department. The 10 service categories are:

- acquisition management services

- communication services

- financial management services

- human resources management services

- information management services

- information technology services

- legal services

- material management services

- management and oversight services

- real property management services

Results

Statistics Canada's internal services have been engaged in the agency's response to COVID-19. This entailed delivering mission-critical programs and adapting practices to support the 2021 Census, while maintaining the safety and health of employees, and included plans and activities, such as return-to-office plans and mental health and wellness training.

The agency envisions a diverse, inclusive, respectful and healthy workplace that is agile and resilient to change. To support this vision, the agency has focused on implementing strategies and new initiatives in response to the results from employee pulse surveys and focus groups. The strategies relative to internal services touch the following areas:

- gender equity, diversity and inclusion

- skill sets and talent management

- data analytics for human resources purposes

- transformation of processes

- internal audit and evaluation

- governance

- digital solutions

- wellness.

Gender equity, diversity and inclusion

The agency updated its 2021 to 2024 Integrated Business and Human Resources Plan to reflect its commitments to strengthen diversity and inclusion, to spotlight areas where human resources programs and services must continue to evolve based on emergent needs that arose because of the disruption and pace of change stemming from the COVID-19 pandemic and to keep step with contemporary business goals, opportunities, and challenges. Statistics Canada set strategic objectives to continue developing an agile and equipped workforce to

- develop and maintain skills for a high-performing workforce

- execute data-driven performance and talent management

- equip managers through strategic human resources management

- support the shaping the agency's workplace of the future.

Other areas of focus include building a diverse workforce, fostering an inclusive workplace and promoting and nurturing a physically and psychologically healthy and safe workplace. This is why Statistics Canada also launched its new 2021 to 2025 Equity, Diversity and Inclusion Action Plan: Moving Forward Together.

As a result of the plan, representation of equity talent in each of the designated groups has improved across the agency, including at the executive level. The agency has made efforts to eliminate barriers to career progression experienced by equity-deserving talent by taking actions such as prioritizing diversity in language training, launching targeted selection processes and building partnerships with external organizations to improve the recruitment of equity talent. Promotion rates for racialized groups have increased, and retention of talent has improved. Among promoted employees in 2020‒2021, 16% identified as members of a racialized group; this figure rose to 23% in 2021‒22. This heightened focus on retention resulted in a 24% increase in the retention of racialized employees.

The development of an Accessibility Measurement Framework led to significant achievements in accessibility. This framework, which focuses on built environments, services, technology, culture, employment and workplace accommodations, identifies barriers and measures progress toward achieving a fully accessible workplace and an inclusive workforce that supports the participation of all employees. The agency also launched the Engaging DisAbility Innovation Study, an innovative, mixed-method research project designed to identify and highlight barriers in employment systems and accommodation processes.

Skill sets and talent management

Statistics Canada's Talent Development Advisory Panel was created in June 2021 and the framework is currently being drafted. A review of the agency's core Recruitment and Development Programs was launched to keep the agency competitive and to better reflect its evolving needs, as well as those of its recruits, and its business lines.

The agency also approved a renewed leadership strategy that aligns with current and future initiatives (culture, values, onboarding, talent management, recognition, diversity, official languages and future of work) and focuses on employee ownership and empowerment where all employees, from recruits to executives, have opportunities to develop as leaders.

Data analytics

In 2021‒22, various data analytics tools were leveraged for human resources purposes. Data from the Employee Wellness Survey were collected then linked to administrative human resources databases to examine the relationships between factors and behaviours. Additionally, to plan the optimal configuration of work arrangements post-pandemic, the Pulse Survey on COVID‑19 and its Impacts on Statistics Canada Employees was conducted in April 2021 to understand employee desires to return to the workplace or work remotely.

The agency approved a new data-driven approach to executive performance in January 2022, whereby informed indicators and data sources provide the foundation of executive performance assessments to remove bias in the evaluation process and to promote consistency across the department. To support this new approach, a performance scorecard was established to yield and depict ratings.

Transformation of processes

Over the course of 2021‒22, Statistics Canada built upon its business planning framework to support the setting of strategies and investment planning. In recognition of the significant progress the agency has made toward its modernization agenda, Statistics Canada established strategies to deepen partnerships, strengthen trust with Canadians and focus on producing integrated data and actionable insights.

Internal audit and evaluation

The agency benefitted from the trusted, neutral and objective information provided by the Audit and Evaluation Branch to inform decision making. In 2021‒2022, the agency received feedback through audit and evaluation projects that used an increasingly agile and focused approach. This timely insight and advice, which was provided at critical times in the early planning and implementation stages of new program strategies and initiatives, such as the modernization for a hybrid workplace, supported the agency's top priorities.

Governance

The governance structure ensures timely, relevant, actionable and integrated enterprise data to support risk-based decision making. Accomplishments in 2021‒22 include the creation of the Integrated Risk Management Framework and the Integrated Risk Management Policy. These act as the agency's foundation for risk management and promote a dynamic and agile risk culture.

Digital solutions

In our digitally focused and evolving context, digital solutions have been key to the success of many of the initiatives discussed in this report, putting in place the foundational technologies and infrastructure for these initiatives. For example, the agency's Digital Solutions Field enabled the Census of Population and the Census of Agriculture and initialized the Census of Environment. It provided the equipment and support for all employees working from home in the hybrid model and ensured that the new COVID-related data products were available to support data-driven insights and evidence-based decision-making.

As the lead on one of the Government of Canada's cloud pathfinder projects, Statistics Canada is uniquely positioned to explore, develop and adopt new technologies. Adopting cloud services and technologies is a crucial part of the agency's modernization efforts, allowing the agency to achieve measurable results in its daily work.

The Cloud Services Enablement Project and the workload migration project are key pillars that allow the agency to evolve its applications and services that support its mandate for a more scalable, modern infrastructure model. This continues to be put in place in 2022‒23. Within this environment, the data analytics platform and services have provided key partners and Canadians with many new products and services, greatly aiding in data-informed decision making during the pandemic and continuing to support the agency's modernization agenda moving forward. With the platform and services that the agency has put in place, employees are empowered to move forward successfully on key digitalization initiatives such as the modernizing data analytics initiative.

Wellness

The agency partnered with the Canadian Innovation Centre for Mental Health to offer online workshops to all employees. In 2021‒22, 2,263 participants attended approximately 75 workshops and sessions that centred on topics including mental health, future of work and diversity and inclusion. This year's focus on wellness was an opportunity to provide managers with mental health resources and training that included mental health first aid training, The Working Mind training for managers, in-house information sessions that covered specific topics tailored to the needs of each division and guest speakers from various forums, including the Federal Speakers' Bureau on Healthy Workplaces.

To support the psychological health of its employees, Statistics Canada's Organizational Health Team launched the first iteration of the Employee Wellness Survey in November 2021. The survey provided a comprehensive overview of employee psychological health and the key drivers that can inform evidence-based actions across the organization.

Budgetary financial resources (dollars)

The following table shows, for internal services, budgetary spending for 2021–22, as well as spending for that year.

| 2021–22 Main Estimates | 2021–22 planned spending | 2021–22 total authorities available for use | 2021–22 actual spending (authorities used) | 2021–22 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 66,905,037 | 66,905,037 | 100,209,616 | 89,989,424 | 23,084,387 |

Human resources (full-time equivalents)

The following table shows, in full‑time equivalents, the human resources the department needed to carry out its internal services for 2021–22.

| 2021–22 planned full-time equivalents | 2021–22 actual full-time equivalents | 2021–22 difference (actual full-time equivalents minus planned full‑time equivalents) |

|---|---|---|

| 563 | 713 | 150 |

The difference between planned spending and actual spending is mainly related to an increase in resources for an initiative, approved in 2018–19, to migrate the agency's infrastructure to the cloud and additional spending related to internal information technology support.

Also contributing to the increase are internal investments approved through the agency's Integrated Strategic Planning Process. In past years, investments were reported centrally under the Statistical information core responsibility, more specifically the Centres of Expertise program.